Michigan Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

If you need to access, acquire, or generate valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to locate the forms you need.

Numerous templates for business and personal use are categorized by types and jurisdictions, or by keywords. Use US Legal Forms to find the Michigan Resolution of Meeting of LLC Members to Dissolve the Company with just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access all forms you saved within your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the Michigan Resolution of Meeting of LLC Members to Dissolve the Company with US Legal Forms. There are a variety of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms member, sign in to your account and click the Download button to access the Michigan Resolution of Meeting of LLC Members to Dissolve the Company.

- You can also view forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

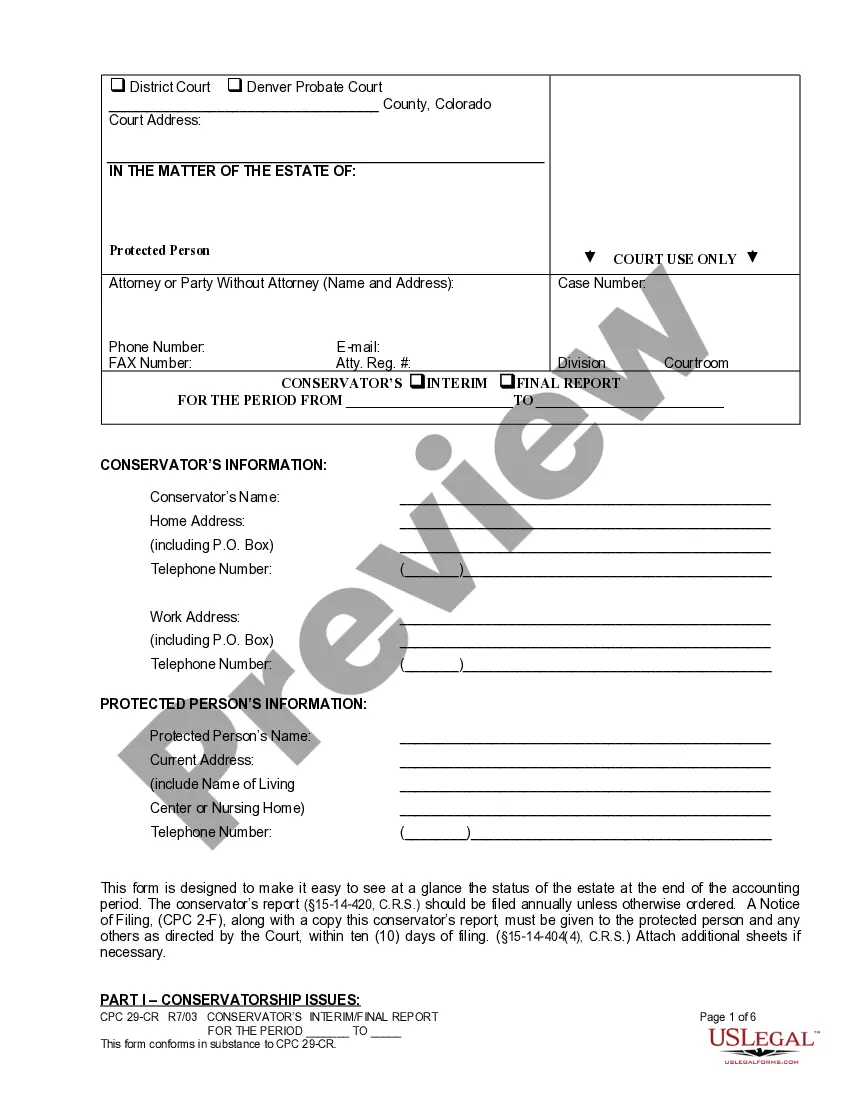

- Step 1. Ensure you’ve selected the correct form for your city/state.

- Step 2. Utilize the Preview feature to review the content of the form. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you find the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Michigan Resolution of Meeting of LLC Members to Dissolve the Company.

Form popularity

FAQ

Less...Hold a Board of Directors meeting and record a resolution to Dissolve the Michigan Corporation.Hold a Shareholder meeting to approve Dissolution of the Michigan Corporation.File all required Annual Reports with the Michigan Secretary of State.File all required tax returns with the Michigan Department of Treasury.More items...

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

6 Steps to Dissolve a Corporation#1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Less...Hold a Board of Directors meeting and record a resolution to Dissolve the Michigan Corporation.Hold a Shareholder meeting to approve Dissolution of the Michigan Corporation.File all required Annual Reports with the Michigan Secretary of State.File all required tax returns with the Michigan Department of Treasury.More items...

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

How do you dissolve an Michigan Limited Liability Company? To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.