Michigan Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Should you need to obtain, secure, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents required.

Various templates for business and personal purposes are categorized by type and state, or by keywords.

Step 4. Once you have located the necessary form, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may utilize your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Michigan Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Michigan Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- You can also retrieve forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm that you have selected the form for the correct city/state.

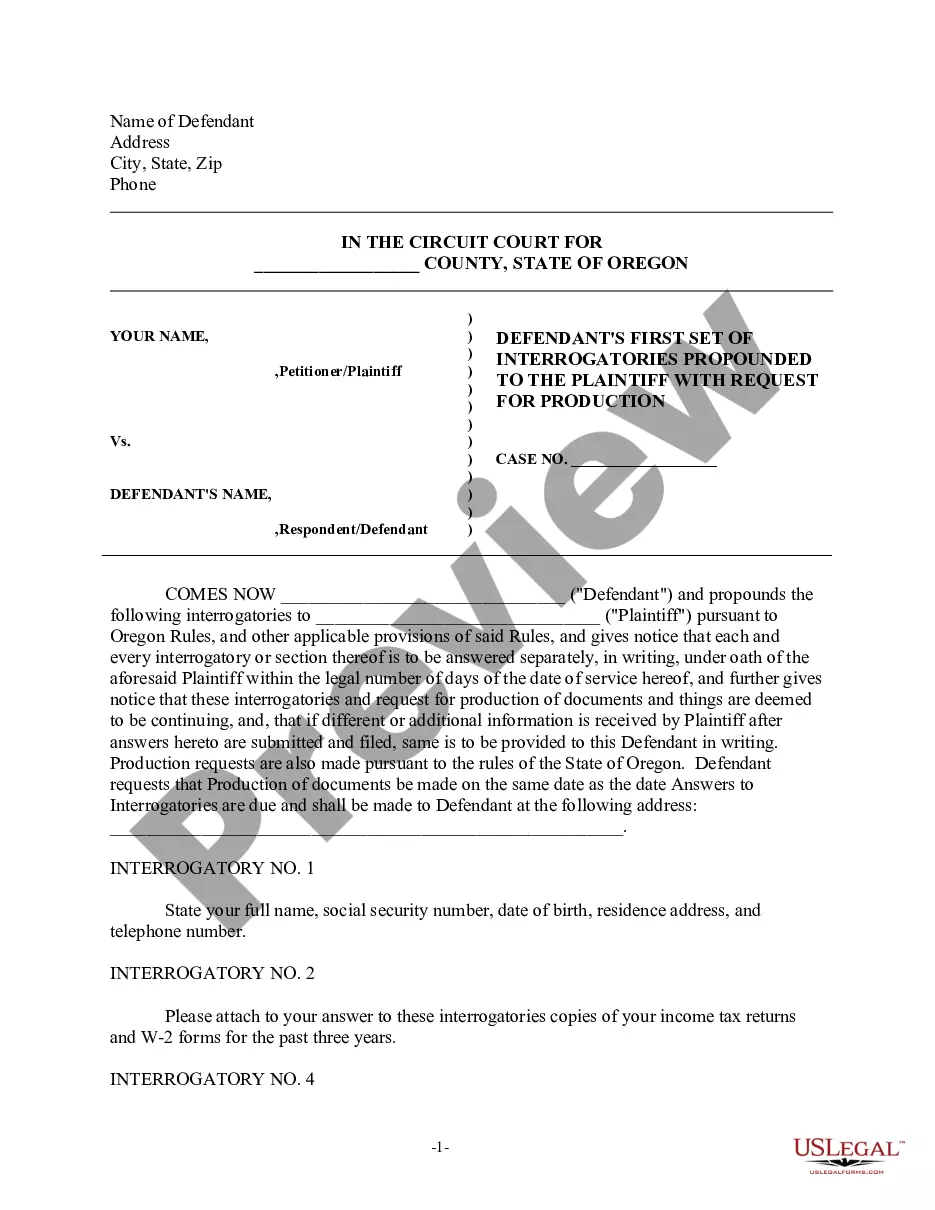

- Step 2. Use the Preview option to inspect the contents of the form. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To add members to an LLC in Michigan, you must follow a formal process, which typically involves amending your operating agreement. This agreement should detail the new member's rights and contributions. It is also advisable to document this decision in the Michigan Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, ensuring everyone is on the same page regarding financial distributions.

The all-purpose clause in a Michigan LLC's operating agreement allows flexibility in describing the business's purposes. This clause can specify various activities the LLC may pursue, enhancing its operational scope. When drafting resolutions, including those pinpointing annual disbursements to members, it’s crucial to refer back to this clause for clarity guided by the Michigan Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

The articles of organization document typically includes the name of the LLC, the type of legal structure (e.g. limited liability company, professional limited liability company, series LLC), the registered agent, whether the LLC is managed by members or managers, the effective date, the duration (perpetual by default

If you want to file by mail (instead of online), you need to:Download the Michigan LLC Articles of Organization (Form CD-700)Prepare a check or money order for $50.Send your payment and the completed Articles of Organization to: Michigan Corporations Division, PO Box 30054, Lansing, MI 48909-7554.

"Piercing the corporate veil" refers to a situation in which courts put aside limited liability and hold a corporation's shareholders or directors personally liable for the corporation's actions or debts. Veil piercing is most common in close corporations.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Filing: The statement/report can be filed online at: or mail the annual statement with the fee to PO Box 30768 Lansing MI 48909. Annual statements may also be delivered in person to our office located at 2501 Woodlake Circle, Okemos, MI.

The Michigan Articles of Organization is the LLC form you fill out and file with the state to form an LLC....Step 2: Fill Out the Articles of OrganizationEntity Name.Business Purpose.Duration of LLC.Registered Agent Name and Registered Office Address.Governing Authority.04-Mar-2022

How to File Articles of OrganizationSelect a name for your company.Download a bonafide copy of the articles of organization form from your Secretary of State's website.Name a registered agent.Draft and sign an LLC operating agreement.Establish if you want to use members or managers.Sign the articles of organization.More items...