Michigan Stop Annuity Request

Description

How to fill out Stop Annuity Request?

Are you in a situation where you require documents for potential business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding trustworthy versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Michigan Stop Annuity Request, that are designed to comply with state and federal regulations.

Once you obtain the appropriate form, click Get now.

Select the payment plan you prefer, fill in the necessary information to set up your account, and complete the purchase using your PayPal or credit card.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Michigan Stop Annuity Request any time. Just select the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Michigan Stop Annuity Request template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/county.

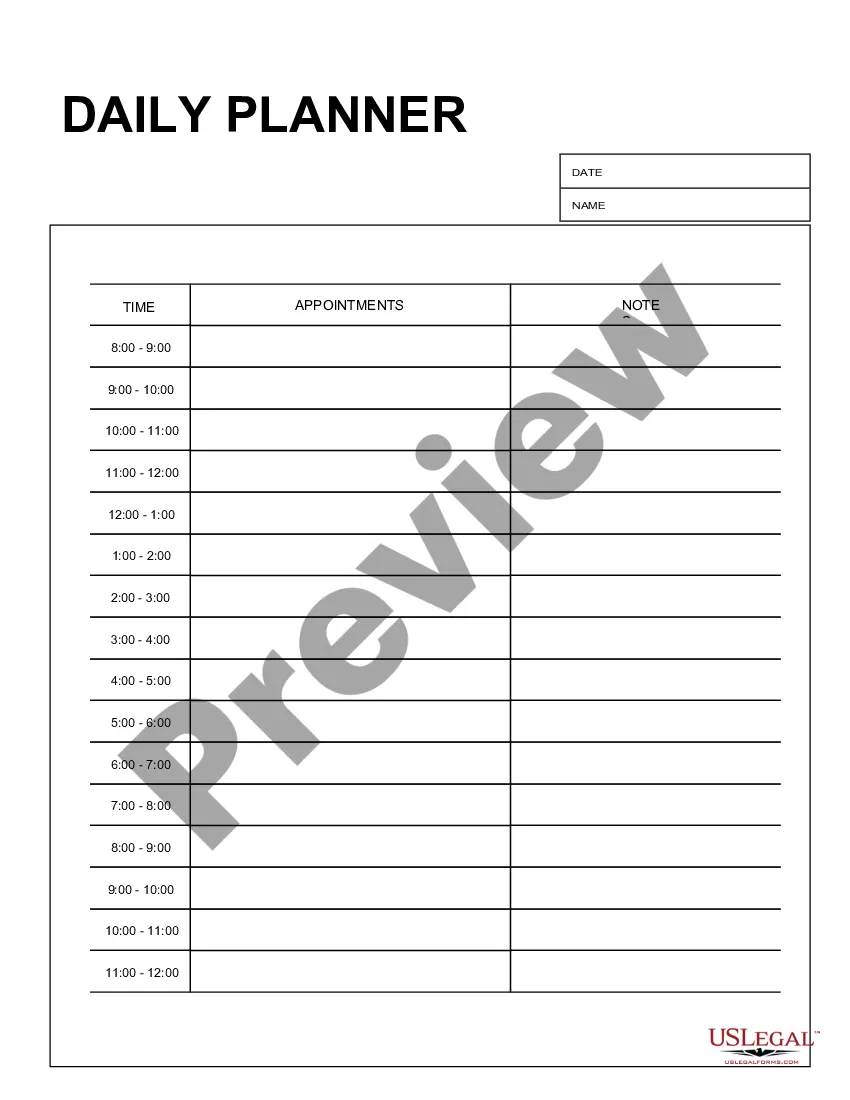

- Use the Preview button to view the form.

- Read the details to confirm that you selected the right template.

- If the template is not what you are looking for, use the Search box to find the form that meets your requirements.

Form popularity

FAQ

These new forms (or substitute forms) will be required for pension distributions made in 2022, although current retirees will not need to complete a new Form W-4P if there are no withholding changes.

The draft Form W-4P is similar to the revised Form W-4 that was rolled out in 2020, and provides for a new default withholding rate of single with no adjustments (rather than married with three allowances).

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

No. Employees who have furnished Form W-4 in any year before 2020 are not required to furnish a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee's most recently furnished Form W-4.

It should be the first name, middle name and last name in that order. Enter your social security number and write your address. Your address should contain street, city, town, state and zip code. Step 3: For line 1, check the box if you do not want any federal income tax withheld from your pension or annuity.

If you do not fill out a new W-4, you employer will definitely still give you a paycheck but will also withhold income taxes at the highest rate for single filers, with no other adjustments.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

More In Forms and Instructions U.S. citizens, resident aliens, or their estates who are recipients of pensions, annuities, and certain other deferred compensation use Form W-4P to tell payers the correct amount of federal income tax to withhold from their payment(s).

Purpose of form. Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Federal income tax withholding applies to the taxable part of these payments.