Michigan Use of Company Equipment refers to the policies and regulations set by the state of Michigan regarding the utilization and management of equipment owned by a company. These guidelines are essential in ensuring proper and lawful usage of company resources, promoting workplace safety, and safeguarding company assets. Companies operating in Michigan must adhere to these policies to maintain compliance with the state laws and protect their employees and equipment. There are several types of Michigan Use of Company Equipment, each with its specific guidelines and implications. These include: 1. Computer and IT Equipment: This category encompasses desktop computers, laptops, servers, routers, printers, and other technological devices provided by the company for work purposes. The Michigan Use of Company Equipment policy outlines rules regarding proper usage, data security protocols, downloading unauthorized software, and other related matters. 2. Vehicles and Machinery: Many companies provide vehicles and heavy machinery equipment to employees for transportation or operational purposes. The state of Michigan has specific regulations in place that govern the use of such equipment, including driver's license requirements, safe operation guidelines, and maintenance protocols to ensure the well-being of employees and prevent accidents. 3. Communication Tools: This category covers equipment such as cell phones, landlines, tablets, and other communication devices provided by the company. The Michigan Use of Company Equipment policy regulates the usage of these tools, including personal vs. professional use, data privacy, and confidentiality of company information. 4. Tools and Equipment: Many businesses provide tools and equipment to employees for various tasks. This can include construction tools, manufacturing machinery, medical devices, or any other equipment necessary for job-related activities. The policy regarding the use of these tools in Michigan typically focuses on safety protocols, proper handling, reporting damages, and maintenance requirements. 5. Personal Protective Equipment (PPE): PPE refers to safety gear or equipment provided by the company to protect employees from occupational hazards. It includes items such as goggles, hardhats, gloves, masks, and protective clothing. Michigan's guidelines for Use of Company Equipment emphasize the proper utilization and care of PPE, ensuring compliance with state and federal rules for workplace safety. Companies operating in the state of Michigan must carefully review and implement policies related to Use of Company Equipment to ensure adherence to state regulations. By doing so, businesses can protect their assets, maintain a safe working environment, and mitigate legal risks associated with improper equipment usage.

Michigan Use of Company Equipment

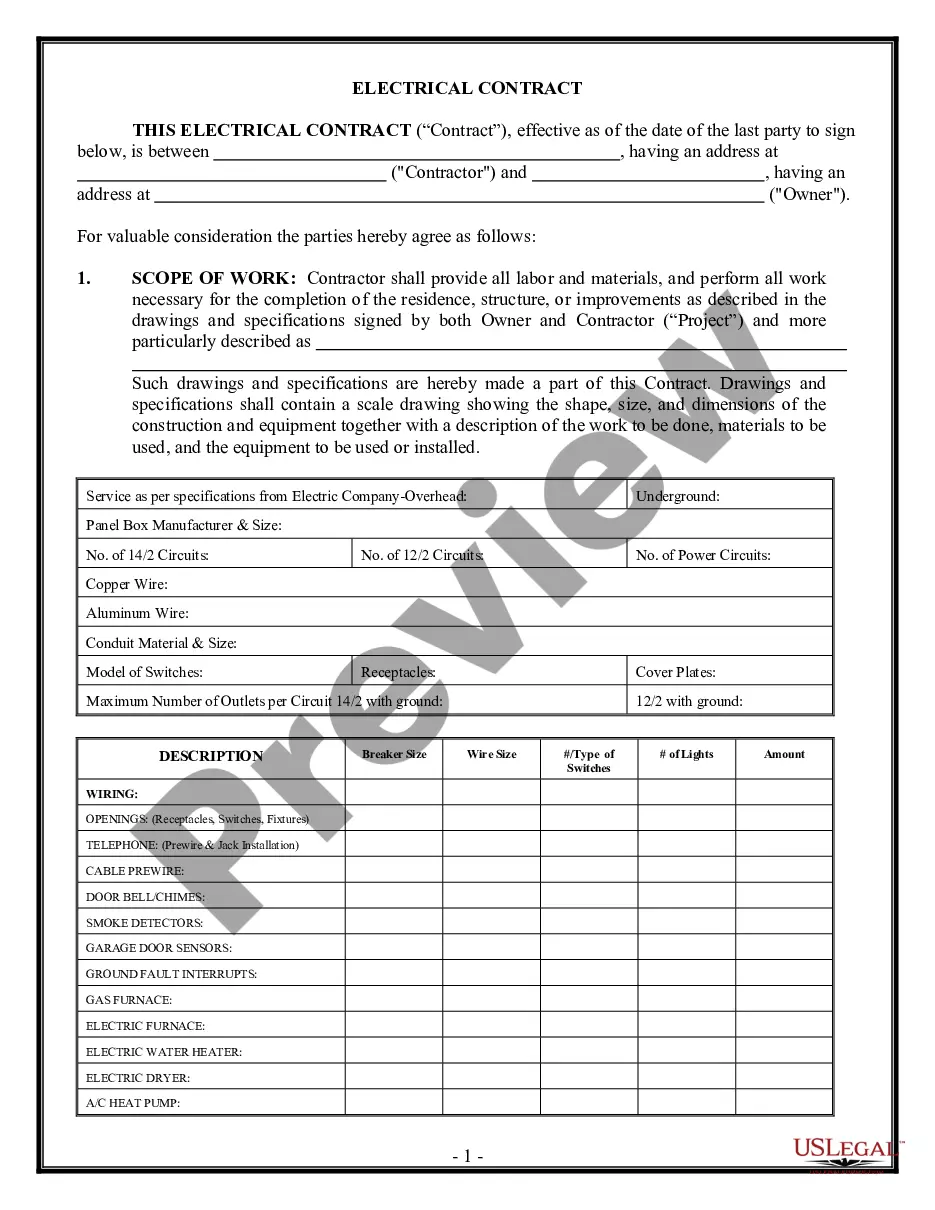

Description

How to fill out Michigan Use Of Company Equipment?

US Legal Forms - one of many largest libraries of lawful forms in America - offers a wide array of lawful record layouts you may obtain or print. Making use of the site, you will get 1000s of forms for organization and specific uses, sorted by categories, says, or keywords and phrases.You can get the latest types of forms such as the Michigan Use of Company Equipment in seconds.

If you currently have a monthly subscription, log in and obtain Michigan Use of Company Equipment from the US Legal Forms collection. The Obtain button can look on each kind you see. You get access to all formerly delivered electronically forms from the My Forms tab of your own profile.

If you would like use US Legal Forms initially, allow me to share simple guidelines to obtain started off:

- Be sure you have selected the best kind for your personal city/region. Click the Review button to analyze the form`s articles. See the kind information to actually have chosen the appropriate kind.

- In case the kind does not suit your demands, take advantage of the Research area near the top of the monitor to obtain the one which does.

- In case you are pleased with the shape, affirm your selection by clicking the Buy now button. Then, choose the prices prepare you want and supply your credentials to sign up for the profile.

- Procedure the transaction. Use your bank card or PayPal profile to accomplish the transaction.

- Choose the structure and obtain the shape on your own system.

- Make changes. Load, edit and print and indication the delivered electronically Michigan Use of Company Equipment.

Every single format you included with your bank account does not have an expiry day and is also your own eternally. So, if you want to obtain or print yet another backup, just visit the My Forms area and then click on the kind you need.

Get access to the Michigan Use of Company Equipment with US Legal Forms, one of the most substantial collection of lawful record layouts. Use 1000s of skilled and status-particular layouts that meet up with your company or specific requirements and demands.

Form popularity

FAQ

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

If you owned the equipment for one year or less, they will charge your regular income tax rate on the gain. If you owned the equipment for over a year, you owe the long-term capital gains rate, which will be 0, 15 or 20 percent of your profit depending on your tax bracket.

Learn more here. Massachusetts generally does charge sales tax on rentals and leases of tangible personal property unless a specific exemption applies. Learn more here. Michigan generally does charge sales tax on the renting and leasing of tangible personal property unless a specific exemption applies.

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing.

What Services Are Subject To Use Tax? Most telecommunications, hotel/motel type accommodations, and industrial laundry services have been subject to Michigan use tax for many years. These services continue to be subject to the tax.

Rentals and Leases - A registered lessor in Michigan has the option of paying six percent Michigan Tax on the acquisition of tangible personal property that is to be leased in Michigan or to collect and remit six percent use tax on the total rental receipts.

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Goods that are subject to sales tax in Michigan include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.

The exemption certificate is properly completed and legible:name and address of the purchaser.description of the item to be purchased.the reason the purchase is exempt.signature of purchaser and date; and.name and address of the seller.

Traditional Goods or Services Goods that are subject to sales tax in Michigan include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.