The Michigan Notice of Annual Report of Employee Benefits Plans is an essential document mandated by the state of Michigan to be filed by employers who offer employee benefit plans. This report aims to provide comprehensive information regarding the benefits offered, ensuring transparency and adherence to legal requirements. This detailed description will explain the purpose, content, and variations of the Michigan Notice of Annual Report of Employee Benefits Plans. The purpose of the Michigan Notice of Annual Report of Employee Benefits Plans is to enable employers to communicate vital information about their employee benefit plans to their employees, as well as regulatory authorities. By filing this report, employers comply with the regulations set forth by Michigan's Employee Benefits Act (Public Act 297 of 1980) and the Federal Employee Retirement Income Security Act (ERICA). Failure to file this report may lead to penalties, legal repercussions, and possible disruption of benefits for employees. The Michigan Notice of Annual Report of Employee Benefits Plans contains several crucial details. It requires employers to disclose information such as the plan name, year-end date, plan number, funding arrangements, number of participants, and the type of plan, whether it is a pension, health, welfare, or other specific benefits plan. Additionally, employers must provide information regarding administrative expenses, contributions, and distributions made to the plan in the reporting year. This report also includes a section to detail any legal actions or audits related to the plan during the reporting period. While there are no specific variations of the Michigan Notice of Annual Report of Employee Benefits Plans, different types of employee benefit plans can be covered under this filing requirement. These may include defined benefit pension plans, defined contribution plans like 401(k) or 403(b) plans, health insurance plans, life insurance plans, disability plans, and more. Employers must accurately disclose the specific type(s) of benefit plans offered to their employees in this report. In conclusion, the Michigan Notice of Annual Report of Employee Benefits Plans is a crucial filing requirement for employers in Michigan who offer employee benefit plans. It ensures compliance with state and federal regulations while providing comprehensive information about the benefits provided to employees. By accurately completing this report, employers facilitate transparency, protect employees' rights, and promote a well-informed workforce.

Michigan Notice of Annual Report of Employee Benefits Plans

Description

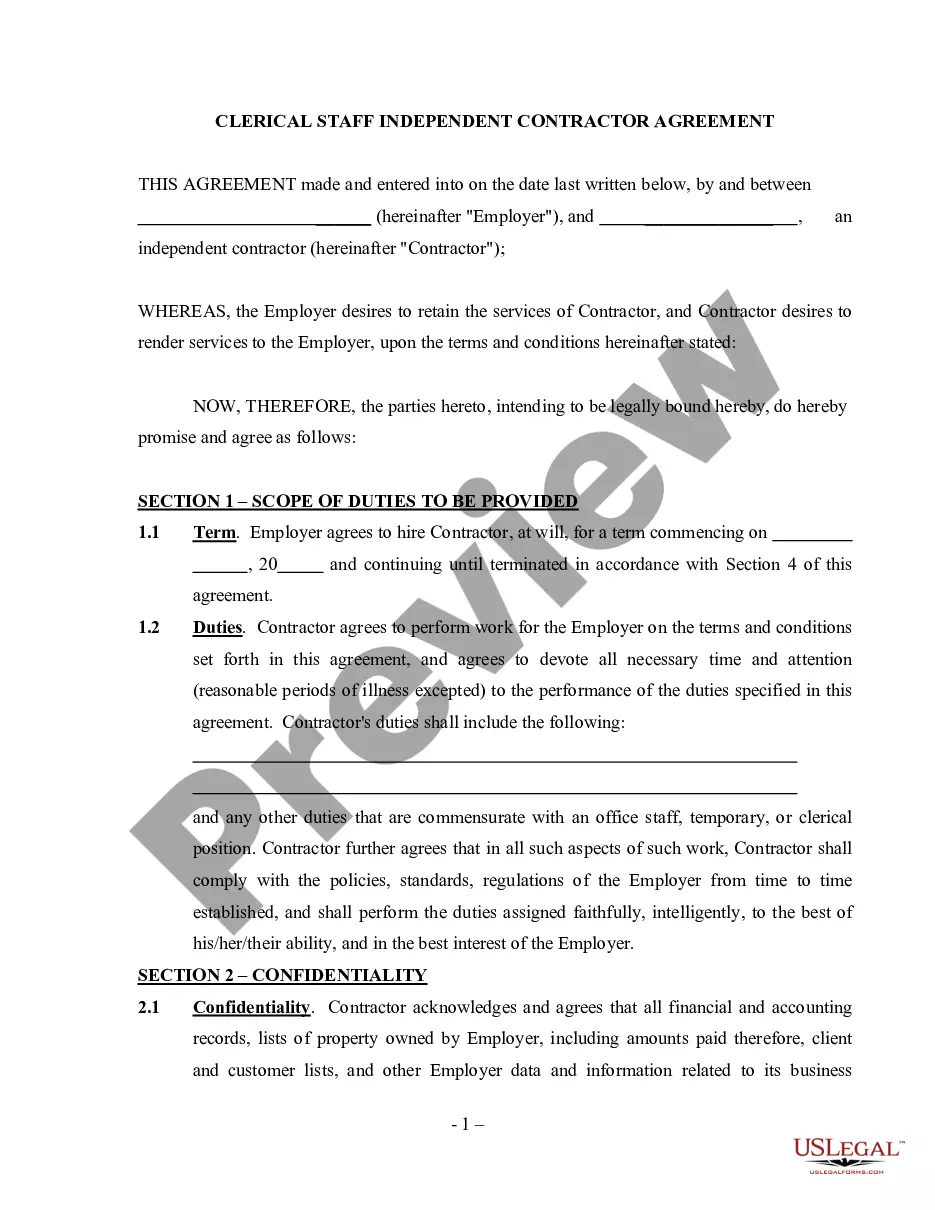

How to fill out Michigan Notice Of Annual Report Of Employee Benefits Plans?

Discovering the right lawful file web template can be quite a have difficulties. Naturally, there are tons of templates available on the net, but how would you find the lawful form you require? Take advantage of the US Legal Forms internet site. The services gives a huge number of templates, like the Michigan Notice of Annual Report of Employee Benefits Plans, that can be used for organization and personal requires. Each of the types are inspected by specialists and satisfy federal and state specifications.

If you are previously registered, log in for your account and click on the Download option to have the Michigan Notice of Annual Report of Employee Benefits Plans. Make use of account to appear throughout the lawful types you might have bought formerly. Check out the My Forms tab of the account and have one more version in the file you require.

If you are a brand new customer of US Legal Forms, listed below are basic guidelines that you should stick to:

- Initial, make certain you have chosen the proper form to your metropolis/county. You are able to check out the form making use of the Review option and look at the form explanation to ensure it will be the right one for you.

- When the form fails to satisfy your requirements, use the Seach field to get the appropriate form.

- Once you are positive that the form is acceptable, click the Buy now option to have the form.

- Select the pricing plan you need and enter in the needed details. Create your account and purchase your order using your PayPal account or Visa or Mastercard.

- Choose the file file format and obtain the lawful file web template for your gadget.

- Total, change and printing and signal the obtained Michigan Notice of Annual Report of Employee Benefits Plans.

US Legal Forms may be the most significant collection of lawful types where you will find different file templates. Take advantage of the service to obtain expertly-made paperwork that stick to status specifications.

Form popularity

FAQ

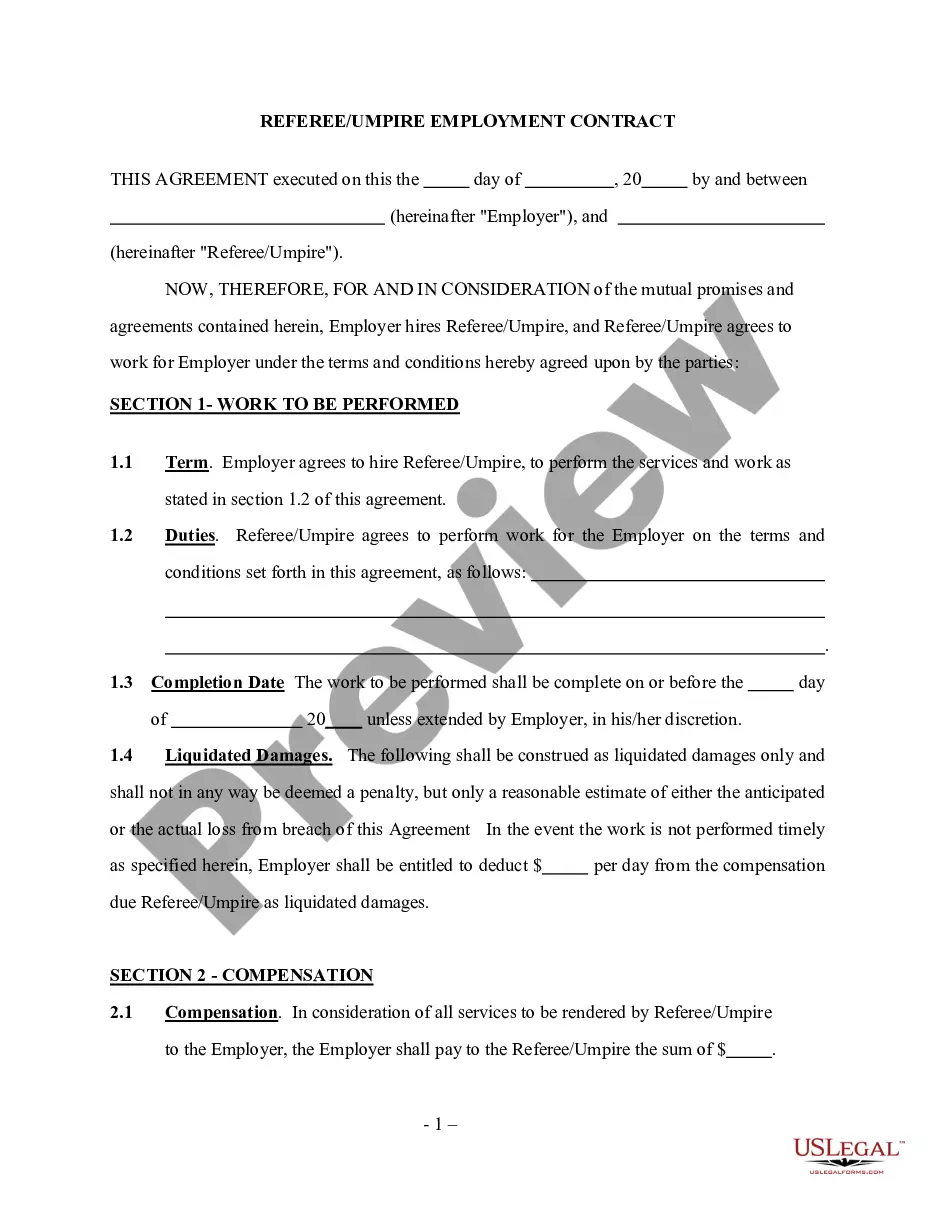

Where can I find a Summary of Benefits and Coverage? You'll find a link to the SBC on each plan page when you preview plans and prices before logging in, and when you've finished your application and are comparing plans. You can ask for a copy from your insurance company or group health plan any time.

Journal Entries. When recording your employees' benefits in your payroll or general ledger, list the amounts you withheld from their paychecks for benefits under the respective accounts as credits. When recording wages paid, include fringe benefits paid to your employees, as a debit.

10 Critical Things You Must Do When Marketing Employee BenefitsCreate Marketing Materials That Speak to the Needs of Employees.Develop Marketing That Covers All Media Formats.Convey Positive Messaging Around Benefit Use.Share Employee Success Stories as Part of Marketing Campaigns.More items...?

5 Ways to Make Your Employee Benefit Presentations FunMake them interactive. Give your employees interactive handouts to follow along with the presentation.Make them visually stimulating. It's no surprise that most benefits presentations are very data driven.Make them concise.Make them virtual.

The SBC provides consumers with information so they can compare benefits and select a health insurance plan that meets their needs. In contrast, the SPD is an easy to understand document that tells participants what benefits the plan provides and how the plan operates.

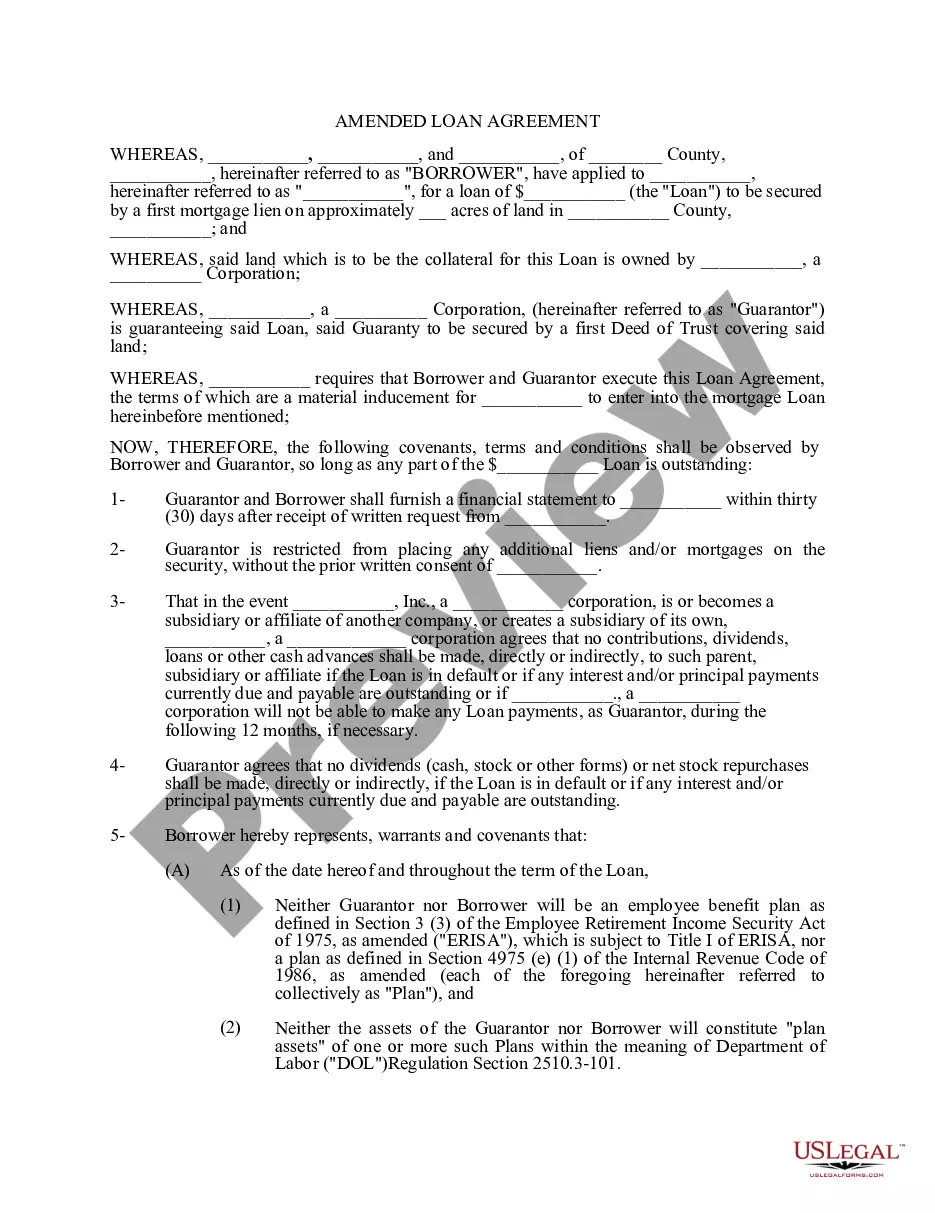

To be eligible to use the Form 5500-SF, the plan must: 2022 Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), 2022 Meet the conditions for being exempt from the requirement that the plan's books and records be audited by an independent qualified public accountant (IQPA), 2022

Form 5500 is the annual return/Report of Employee Benefit Plan. Pension and welfare plans must generally file the Form 5500 to report their financial condition and operations. The Form 5500 must be filed electronically through the EFAST2 system. The form is due the last day of the seventh month of the plan year.

The most common types of employee benefits offered today are:Medical insurance.Life insurance.Disability insurance.Retirement contributions and pension plans.

To streamline your message:Avoid noninformation that's factually accurate but of little value to someone who isn't a benefits wonk.Appeal to employees' logic ("Here's what is changing for you") and their emotions ("Here's how it will benefit you").More items...?

The SPD is a detailed guide to the benefits the program provides and how the plan works. It must describe when employees become eligible to participate in the plan, how benefits are calculated and paid, how to claim benefits, and when benefits become vested.