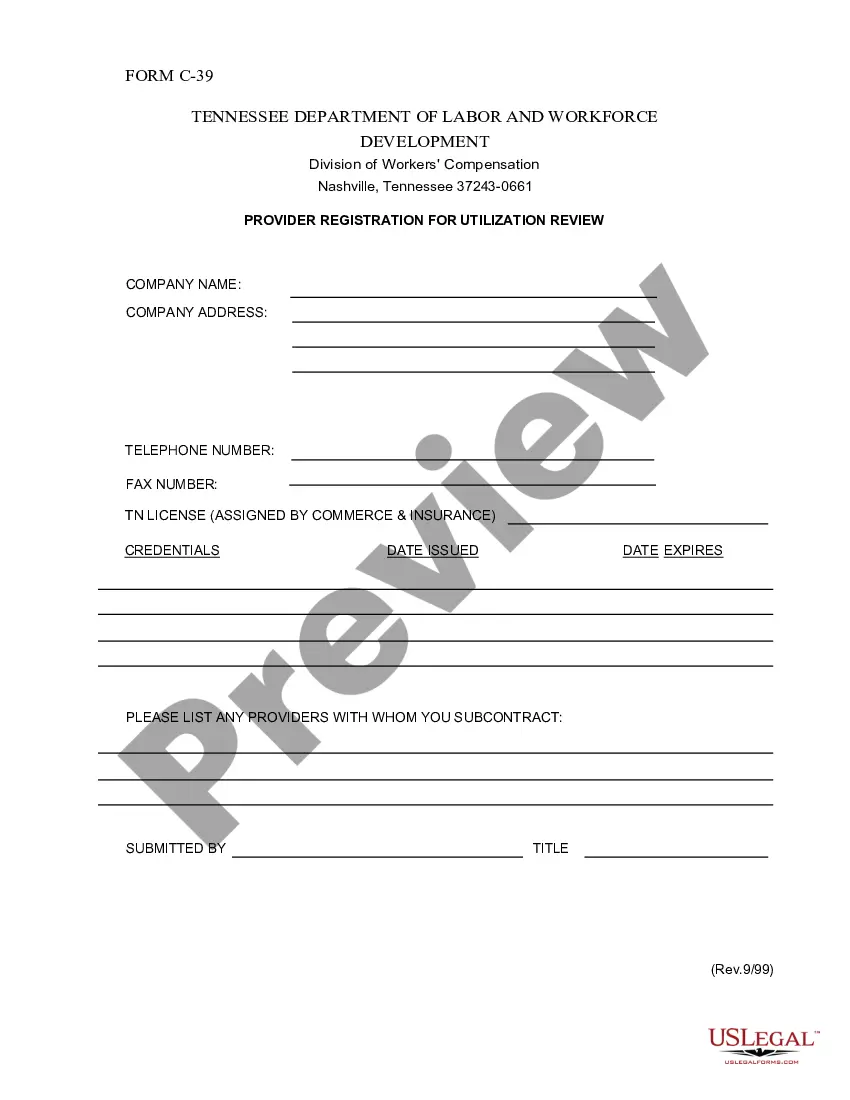

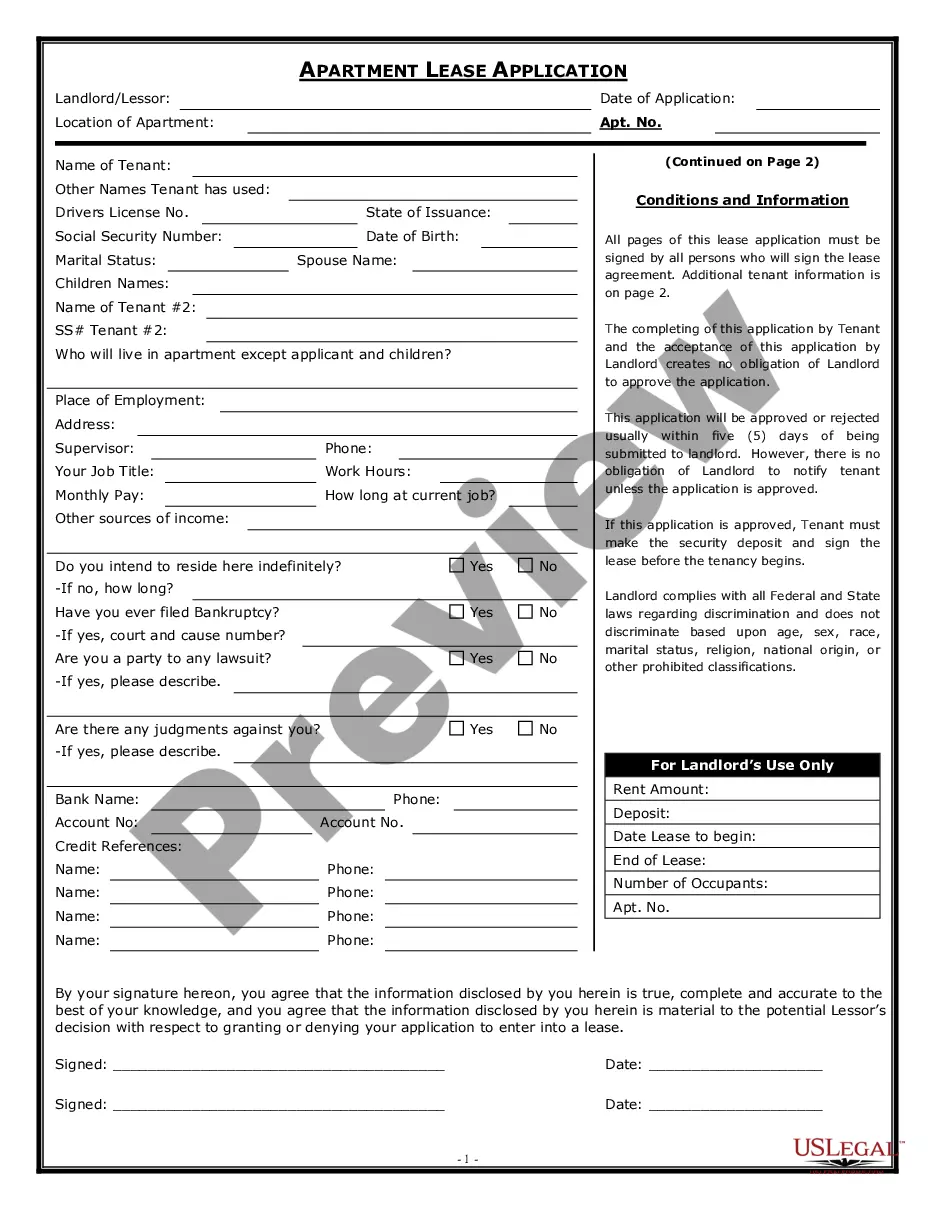

The Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors is a legal document that serves as proof of acknowledgment between a consultant or self-employed independent contractor and their respective client or company in the state of Michigan. This form outlines the terms and conditions of their professional relationship, ensuring that both parties understand their rights and obligations. The Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors is crucial for establishing clear expectations and avoiding any misunderstandings that may arise during the course of their engagement. This document is typically customized to suit the specific needs of the working arrangement and may vary depending on the nature of the services being provided. Some common types of Michigan Acknowledgment Forms for Consultants or Self-Employed Independent Contractors include: 1. Standard Terms and Conditions: This form includes general provisions that are applicable to most consulting or self-employment arrangements. It may cover essential elements such as payment terms, confidentiality clauses, project scope, termination clauses, intellectual property rights, and dispute resolution procedures. 2. Non-Disclosure Agreement (NDA): If the consultant or independent contractor will have access to sensitive information or trade secrets, an NDA may be incorporated into the acknowledgment form. This agreement ensures the protection of confidential information and prohibits its unauthorized use or disclosure. 3. Service Agreement: This specific type of acknowledgment form is used when the consultant or independent contractor will be providing a range of services for the client. It outlines the scope of work, deliverables, timelines, and any additional terms related to the provision of services. 4. Independent Contractor Agreement: In situations where the consultant or independent contractor will be providing services as an independent entity rather than an employee, this agreement will be included. It clarifies the contractor's status as a self-employed individual and defines the relationship between them and the client. Overall, the Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors plays a vital role in establishing a formal agreement, protecting the rights of both parties involved, and ensuring a smooth working relationship throughout the engagement. Consulting or self-employment arrangements can vary in terms of their complexity and requirements, therefore the acknowledgment form must be carefully tailored to address the specific needs and concerns of all parties involved.

Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Michigan Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of several greatest libraries of lawful varieties in America - provides an array of lawful record themes it is possible to obtain or printing. Making use of the site, you can get a large number of varieties for enterprise and person purposes, sorted by categories, says, or keywords and phrases.You can find the most up-to-date variations of varieties like the Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors in seconds.

If you have a monthly subscription, log in and obtain Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors in the US Legal Forms library. The Obtain button will appear on each kind you see. You have access to all in the past saved varieties from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, listed here are basic instructions to help you get started:

- Ensure you have selected the right kind to your city/region. Select the Review button to analyze the form`s articles. Read the kind description to actually have chosen the correct kind.

- In case the kind doesn`t match your demands, make use of the Search discipline near the top of the monitor to find the one who does.

- If you are pleased with the form, validate your choice by visiting the Purchase now button. Then, select the rates strategy you prefer and provide your references to register for the accounts.

- Approach the financial transaction. Use your charge card or PayPal accounts to finish the financial transaction.

- Choose the structure and obtain the form in your gadget.

- Make alterations. Load, modify and printing and signal the saved Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

Every single template you put into your bank account lacks an expiration day and it is your own permanently. So, if you wish to obtain or printing another version, just proceed to the My Forms section and click on about the kind you will need.

Obtain access to the Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors with US Legal Forms, by far the most extensive library of lawful record themes. Use a large number of expert and express-particular themes that satisfy your small business or person requires and demands.

Form popularity

FAQ

How to become an independent consultantCommit to your specialty.Pursue education or training.Gain relevant experience.Find clients.Create a website and increase social media presence.Ask for recommendations.Be patient.Meet new people.More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent consultant is a unique option for those looking for a role with a bit more flexibility than a traditional nine-to-five job. Independent consultants provide services to a variety of clients, rather than working for one establishment.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

When you work as a consultant, you are considered a self-employed individual. Most companies treat consultants as independent contractors.

At that point the Consultant may be said to become a Contractor. The terms have also become blurred as industry has incorporated them into employee job titles. Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.