Title: Michigan Sample FCRA Letter to Applicant — A Comprehensive Guide to Compliance Introduction: In this article, we will provide a detailed description and explanation of a Michigan Sample FCRA Letter to Applicant. The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer information, including credit reports. In Michigan, employers must adhere to specific guidelines when utilizing this law to perform background checks on job applicants. This article aims to guide employers in drafting appropriate FCRA letters that comply with Michigan regulations. 1. Understanding the FCRA: To begin, it is crucial to comprehend the FCRA and its implications for employers. We will delve into the core components of FCRA compliance, such as securing written consent from the applicant, notifying the applicant about their rights, providing the applicant with a summary of their rights, and ensuring the fair and accurate use of consumer reports. 2. Components of a Michigan Sample FCRA Letter to Applicant: A variety of FCRA letters may be required during the background check process. Here are a few key types of letters employers should be familiar with: a. Authorization and Consent Letter: This letter requests the applicant's permission to obtain their consumer report and is a crucial initial step in obtaining their written consent for a background check. We will provide a template that adheres to Michigan's specific requirements at the end of this article. b. Pre-Adverse Action Letter: If an employer finds information in an applicant's consumer report that may negatively impact their employment decision, they must provide this letter. It informs the applicant of their rights to review the report and dispute any potential inaccuracies. c. Adverse Action Letter: When an employer decides to reject an applicant based on their consumer report, this letter is sent to communicate the decision. It outlines the reasons for rejection, provides information on the consumer reporting agency that provided the report, and explains the applicant's rights to dispute any inaccuracies. 3. Crafting a Michigan Sample FCRA Letter to Applicant: We will discuss the essential elements and best practices for drafting an FCRA letter specific to Michigan's requirements. Focus areas include properly identifying the employer, specifying the purpose of the letter, accurately summarizing the applicant's rights, and complying with the necessary timelines for sending the letter. 4. Additional Considerations for Michigan Employers: Michigan has additional state-specific regulations that employers must consider when utilizing FCRA letters. We will highlight any specific requirements, such as the inclusion of the Michigan Consumer Protection Act (MCPA) notice or other local regulations. Conclusion: Compliance with the FCRA is vital for employers when conducting background checks on job applicants. By understanding the different types of Michigan Sample FCRA Letters to Applicants, employers can ensure they are fulfilling their legal obligations while respecting the rights of applicants. Employing appropriate FCRA letters not only demonstrates regulatory compliance but also fosters transparency and fairness throughout the hiring process.

Michigan Sample FCRA Letter to Applicant

Description

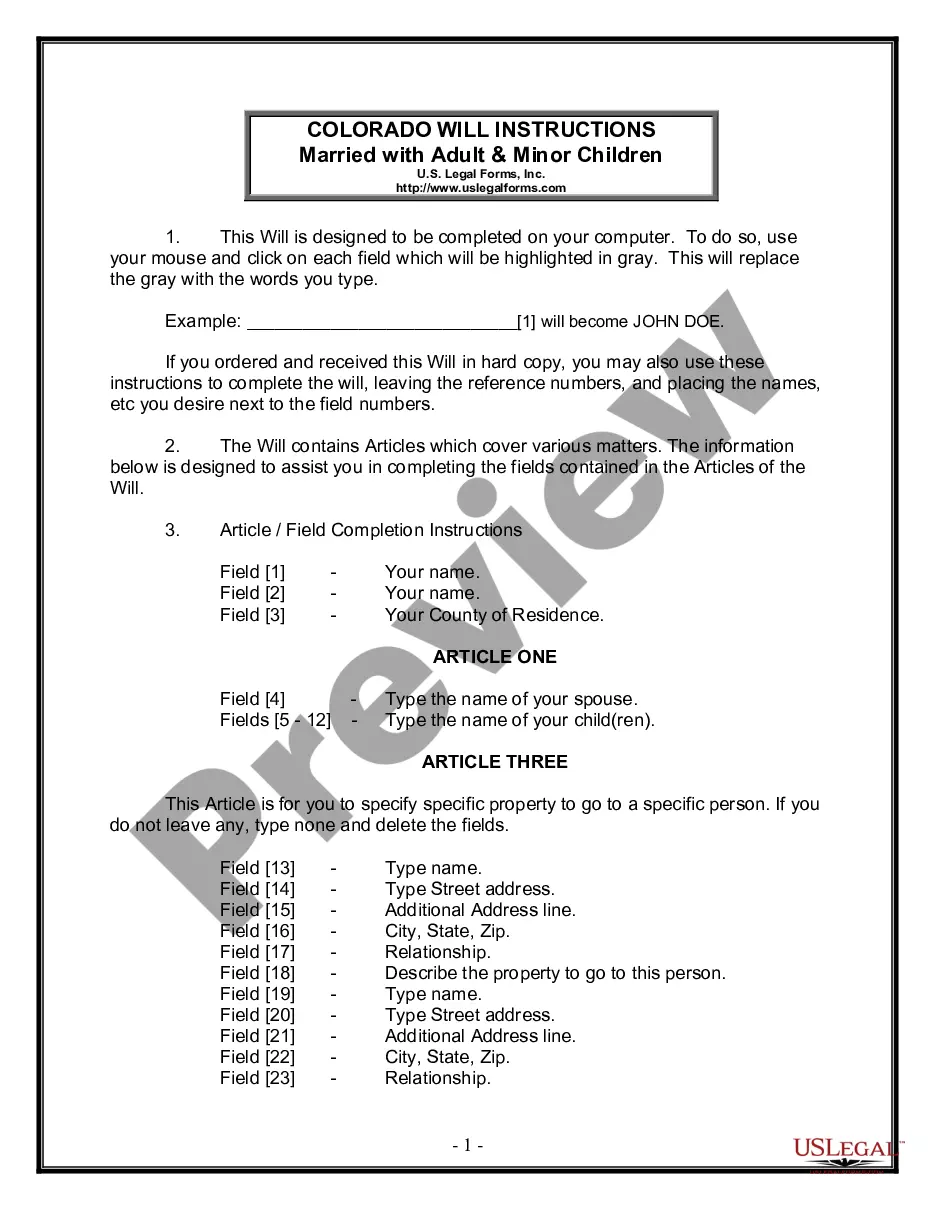

How to fill out Michigan Sample FCRA Letter To Applicant?

You are able to spend several hours on the Internet trying to find the authorized papers design that suits the federal and state demands you want. US Legal Forms provides a large number of authorized forms that happen to be analyzed by experts. You can actually download or produce the Michigan Sample FCRA Letter to Applicant from my support.

If you have a US Legal Forms bank account, you may log in and then click the Obtain button. Next, you may comprehensive, edit, produce, or indication the Michigan Sample FCRA Letter to Applicant. Every authorized papers design you buy is your own permanently. To acquire another backup for any acquired kind, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site for the first time, adhere to the easy instructions below:

- Initial, make sure that you have selected the correct papers design for that region/town of your choice. Read the kind explanation to make sure you have picked the right kind. If accessible, use the Review button to appear through the papers design also.

- In order to find another model of your kind, use the Look for field to find the design that fits your needs and demands.

- Once you have identified the design you want, click Buy now to move forward.

- Find the pricing program you want, type in your qualifications, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal bank account to purchase the authorized kind.

- Find the structure of your papers and download it for your product.

- Make changes for your papers if possible. You are able to comprehensive, edit and indication and produce Michigan Sample FCRA Letter to Applicant.

Obtain and produce a large number of papers themes utilizing the US Legal Forms site, that provides the greatest variety of authorized forms. Use specialist and status-distinct themes to take on your organization or personal requires.

Form popularity

FAQ

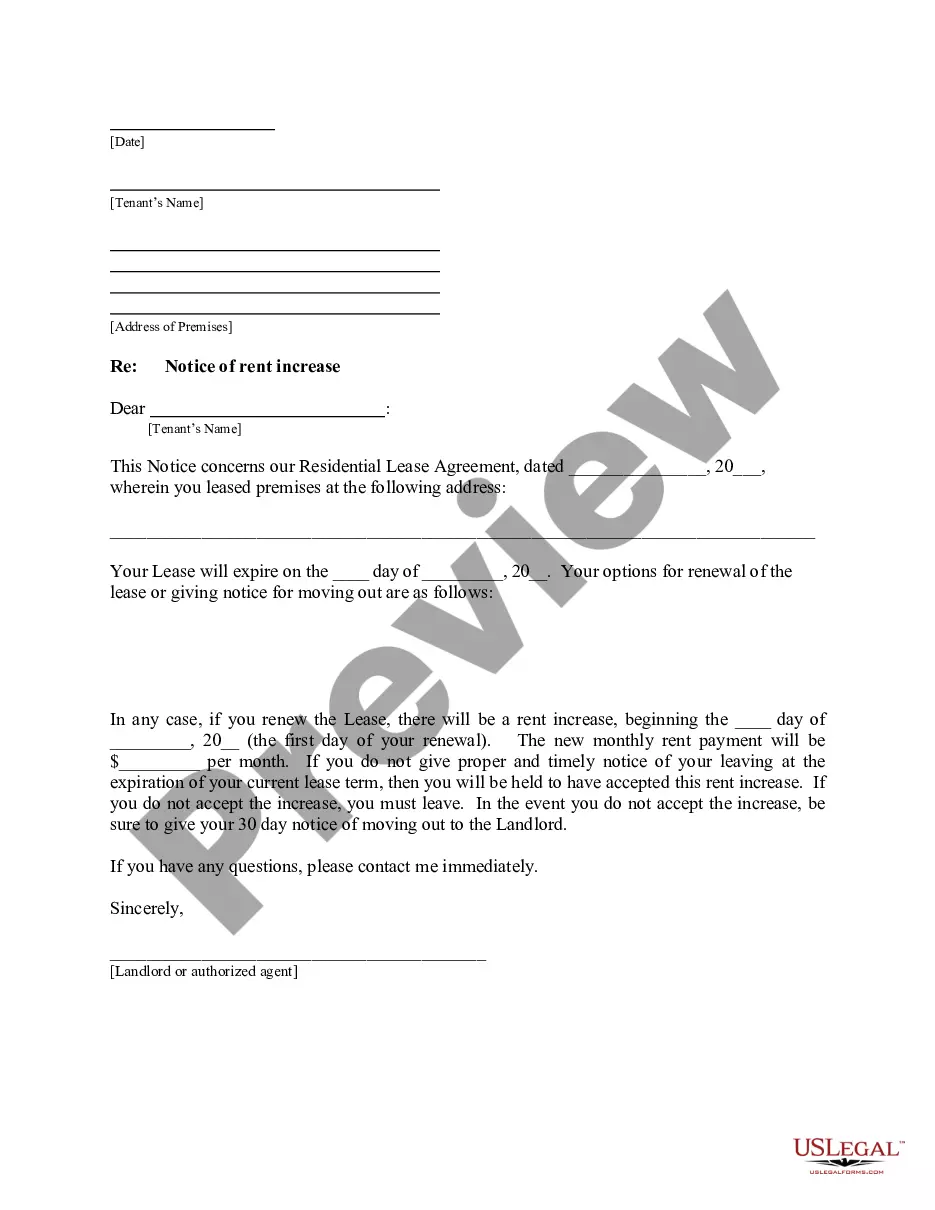

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

If, after the candidate has issued a response to the pre-adverse action letter and requested necessary corrections to their background check document, you still decide that you will not hire the candidate based on the contents of a background check, you must issue an official adverse action notice, which explains your

Before you take adverse action, you will provide the applicant or employee a notice that includes a copy of the background check/consumer report you used to make your decision and provide them with a summary of their rights under the FCRA. This is commonly referred to as a Pre-Adverse Action Notice.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

Adverse action notices can be provided electronically via email as long as the consumer provides consents to receiving electronic notices that complies with the ESIGN Act. The ESIGN Act disclosure has a number of requirements and must be signed by the consumer before the consumer receives the electronic notices.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

The FCRA For Employment Purposes Consumer reports can include a broad range of categories, including driving records, criminal records, credit reports, and other reports from third parties, such as drug tests.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.