Michigan Employee Evaluation Form (Upon Separation)

Description

How to fill out Employee Evaluation Form (Upon Separation)?

It is feasible to spend multiple hours online searching for the valid document template that suits the federal and state requirements you have.

US Legal Forms provides thousands of valid documents that have been reviewed by experts.

You can effortlessly download or print the Michigan Employee Evaluation Form (Upon Separation) from our services.

If available, utilize the Preview button to review the document template too. To find another version of the document, use the Search field to locate the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you may complete, modify, print, or sign the Michigan Employee Evaluation Form (Upon Separation).

- Every valid document template you obtain belongs to you for an extended period.

- To retrieve another copy of a purchased document, navigate to the My documents tab and click on the relevant button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/city you have chosen.

- Review the document description to confirm you have chosen the right document.

Form popularity

FAQ

You can file the protest electronically, by fax, or by mail, using the UIA's protest form. You must attach any documents you want the UIA to consider. The UIA will issue a redetermination of your claim. If you don't agree with this redetermination, you may appeal within 30 days.

A decision has been made regarding your eligibility or disqualification of benefits.

Form UIA 1028 can also be filed online by selecting the Operate a Business option from the Michigan Business One Stop web site and selecting the task File and Pay Quarterly Taxes. Selecting this task will link you to the online services offered by UIA through the Michigan Web Account Manager (MiWAM).

You can submit your protest through your MIWAM account. After accessing your MIWAM account: Click on the claim ID of the involved benefit year to view the details. Next, click on "Determination Status", and then click on "file a protest" or "file appeal" for the issue you wish to protest.

A state Employer Identification Number (EIN) or Employer Account Number (EAN) is a number assigned by a state government to an employer to track one of the following: Payroll tax liabilities and remittances. Unemployment insurance liability.

You can find your employers FEIN on your W-2 form.

Employers are required to file Employer's Quarterly Wage/Tax Reports listing their employees and the wages earned for each quarter. A quarterly report must be filed even if you do not have any employees and/or wages to report for the quarter.

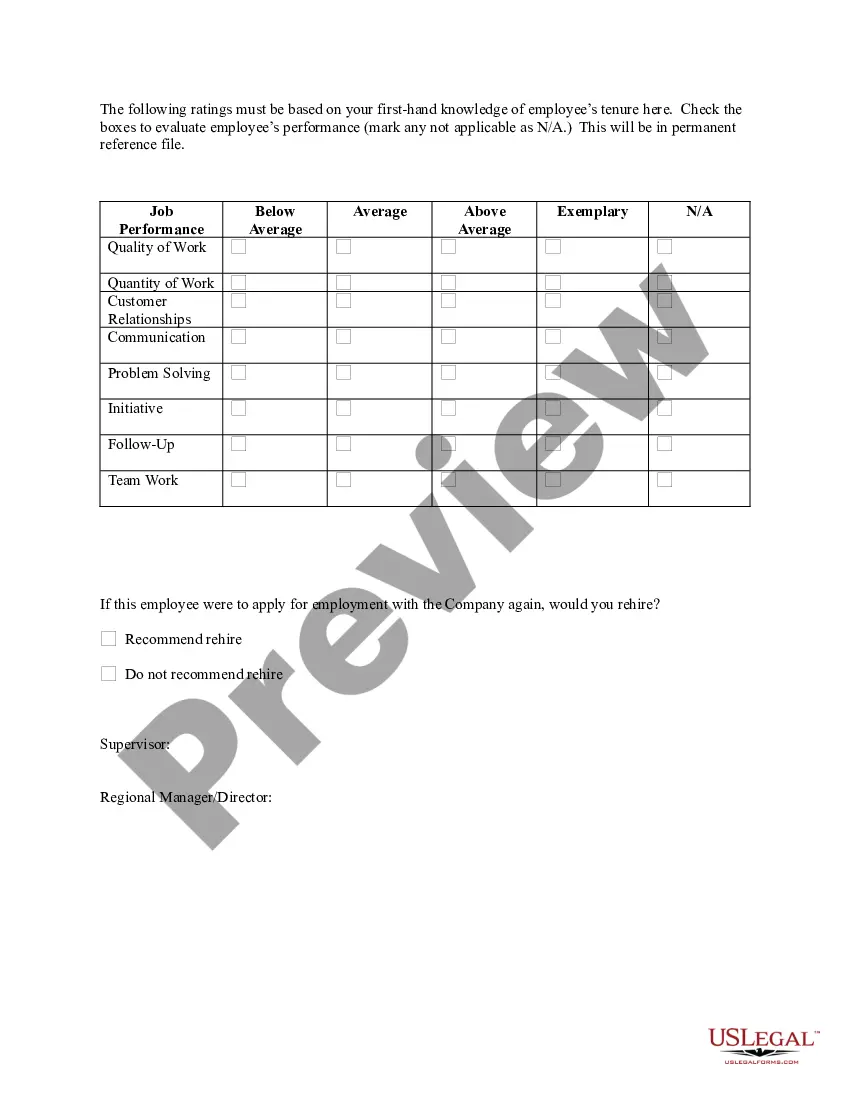

The interim rating is an evaluation of the employee's performance against each core competency in the employee's performance plan, to include a complete narrative statement of performance.

File a New Claim (cont.)If you need to make changes, click any hyperlink next to the steps to go back and make corrections.

You must complete a Separation Statement for each employer you were separated from in the last 18 months (except when you are laid off) if you were separated due to voluntary leaving or discharged due to theft, willful destruction of property, assault and battery, or possession or use of illegal drugs.