Michigan Voluntary Petition for Non-Individuals Filing for Bankruptcy

Description

How to fill out Voluntary Petition For Non-Individuals Filing For Bankruptcy?

Have you been in a position that you need documents for possibly organization or person functions almost every day? There are a variety of legitimate papers web templates available online, but locating kinds you can rely is not straightforward. US Legal Forms gives 1000s of kind web templates, much like the Michigan Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act, that are written to fulfill federal and state demands.

If you are already familiar with US Legal Forms site and also have a free account, just log in. After that, you are able to down load the Michigan Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act web template.

If you do not provide an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you want and ensure it is for that correct area/county.

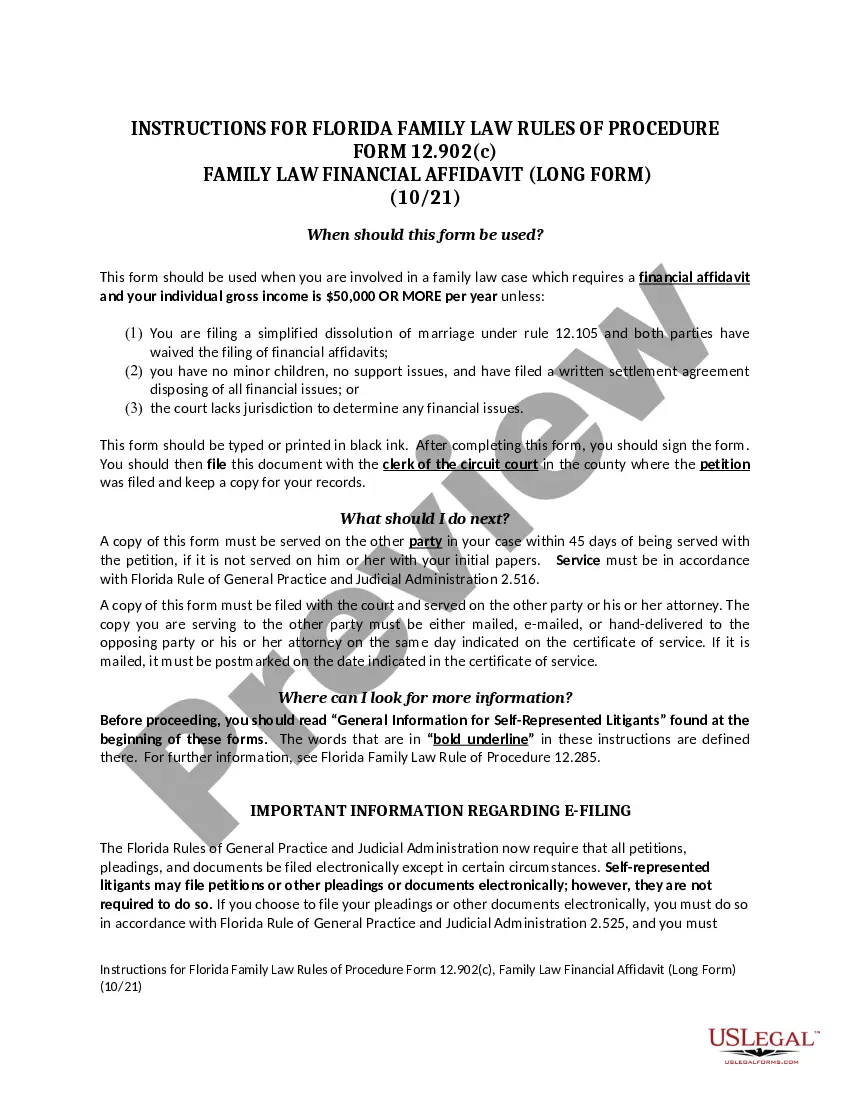

- Use the Review key to analyze the form.

- See the explanation to actually have chosen the correct kind.

- When the kind is not what you`re searching for, use the Search area to find the kind that suits you and demands.

- When you find the correct kind, click Acquire now.

- Pick the pricing strategy you desire, complete the specified info to generate your account, and buy an order using your PayPal or charge card.

- Choose a convenient paper file format and down load your backup.

Get all the papers web templates you may have bought in the My Forms menu. You can aquire a extra backup of Michigan Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act whenever, if required. Just click the required kind to down load or produce the papers web template.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, to conserve time and steer clear of faults. The services gives appropriately produced legitimate papers web templates which you can use for a range of functions. Produce a free account on US Legal Forms and begin producing your daily life a little easier.