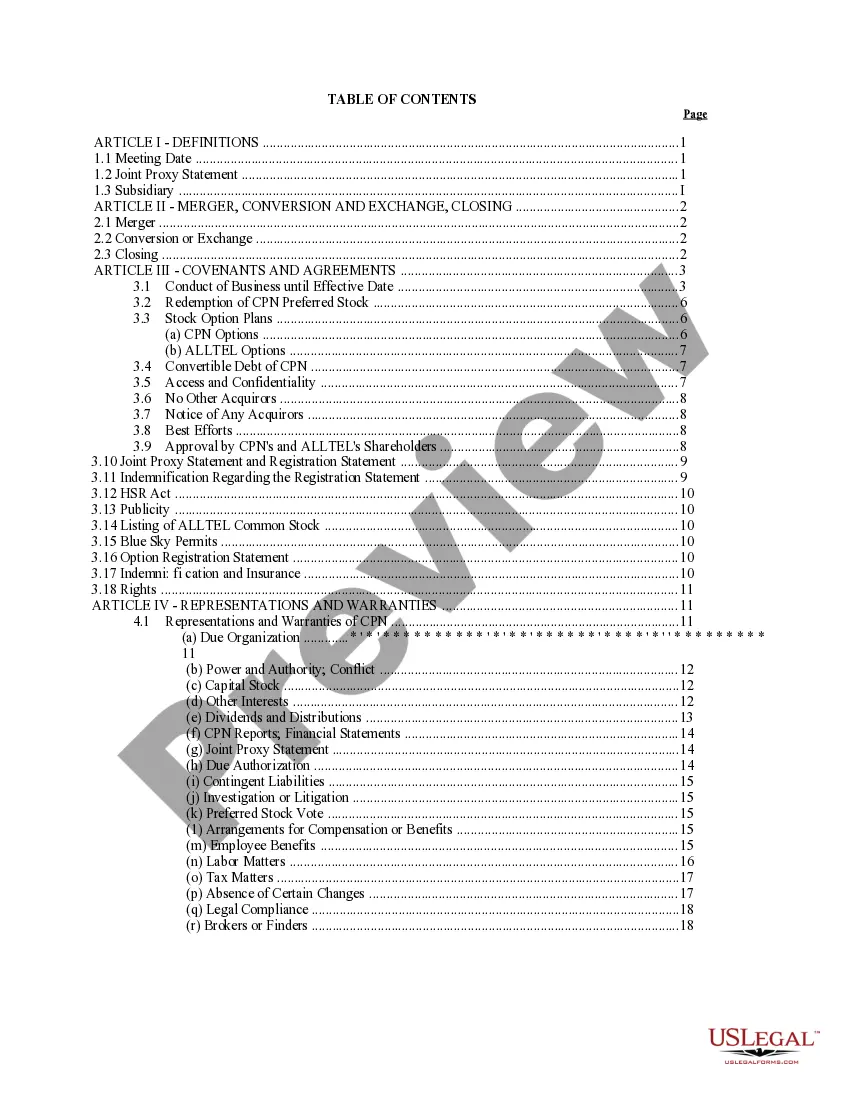

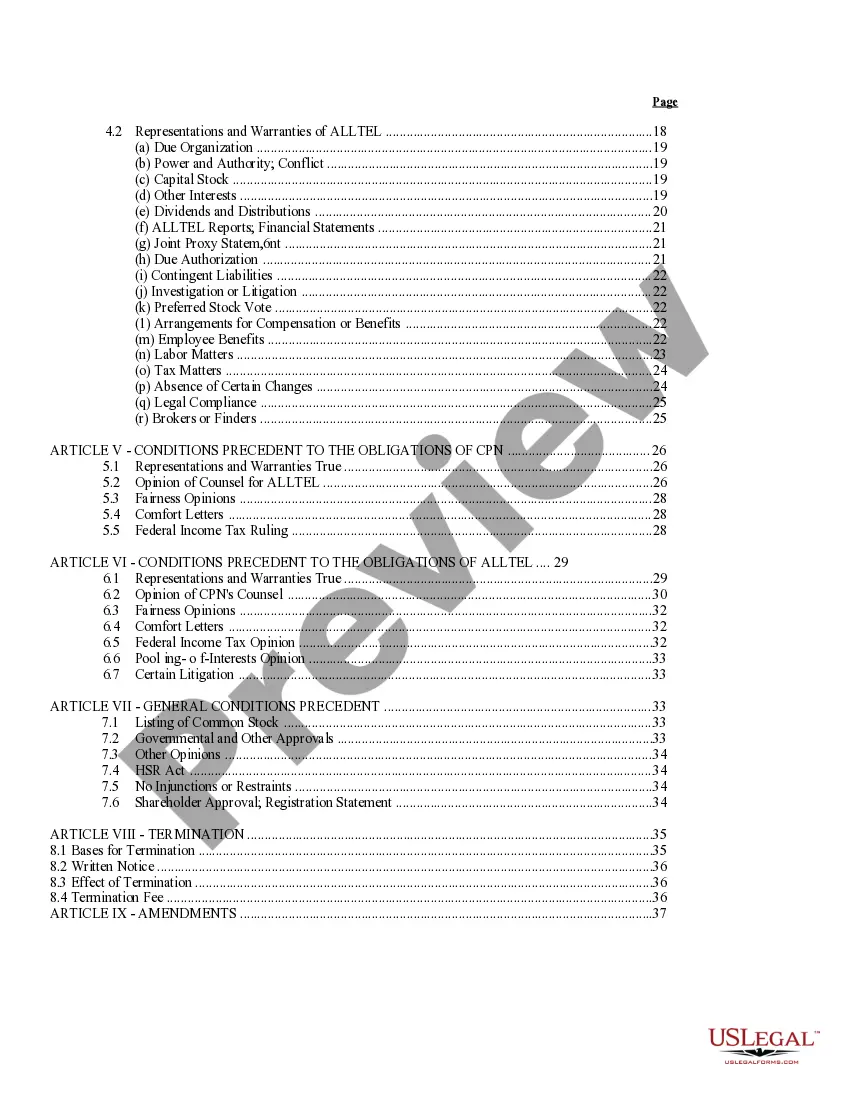

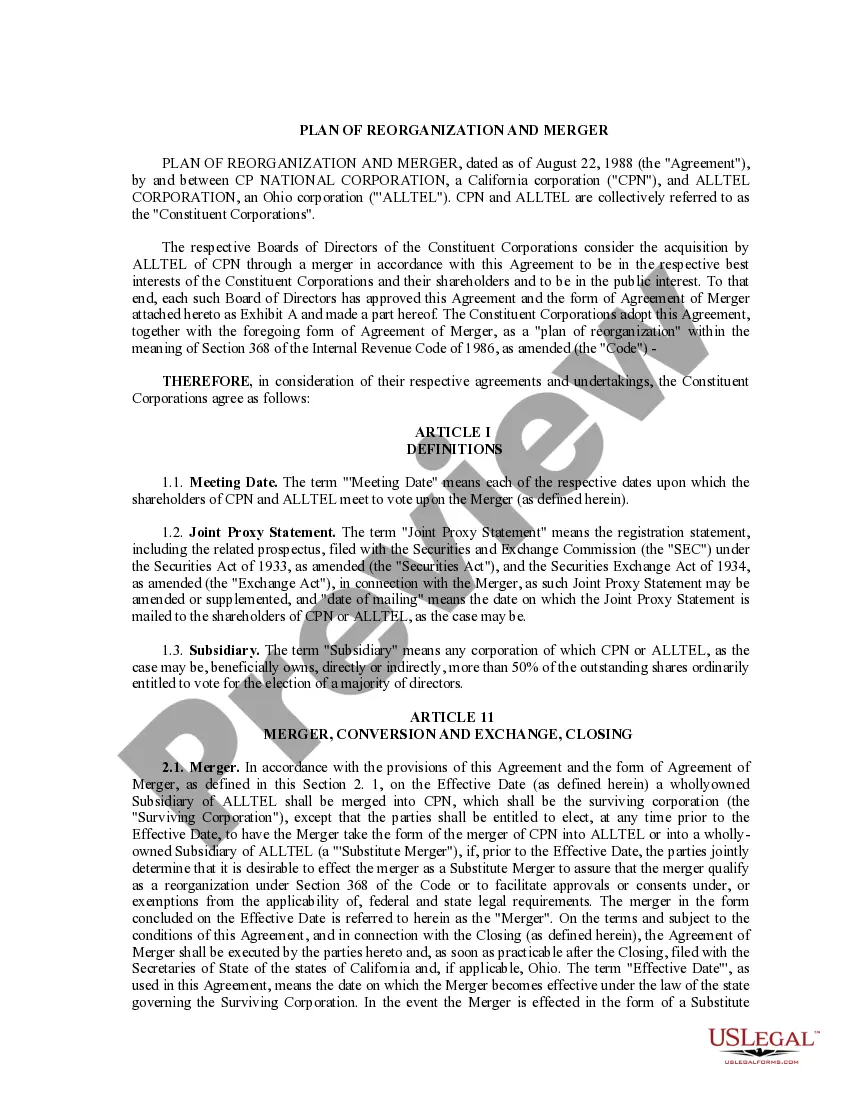

Michigan Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.

Description

How to fill out Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

Have you been in a situation the place you need papers for either enterprise or specific reasons virtually every day time? There are a variety of legal file web templates available online, but locating versions you can trust isn`t straightforward. US Legal Forms offers a huge number of kind web templates, such as the Michigan Plan of Reorganization and Merger between CP National Corp. and Alltel Corp., which can be written in order to meet federal and state specifications.

If you are presently acquainted with US Legal Forms web site and have an account, basically log in. Next, you may download the Michigan Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. design.

Should you not come with an bank account and would like to start using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is for that right metropolis/state.

- Use the Review option to analyze the form.

- See the description to ensure that you have chosen the proper kind.

- When the kind isn`t what you are trying to find, take advantage of the Research field to find the kind that suits you and specifications.

- When you find the right kind, simply click Purchase now.

- Choose the rates prepare you desire, submit the required info to produce your money, and pay for the transaction making use of your PayPal or credit card.

- Pick a hassle-free paper file format and download your version.

Get all the file web templates you possess purchased in the My Forms menu. You can get a more version of Michigan Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. whenever, if necessary. Just click the required kind to download or produce the file design.

Use US Legal Forms, one of the most comprehensive variety of legal varieties, to conserve time and avoid errors. The assistance offers expertly created legal file web templates which you can use for a selection of reasons. Make an account on US Legal Forms and begin generating your lifestyle easier.