Michigan Approval of Stock Retainer Plan for Nonemployee Directors: Comprehensive Guide and Sample Plan Introduction: This article provides a detailed description of the Michigan Approval of Stock Retainer Plan for Nonemployee Directors. It explains the purpose, requirements, and benefits of such a plan in Michigan. Additionally, it includes a copy of a sample plan for better understanding. Key terms: Michigan, Approval, Stock Retainer Plan, Nonemployee Directors, sample plan, requirements, benefits. I. Purpose of Michigan Approval of Stock Retainer Plan for Nonemployee Directors: — The Michigan Approval of Stock Retainer Plan is designed to attract and retain experienced nonemployee directors by offering them an equity interest in the company. — This plan provides a means to compensate nonemployee directors with stock retainers instead of cash, aligning their interests with the long-term success of the company. — The plan also promotes corporate governance by encouraging nonemployee directors to act in the best interests of the company's shareholders. II. Requirements for Michigan Approval of Stock Retainer Plan for Nonemployee Directors: — Under Michigan law, to implement a Stock Retainer Plan for Nonemployee Directors, the plan must be approved by the board of directors and the company's shareholders. — Shareholder approval is typically obtained through a vote at the annual general meeting or through written consent. — The plan must clearly specify the number of shares to be granted, the vesting schedule, and any performance-based criteria for eligibility and continued participation. — The plan must also comply with relevant federal securities laws, including those governing the offer, issuance, and resale of securities. III. Benefits of Michigan Approval of Stock Retainer Plan for Nonemployee Directors: — Aligning interests: By granting nonemployee directors equity ownership, companies align their interests with the overall success of the organization, fostering a sense of ownership and commitment. — Long-term focus: Stock retainer plans encourage nonemployee directors to take a long-term view of the company's performance, as their rewards are tied to the stock's value over time. — Attracting experienced directors: Offering stock retainers can help attract highly qualified nonemployee directors who are motivated by long-term growth and stability rather than short-term compensation. — Enhanced governance: Stock retainer plans promote better corporate governance as nonemployee directors become more engaged and proactive in overseeing the company's operations and strategic decisions. Sample Michigan Approval of Stock Retainer Plan for Nonemployee Directors: [INSERT COPY OF SAMPLE MICHIGAN APPROVAL OF STOCK RETAINER PLAN] Types of Michigan Approval of Stock Retainer Plan for Nonemployee Directors: — Restricted Stock Plan: A plan that grants nonemployee directors a set number of shares to vest at a certain rate or upon achieving specific performance-based goals. — Stock Option Plan: A plan that allows nonemployee directors to purchase company stock at a predetermined price within a specified time frame. — Performance Stock Plan: A plan where the grant of shares is tied to specific predetermined performance goals, such as achieving certain revenue targets or improving shareholder value. Conclusion: The Michigan Approval of Stock Retainer Plan for Nonemployee Directors is an effective means of attracting and retaining experienced directors, aligning their interests with the long-term success of the company. By complying with Michigan law, companies can design a plan that provides valuable equity compensation to nonemployee directors, encouraging their active participation and commitment.

Michigan Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan

Description

How to fill out Approval Of Stock Retainer Plan For Nonemployee Directors With Copy Of Plan?

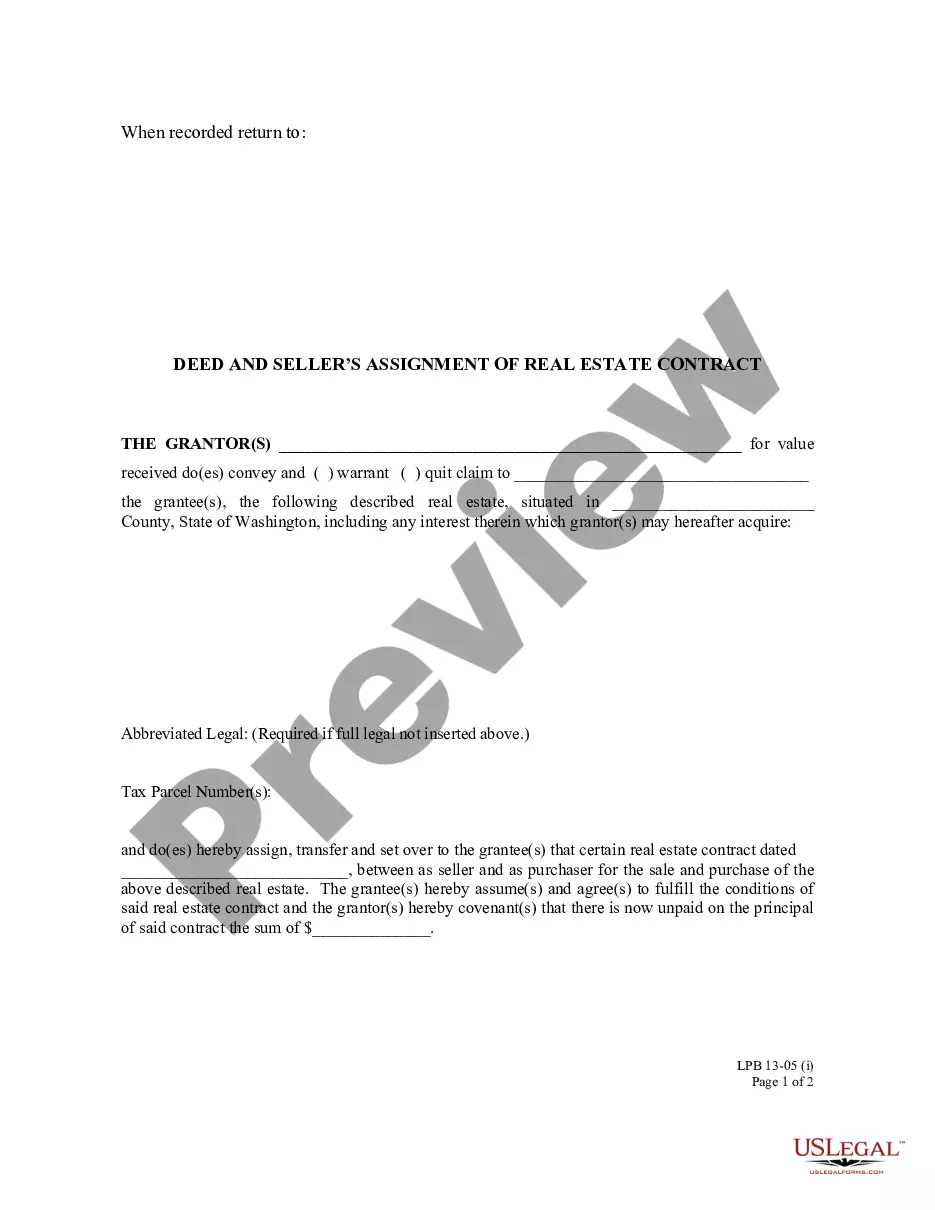

Choosing the right legal document web template can be a have a problem. Of course, there are plenty of templates accessible on the Internet, but how can you get the legal develop you want? Use the US Legal Forms website. The service gives thousands of templates, for example the Michigan Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan, which can be used for enterprise and personal demands. Each of the varieties are examined by pros and fulfill federal and state needs.

Should you be currently signed up, log in in your profile and then click the Acquire switch to get the Michigan Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan. Make use of profile to look through the legal varieties you have purchased previously. Go to the My Forms tab of the profile and get one more backup of your document you want.

Should you be a whole new consumer of US Legal Forms, listed below are basic recommendations so that you can comply with:

- Initial, ensure you have chosen the right develop for your personal town/county. You can look through the shape while using Review switch and read the shape outline to make certain it is the best for you.

- In case the develop fails to fulfill your expectations, use the Seach field to get the appropriate develop.

- Once you are positive that the shape is proper, select the Get now switch to get the develop.

- Choose the rates program you want and enter in the required info. Make your profile and pay for an order utilizing your PayPal profile or bank card.

- Opt for the submit structure and down load the legal document web template in your device.

- Full, change and print and signal the received Michigan Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan.

US Legal Forms will be the biggest collection of legal varieties in which you can find different document templates. Use the company to down load professionally-manufactured documents that comply with express needs.