The Michigan Stock Option Plan is a comprehensive program that offers various types of stock options and stock appreciation rights (SARS) to eligible participants. This plan aims to incentivize employees and key personnel by providing them with a stake in the company's success. By offering both Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS), the plan caters to different tax considerations and individual circumstances. Incentive Stock Options (SOS) are one type of stock option granted under the Michigan Stock Option Plan. These options are designed to provide favorable tax treatment to employees. When exercising SOS, participants can potentially qualify for long-term capital gains tax rates on the appreciation of the stock. However, certain restrictions and requirements, such as a maximum grant value per year, must be met for SOS to maintain their tax advantages. Nonqualified Stock Options (SOS), on the other hand, are another type of stock option available within the plan. SOS do not offer the same tax advantages as SOS. When employees exercise SOS, the difference between the exercise price and the fair market value at the time of exercise is considered ordinary income and subject to regular income tax rates. Nevertheless, SOS provide more flexibility as they do not have to comply with the strict criteria imposed on SOS. In addition to stock options, the Michigan Stock Option Plan also includes Stock Appreciation Rights (SARS). SARS are grants that allow employees to receive cash or stock equivalent to the appreciation in the company's stock price over a specified period. Unlike stock options, SARS do not require participants to make an upfront purchase of shares. Instead, they capitalize on the stock's value growth without requiring an initial investment. The Michigan Stock Option Plan recognizes the varying needs and preferences of employees, executives, and other key personnel. By offering a combination of Incentive Stock Options, Nonqualified Stock Options, and Stock Appreciation Rights, the plan enables participants to select the type of equity compensation that aligns with their financial goals and tax considerations. This comprehensive approach ensures that eligible individuals can benefit from the success of the company while optimizing their overall financial strategy.

Michigan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

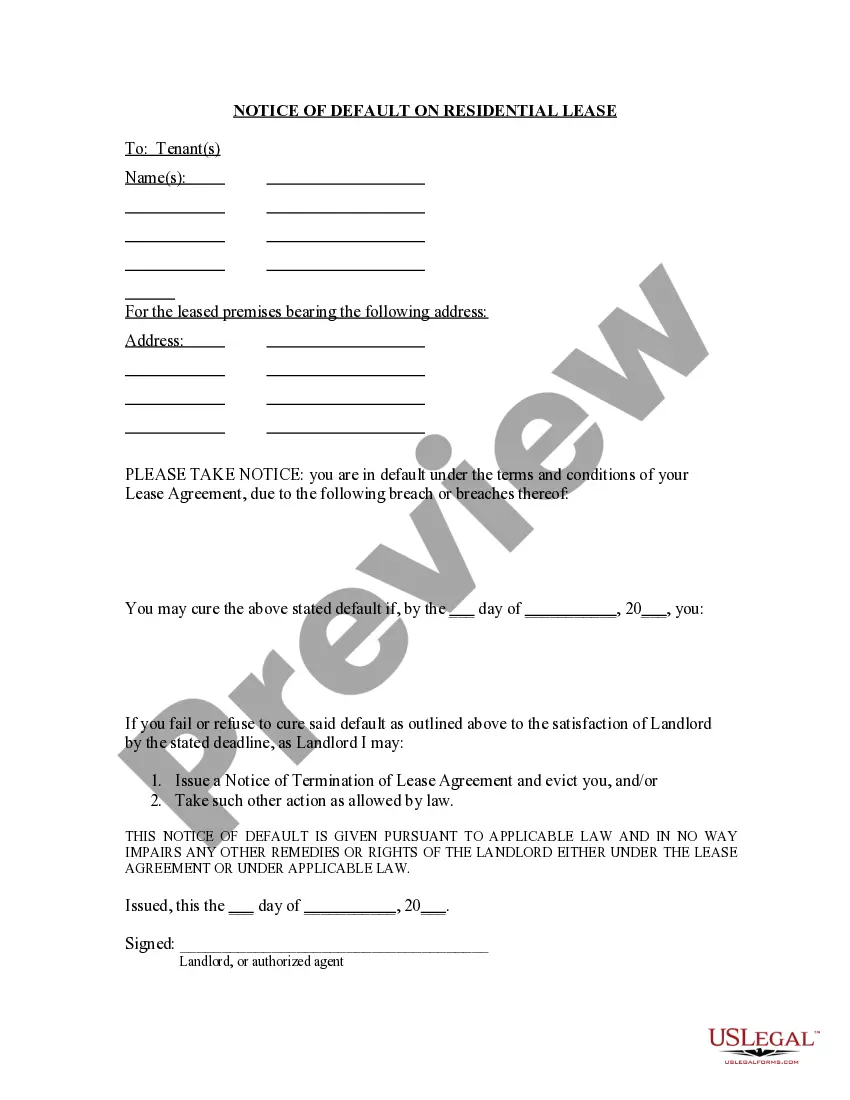

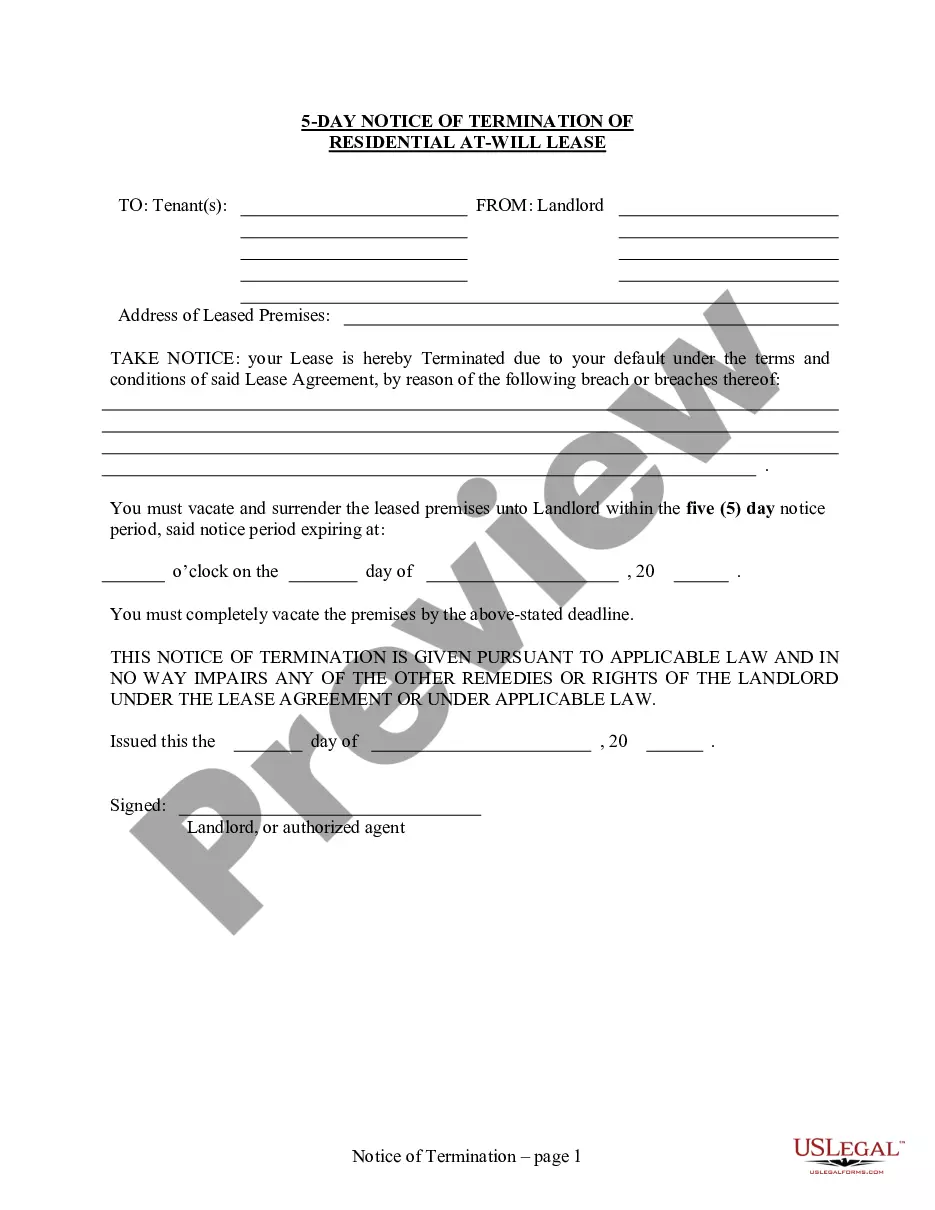

How to fill out Michigan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

US Legal Forms - one of many most significant libraries of lawful kinds in America - delivers a wide range of lawful record web templates you are able to down load or print out. While using internet site, you can get thousands of kinds for organization and specific reasons, sorted by classes, claims, or keywords and phrases.You will find the newest models of kinds just like the Michigan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights within minutes.

If you already possess a monthly subscription, log in and down load Michigan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights from your US Legal Forms collection. The Obtain option can look on each kind you perspective. You gain access to all previously downloaded kinds within the My Forms tab of your own accounts.

In order to use US Legal Forms initially, allow me to share simple guidelines to help you started off:

- Be sure you have chosen the best kind for your personal metropolis/area. Click on the Preview option to examine the form`s articles. See the kind outline to actually have chosen the right kind.

- In the event the kind doesn`t suit your specifications, utilize the Research discipline at the top of the screen to find the one which does.

- If you are pleased with the form, validate your option by clicking the Buy now option. Then, pick the costs plan you like and offer your accreditations to sign up to have an accounts.

- Method the deal. Utilize your charge card or PayPal accounts to accomplish the deal.

- Find the formatting and down load the form in your system.

- Make alterations. Load, revise and print out and indication the downloaded Michigan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Each and every template you added to your bank account lacks an expiry date and it is your own forever. So, in order to down load or print out an additional duplicate, just check out the My Forms segment and click on around the kind you want.

Gain access to the Michigan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights with US Legal Forms, probably the most extensive collection of lawful record web templates. Use thousands of specialist and state-distinct web templates that meet your organization or specific requires and specifications.

Form popularity

FAQ

First things first: You don't have to pay any tax when you're granted those options. If you are given an option agreement that allows you to purchase 1,000 shares of company stock, you have been granted the option to purchase stock. This grant by itself isn't taxable.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

There are two types, each with different taxation: nonqualified stock options (NQSOs) and incentive stock options (ISOs). Since the exercise price is nearly always the company's stock price on the grant date, stock options become valuable only if the stock price rises.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.

The grant price is the price at which you can purchase shares, and the grant date is the day the stock options are given to you. Vesting is the process of fulfilling the grant (promise). The vesting schedule determines the vesting date - the date when you can begin purchasing stock and using your options.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.