The Michigan Stock Option Plan of WSFS Financial Corporation is a program designed to provide employees with the opportunity to purchase company stock at a predetermined price within a specified period. This plan comes with certain terms and conditions that aim to incentivize and reward employees, while aligning their interests with the long-term success of the organization. Under the Michigan Stock Option Plan, WSFS Financial Corporation offers different types of stock options to eligible employees. These options can be categorized into two types: non-qualified stock options (SOS) and incentive stock options (SOS). 1. Non-Qualified Stock Options (SOS): Non-Qualified Stock Options are a common type of stock option that provides employees with the right to purchase company stock at a predetermined exercise price. Employees can exercise these options at any time after a specified vesting period. SOS are subject to taxation on the difference between the exercise price and the fair market value of the stock at the time of exercise, known as the "bargain element." 2. Incentive Stock Options (SOS): Incentive Stock Options are another form of stock options granted to employees, but with specific tax advantages. SOS offer employees the opportunity to purchase company stock at a predetermined exercise price, typically at a discount to the fair market value. To qualify for favorable tax treatment, SOS must comply with certain conditions set by the Internal Revenue Service (IRS). If employees meet these requirements, they may benefit from capital gains tax treatment upon the sale of the stock. The Michigan Stock Option Plan is designed to attract and retain talented employees by providing them with an ownership stake in the company. By offering stock options, WSFS Financial Corporation aims to motivate and incentivize employees, aligning their interests with those of the shareholders. This plan encourages employees to contribute to the long-term growth and profitability of the organization. WSFS Financial Corporation carefully administers the Michigan Stock Option Plan, ensuring compliance with applicable laws and regulations. Employees are typically provided with detailed information regarding the terms, vesting periods, exercise prices, and tax implications of the stock options they are granted. In conclusion, the Michigan Stock Option Plan offered by WSFS Financial Corporation provides employees with the opportunity to purchase company stock through SOS and SOS. This program serves as a valuable tool for attracting, rewarding, and retaining top talent while fostering a sense of ownership and commitment among employees.

Michigan Stock Option Plan of WSFS Financial Corporation

Description

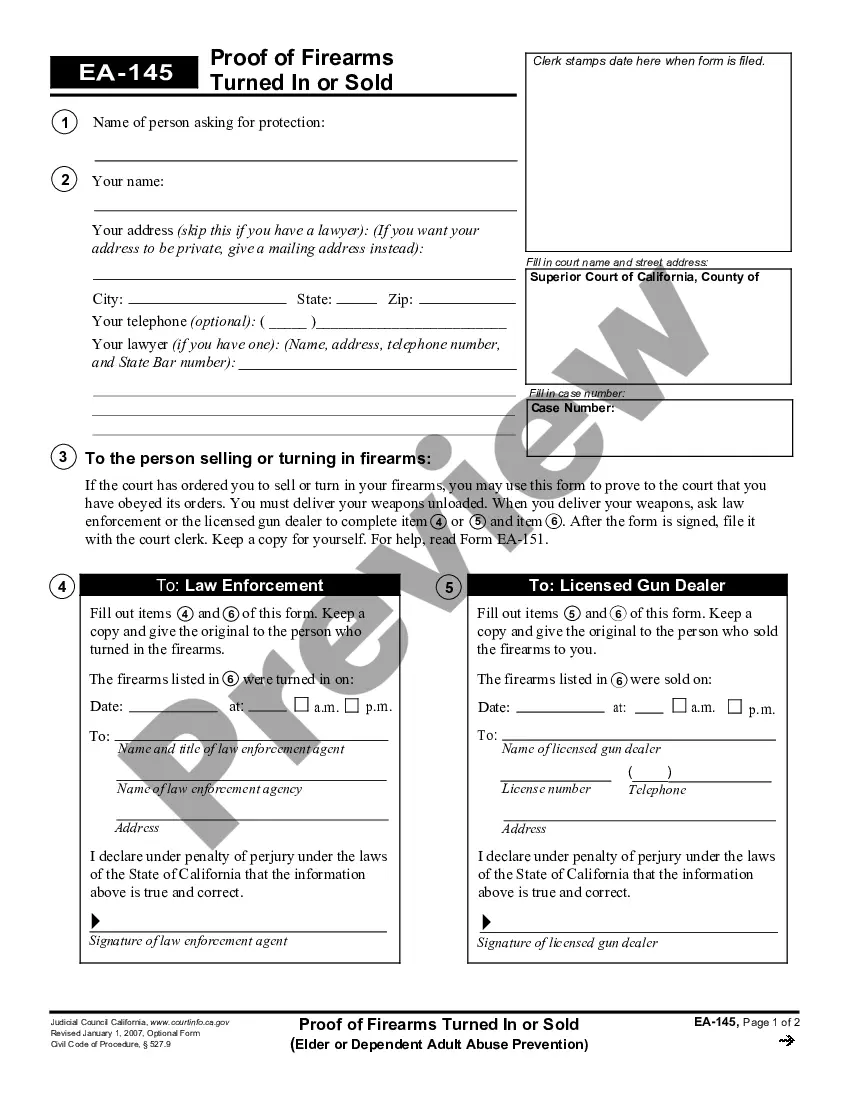

How to fill out Michigan Stock Option Plan Of WSFS Financial Corporation?

Finding the right lawful file format could be a have a problem. Of course, there are tons of layouts available on the net, but how will you get the lawful develop you want? Use the US Legal Forms web site. The assistance provides a huge number of layouts, including the Michigan Stock Option Plan of WSFS Financial Corporation, that can be used for enterprise and personal requirements. All of the kinds are examined by professionals and fulfill federal and state requirements.

Should you be already authorized, log in to your profile and click the Acquire button to obtain the Michigan Stock Option Plan of WSFS Financial Corporation. Make use of profile to check through the lawful kinds you have ordered in the past. Go to the My Forms tab of your profile and have an additional version in the file you want.

Should you be a fresh consumer of US Legal Forms, listed below are simple recommendations so that you can adhere to:

- Very first, ensure you have selected the proper develop to your metropolis/region. You may look over the shape using the Preview button and read the shape explanation to guarantee this is the right one for you.

- When the develop is not going to fulfill your needs, use the Seach area to get the appropriate develop.

- When you are positive that the shape is acceptable, click on the Acquire now button to obtain the develop.

- Opt for the costs plan you need and enter the essential information and facts. Make your profile and buy the transaction utilizing your PayPal profile or Visa or Mastercard.

- Pick the submit structure and download the lawful file format to your system.

- Total, change and printing and signal the acquired Michigan Stock Option Plan of WSFS Financial Corporation.

US Legal Forms will be the biggest library of lawful kinds where you will find different file layouts. Use the company to download appropriately-made papers that adhere to state requirements.

Form popularity

FAQ

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.

WSFS | Bank Center | 500 Delaware Avenue Wilmington DE US 19801.

WSFS Financial Corporation is a multibillion-dollar financial services company. Its primary subsidiary, WSFS Bank, is the oldest and largest locally headquartered bank and trust company in the Greater Philadelphia and Delaware region.

WSFS officially stands for Wilmington Savings Fund Society; founded in 1832.

WSFS Financial Corporation operates as the savings and loan holding company for the Wilmington Savings Fund Society, FSB that provides various banking services in the United States. It operates through three segments: WSFS Bank, Cash Connect, and Wealth Management.

WSFS is a small cap regional bank that has established a foothold across Northern Delaware, Southern New Jersey, and Southeastern Pennsylvania.

Wilmington Savings Fund Society was chartered as a Delaware thrift in 1832 by a group of Wilmington community leaders and businessmen.