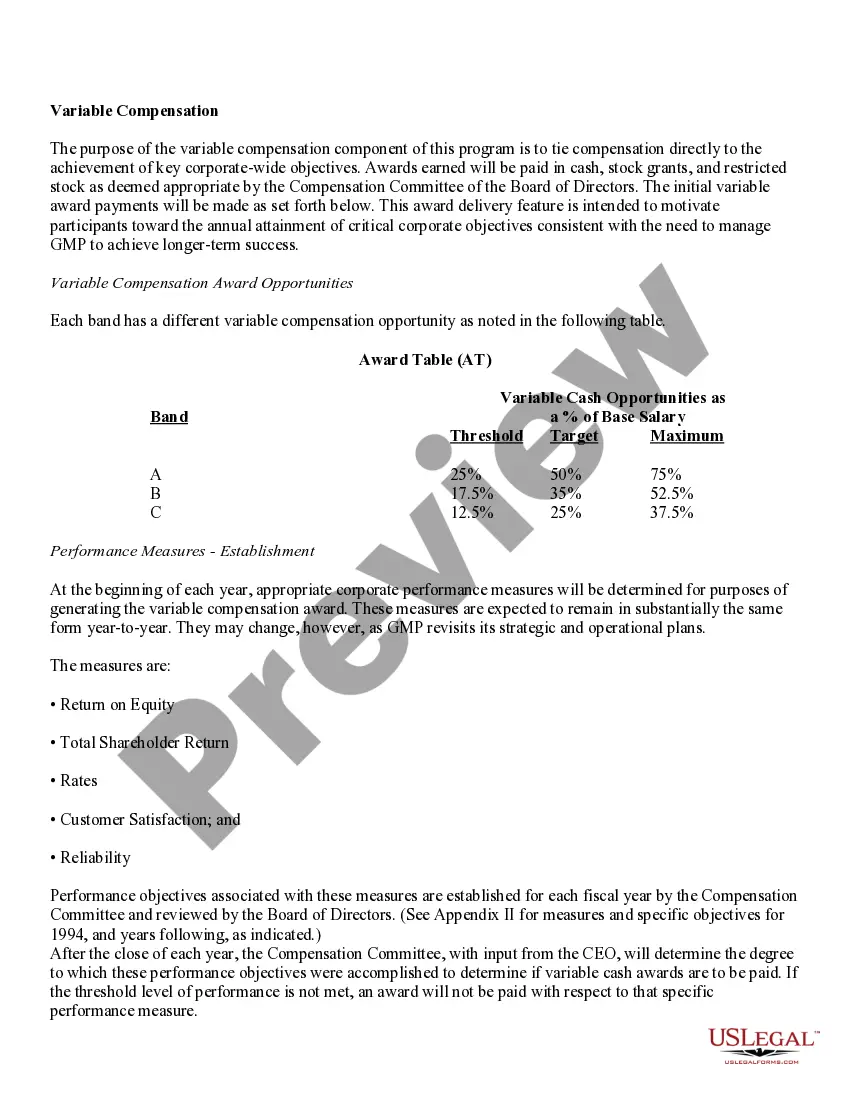

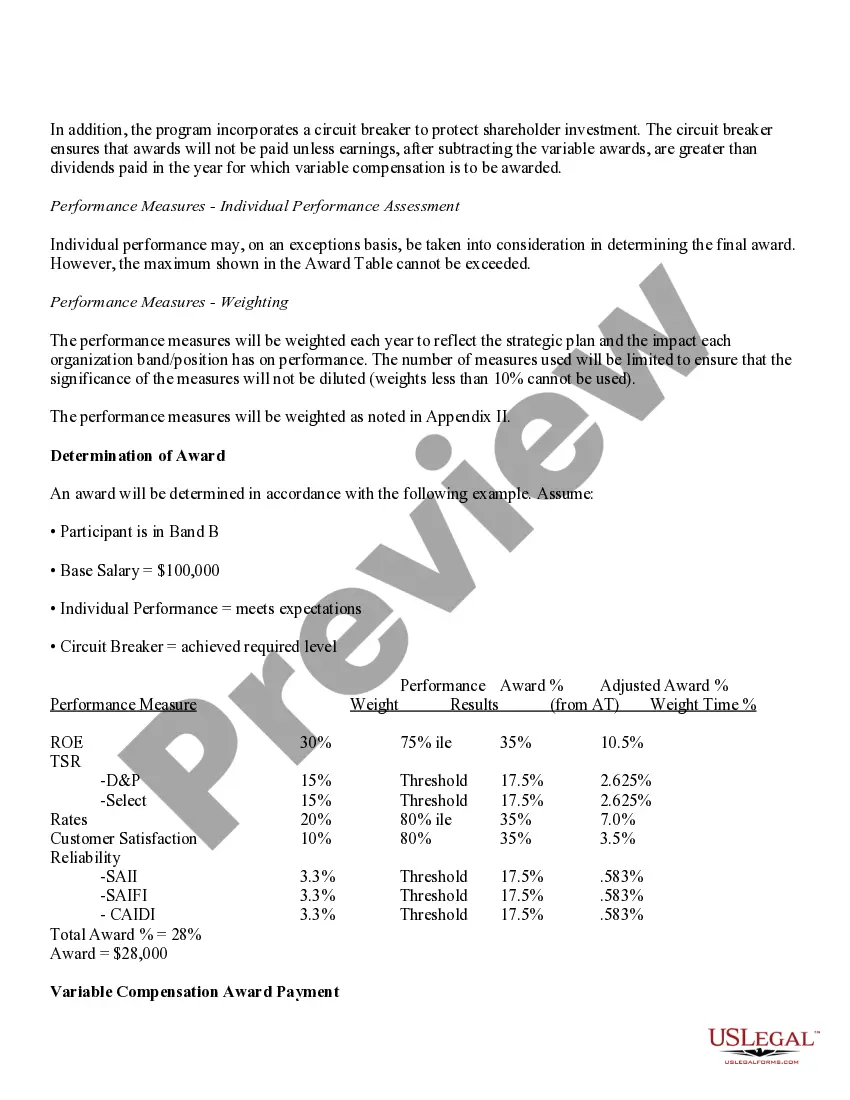

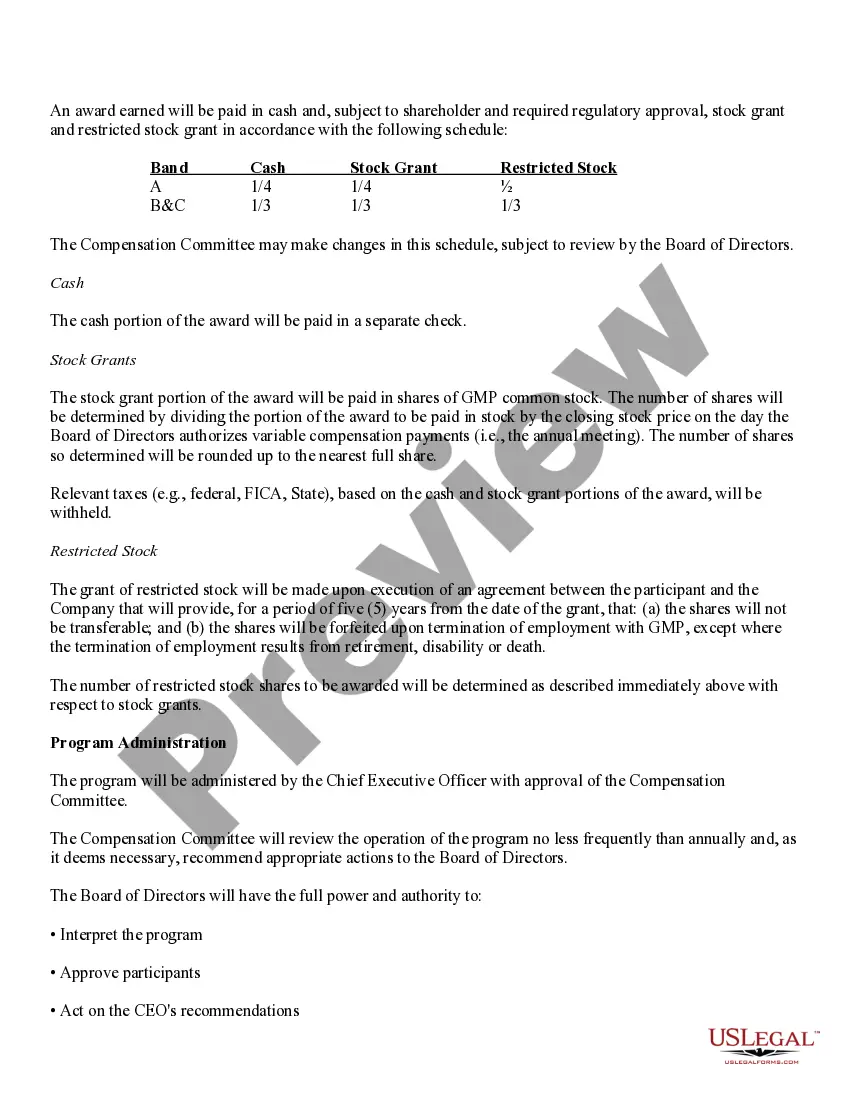

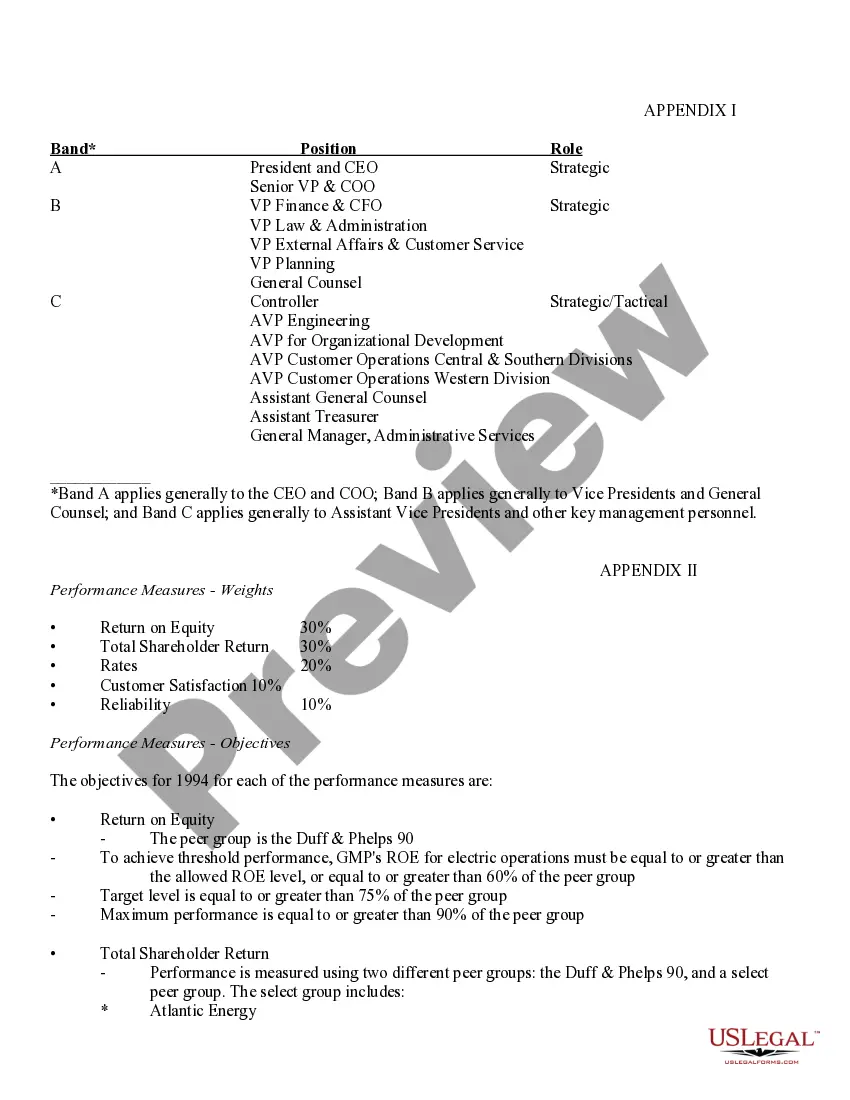

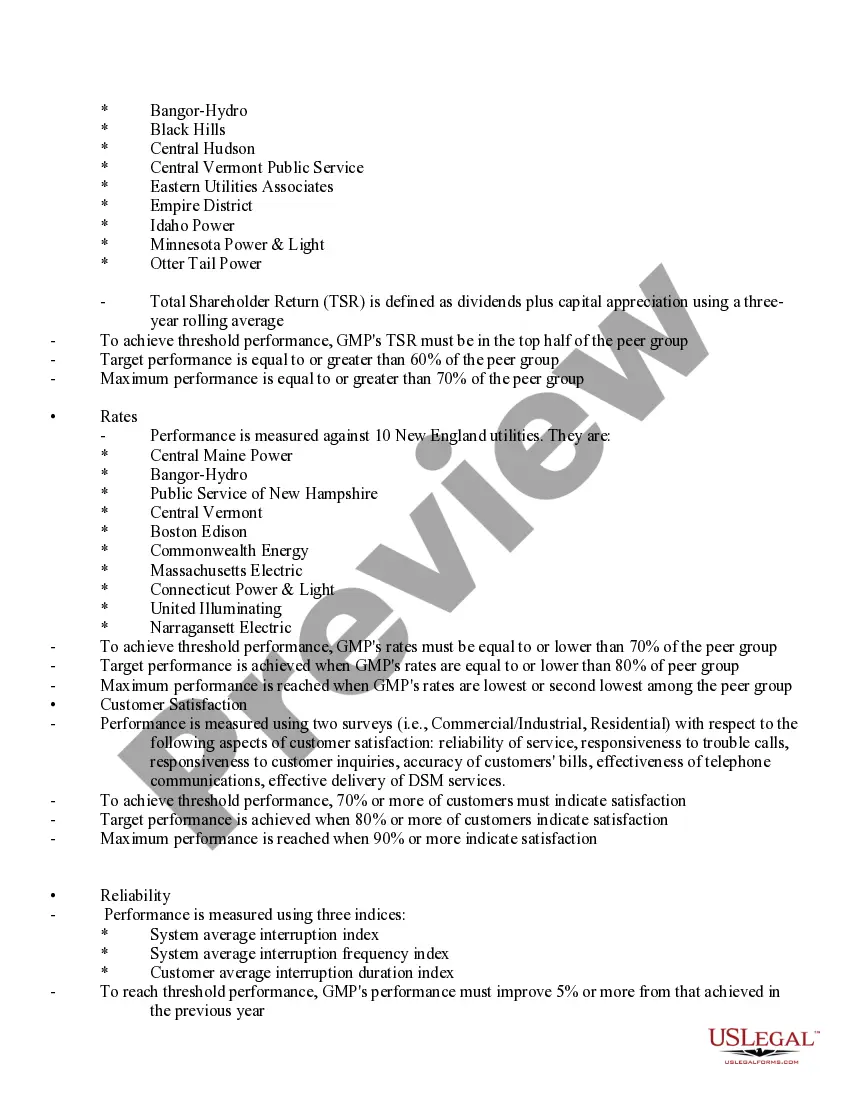

The Michigan Compensation Program for Officers and Certain Key Management Personnel is a comprehensive framework specifically designed to govern the compensation packages of officers and key management personnel in public and private sector organizations operating in Michigan. This program aims to ensure fair and equitable compensation practices while attracting and retaining top talent. Under this program, there are various types of compensation packages available, each tailored to accommodate the diverse needs and responsibilities of officers and key management personnel. The specific types of compensation programs may include: 1. Base Salary: The base salary is the fixed amount of compensation paid regularly to officers and key management personnel. It is determined based on factors such as job responsibilities, experience, qualifications, market conditions, and performance metrics. 2. Incentive Compensation: In addition to the base salary, officers and key management personnel may be eligible for incentive compensation programs, which provide additional financial rewards based on meeting predefined targets or goals. These incentives may be in the form of bonuses, profit-sharing, or stock options. 3. Deferred Compensation: The program may also include deferred compensation plans, allowing officers and key management personnel to defer a portion of their salary or bonuses to future years. These plans offer benefits such as tax advantages, increased savings, and retirement planning. 4. Retirement and Pension Plans: Michigan Compensation Program often incorporates retirement and pension plans to help officers and key management personnel secure their future. These plans could include defined-benefit pension plans, defined-contribution plans like 401(k)s, or a combination of both. 5. Insurance and Health Benefits: To provide comprehensive coverage, the program may offer officers and key management personnel benefits such as health insurance plans, disability insurance, life insurance, and other employee welfare programs. 6. Stock-Based Compensation: In recognition of their contribution to the organization's success and to align their interests with shareholders, officers and key management personnel may receive stock-based compensation. This could include stock options, restricted stock units, and other equity-based incentives. 7. Perquisites and Benefits: Some compensation programs offer additional perks and benefits like car allowances, housing or housing subsidies, club memberships, professional development allowances, and other non-monetary benefits to enhance the work-life balance and job satisfaction of officers and key management personnel. Attachments associated with the Michigan Compensation Program may include official policies, agreements, reports, and documents outlining the program's guidelines, eligibility criteria, compensation structure, performance measurement metrics, legal compliance information, and any forms required for enrollment or administration of the program. In conclusion, the Michigan Compensation Program for Officers and Certain Key Management Personnel encompasses a range of compensation types and benefits designed to attract, retain, and properly compensate executives and key personnel. The program ensures competitiveness, fairness, and transparency in compensation practices, ultimately benefiting both organizations and individuals.

Michigan Compensation Program for Officers and Certain Key Management Personnel with attachments

Description

How to fill out Michigan Compensation Program For Officers And Certain Key Management Personnel With Attachments?

If you want to total, acquire, or print out legal papers web templates, use US Legal Forms, the biggest selection of legal types, which can be found on the Internet. Utilize the site`s basic and convenient search to obtain the documents you want. Various web templates for enterprise and person functions are sorted by categories and says, or search phrases. Use US Legal Forms to obtain the Michigan Compensation Program for Officers and Certain Key Management Personnel with attachments in just a handful of clicks.

Should you be previously a US Legal Forms consumer, log in to the profile and click the Acquire key to have the Michigan Compensation Program for Officers and Certain Key Management Personnel with attachments. You may also gain access to types you previously delivered electronically in the My Forms tab of the profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape to the appropriate town/region.

- Step 2. Make use of the Review solution to examine the form`s content. Do not forget to learn the description.

- Step 3. Should you be not happy using the type, make use of the Search field towards the top of the display to find other versions of your legal type web template.

- Step 4. When you have discovered the shape you want, select the Purchase now key. Choose the pricing program you choose and put your references to register for an profile.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal profile to complete the financial transaction.

- Step 6. Pick the file format of your legal type and acquire it on your product.

- Step 7. Total, revise and print out or indicator the Michigan Compensation Program for Officers and Certain Key Management Personnel with attachments.

Each legal papers web template you get is your own property for a long time. You may have acces to every single type you delivered electronically in your acccount. Go through the My Forms section and select a type to print out or acquire again.

Be competitive and acquire, and print out the Michigan Compensation Program for Officers and Certain Key Management Personnel with attachments with US Legal Forms. There are many expert and state-specific types you can use for your personal enterprise or person requirements.