Michigan Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

You can spend hours on the web looking for the lawful record web template which fits the state and federal demands you need. US Legal Forms supplies 1000s of lawful forms which are reviewed by pros. You can easily down load or produce the Michigan Profit Sharing Plan from my support.

If you have a US Legal Forms profile, you are able to log in and click on the Down load switch. After that, you are able to total, change, produce, or indication the Michigan Profit Sharing Plan. Each and every lawful record web template you purchase is your own property forever. To obtain an additional copy of the acquired kind, visit the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site initially, adhere to the easy directions below:

- First, make certain you have selected the correct record web template for that county/city of your liking. See the kind information to make sure you have chosen the proper kind. If available, take advantage of the Review switch to check through the record web template also.

- If you wish to discover an additional variation of the kind, take advantage of the Search industry to obtain the web template that meets your requirements and demands.

- After you have identified the web template you would like, simply click Get now to carry on.

- Select the rates strategy you would like, enter your accreditations, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal profile to cover the lawful kind.

- Select the file format of the record and down load it to your system.

- Make alterations to your record if needed. You can total, change and indication and produce Michigan Profit Sharing Plan.

Down load and produce 1000s of record themes making use of the US Legal Forms site, which provides the largest collection of lawful forms. Use skilled and status-particular themes to deal with your business or specific requirements.

Form popularity

FAQ

Profit sharing helps create a culture of ownership. As owners, employees have more incentive to increase the company's profitability. However, this strategy will work only if the company and its management create ways for employees to understand the company's challenges and contribute to the solutions.

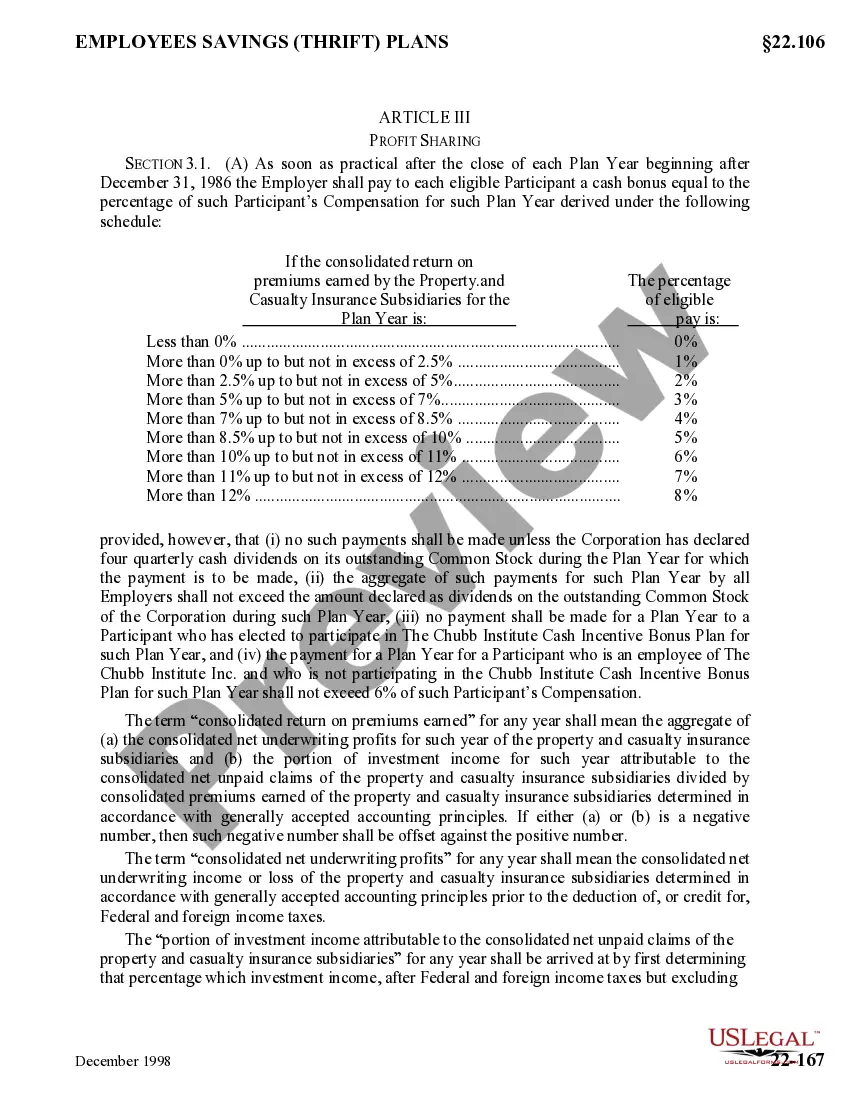

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so. Other years, you do not need to make contributions.

Profit sharing may increase compensation risks for employees by making earnings more variable. Profit sharing may incur high administrative costs. There is a negative link between unionization and profit sharing as most unions oppose such organizational incentive programs.

Typically profit share is calculated by determining the ratio of the employee's compensation to the total compensation of all employees. For example, if employees earn 1% of all compensation, they receive 1% of the profits for the year or period. Profits are typically paid out quarterly, annually, or semi-annually.

For small businesses considering a retirement plan, profit sharing plans can be a powerful tool to promote financial security in retirement, as they provide benefits to both employees and their employers. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.

sharing plan is a great way for a business to give its employees a sense of ownership in the company, but there are typically restrictions as to when and how a person can withdraw these funds without penalties.

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.