Michigan Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

How to fill out Supplemental Employee Stock Ownership Plan Of SPX Corporation?

US Legal Forms - one of the most significant libraries of authorized types in America - gives a wide array of authorized document web templates you can down load or print out. Using the website, you can get a huge number of types for company and person uses, categorized by classes, says, or keywords and phrases.You can find the most recent versions of types much like the Michigan Supplemental Employee Stock Ownership Plan of SPX Corporation within minutes.

If you already have a membership, log in and down load Michigan Supplemental Employee Stock Ownership Plan of SPX Corporation from the US Legal Forms catalogue. The Obtain button can look on each and every develop you see. You gain access to all in the past saved types within the My Forms tab of your accounts.

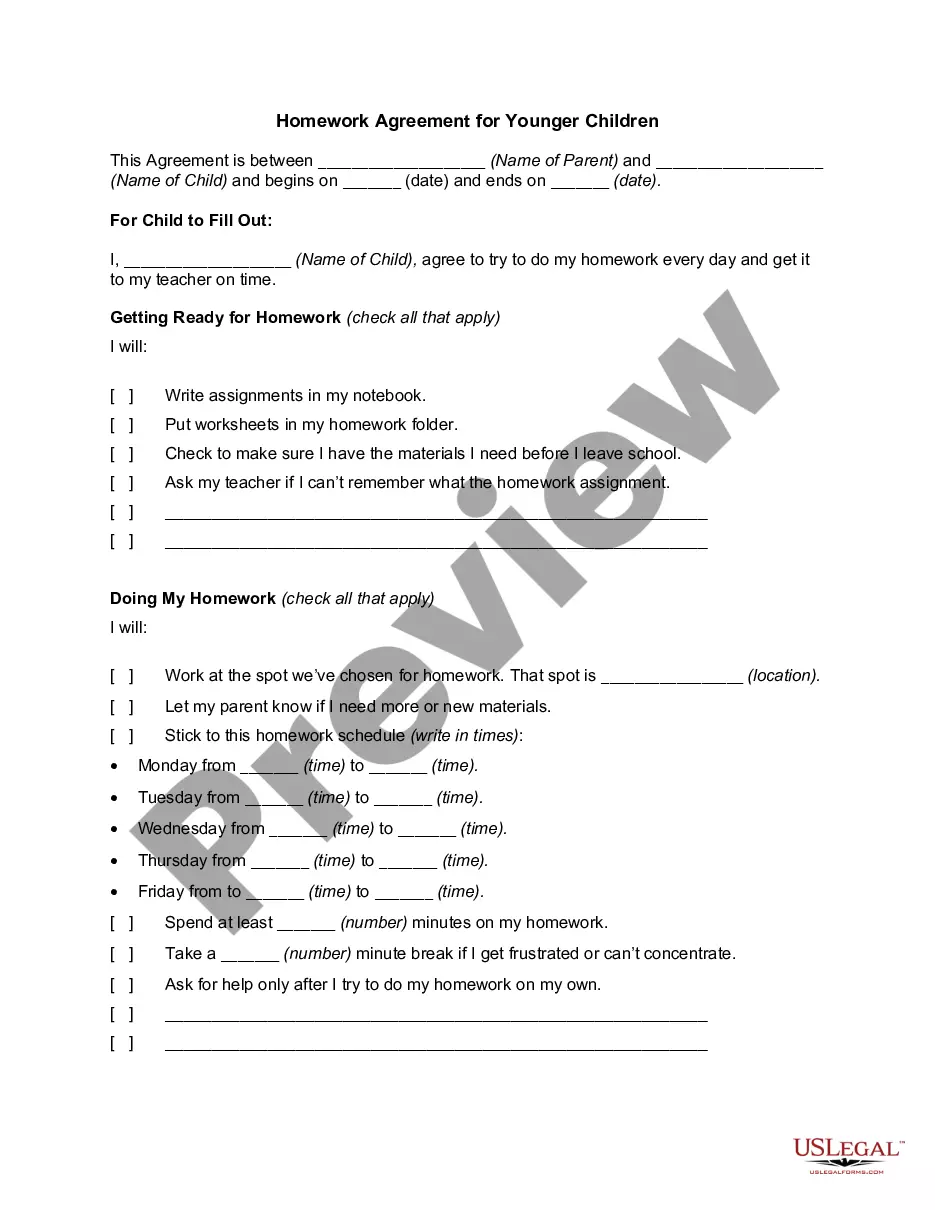

If you want to use US Legal Forms the very first time, listed below are straightforward instructions to obtain started:

- Be sure to have chosen the best develop to your town/state. Go through the Review button to review the form`s content material. Look at the develop description to ensure that you have selected the proper develop.

- If the develop doesn`t satisfy your needs, make use of the Research area towards the top of the display to obtain the one who does.

- When you are pleased with the form, verify your decision by visiting the Buy now button. Then, choose the rates strategy you want and provide your references to register on an accounts.

- Procedure the financial transaction. Make use of your bank card or PayPal accounts to complete the financial transaction.

- Choose the structure and down load the form on the product.

- Make adjustments. Fill out, revise and print out and sign the saved Michigan Supplemental Employee Stock Ownership Plan of SPX Corporation.

Each design you added to your bank account lacks an expiry time which is your own eternally. So, if you would like down load or print out an additional backup, just proceed to the My Forms section and then click about the develop you will need.

Gain access to the Michigan Supplemental Employee Stock Ownership Plan of SPX Corporation with US Legal Forms, probably the most extensive catalogue of authorized document web templates. Use a huge number of specialist and status-specific web templates that meet your organization or person needs and needs.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An ESOP is a retirement benefit. But it's different than a 401(k) or pension plan. It's an exclusive option for C- and S-corporations. Assets are primarily invested in company stock.

An Employee Stock Ownership Plan (ESOP) is a form of defined contribution plan in which the investments are primarily in employer stock. A Cash Balance Plan is a defined benefit plan that defines the benefit in terms that are more characteristic of a defined contribution plan.

Pretax contributions: Employer contributions to a qualified plan are generally able to be made on a pretax basis. That is, you don't pay income tax on amounts contributed by your employer until you withdraw money from the plan. Your contributions to a 401(k) plan may also be made on a pretax basis.

An ESOP is a retirement benefit. But it's different than a 401(k) or pension plan. It's an exclusive option for C- and S-corporations. Assets are primarily invested in company stock.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.