Michigan Private Placement of Common Stock refers to the process of raising capital through the sale of common stock to a select group of private investors within the state of Michigan. It differs from a public offering as it is not offered to the public, rather, it is limited to a specific group of accredited and institutional investors. One type of Michigan Private Placement of Common Stock is known as a Rule 506 offering, which is conducted under Regulation D of the Securities Act of 1933. This allows companies to sell securities privately to accredited investors and a limited number of non-accredited investors who meet certain financial criteria. Rule 506 offerings can be conducted without any specific limits on the amount of money that can be raised. Another type is the Intrastate Offering, which is conducted under the Michigan Uniform Securities Act. This offering is restricted to residents and entities based within the state of Michigan. It allows companies to raise capital from both accredited and non-accredited investors within the state, as long as certain filing requirements are met. In a Michigan Private Placement of Common Stock, companies typically prepare a private placement memorandum (PPM) that includes detailed information about the company, its operations, financial statements, and the terms of the offering. This document is shared with potential investors to provide them with all the necessary information to make an informed investment decision. Investors participating in a private placement of common stock may benefit from potential capital appreciation and the opportunity to become shareholders of the company. However, they also bear the risk of the investment, as these offerings are often more speculative and illiquid than publicly traded stocks. Michigan Private Placement of Common Stock offers companies an alternative means of raising capital, allowing them to avoid the costly and time-consuming process of undergoing a public offering. It can be an attractive option for smaller businesses or startups seeking funding, as it provides access to a select group of investors who may be interested in supporting local businesses. In conclusion, Michigan Private Placement of Common Stock involves raising capital by selling common stock privately to a specific group of investors in the state. This type of offering can be conducted under Rule 506 or as an Intrastate Offering. It provides companies with an efficient way to raise funds while offering investors the opportunity to support local businesses and potentially benefit from their growth.

Michigan Private placement of Common Stock

Description

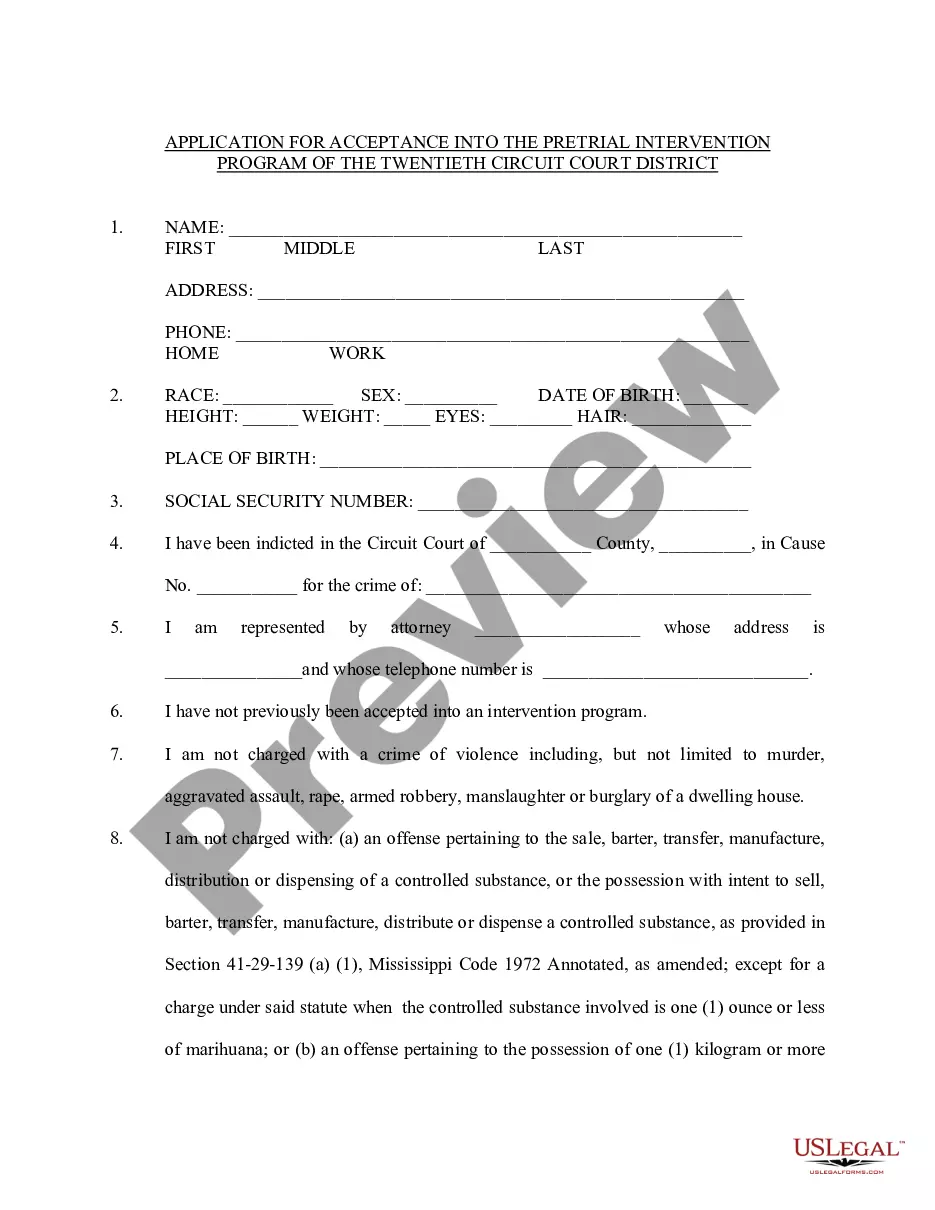

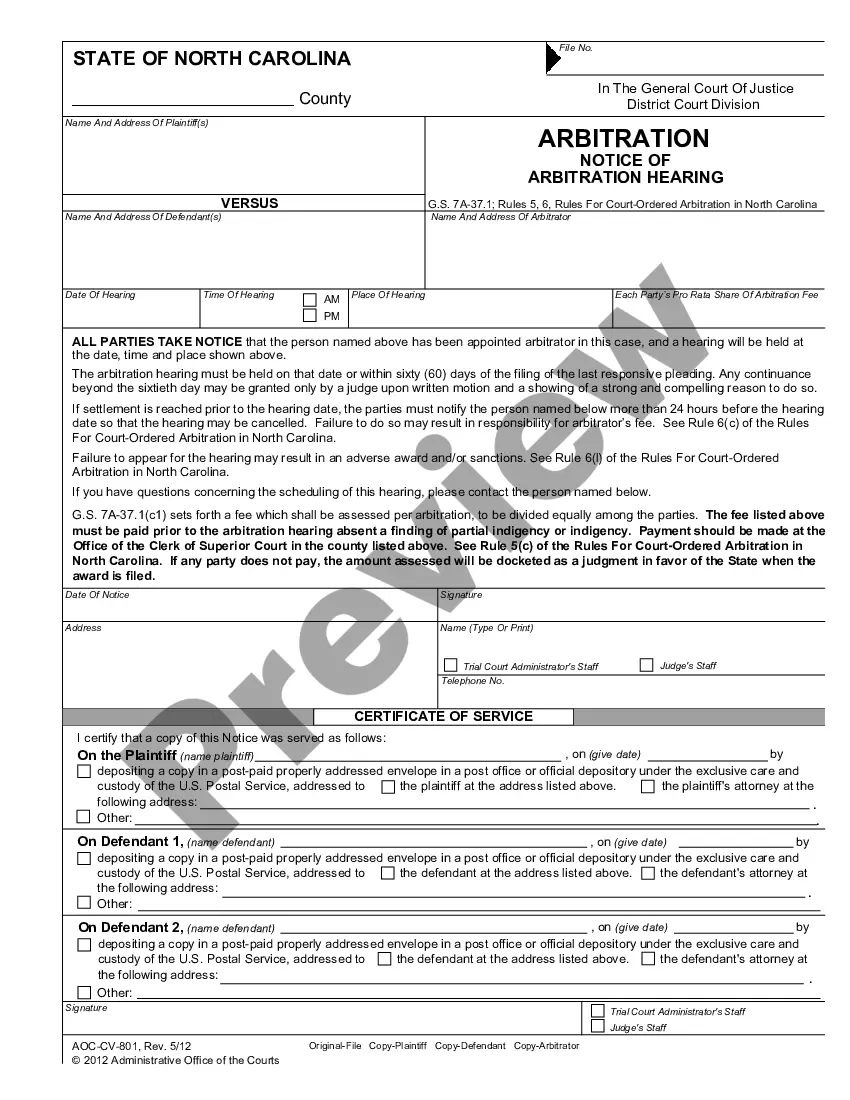

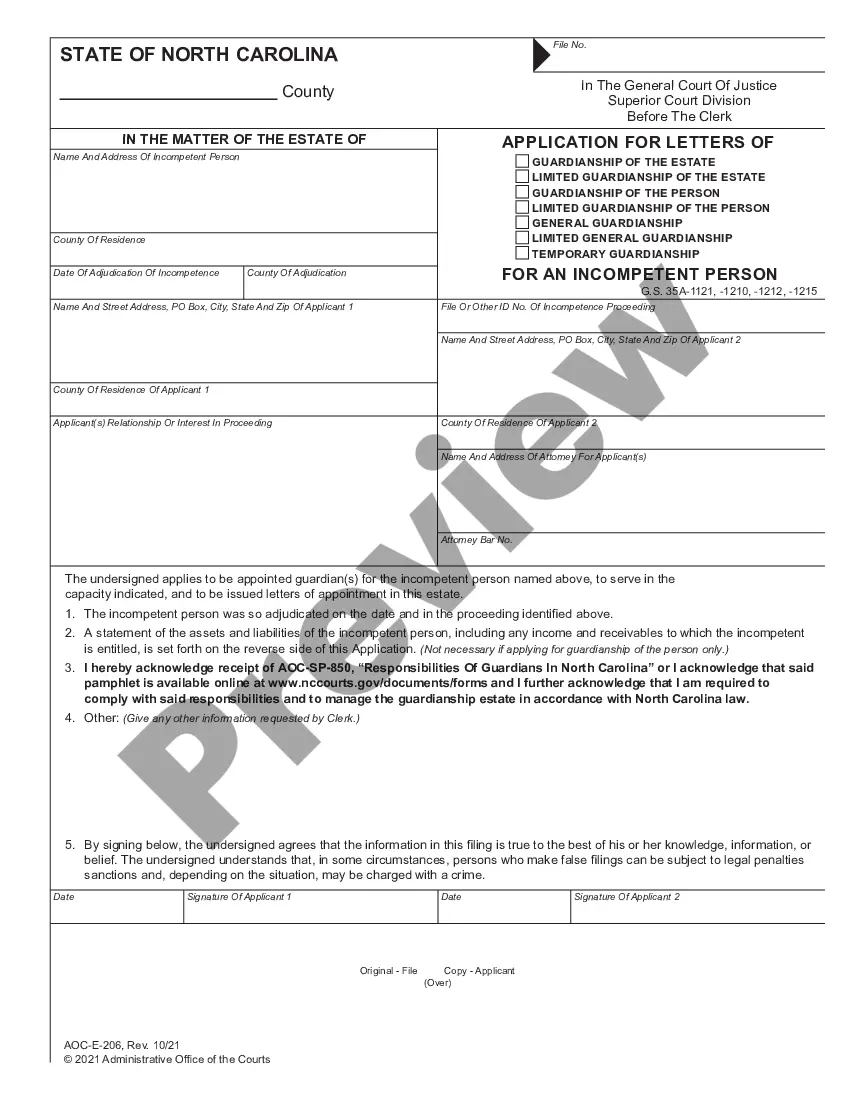

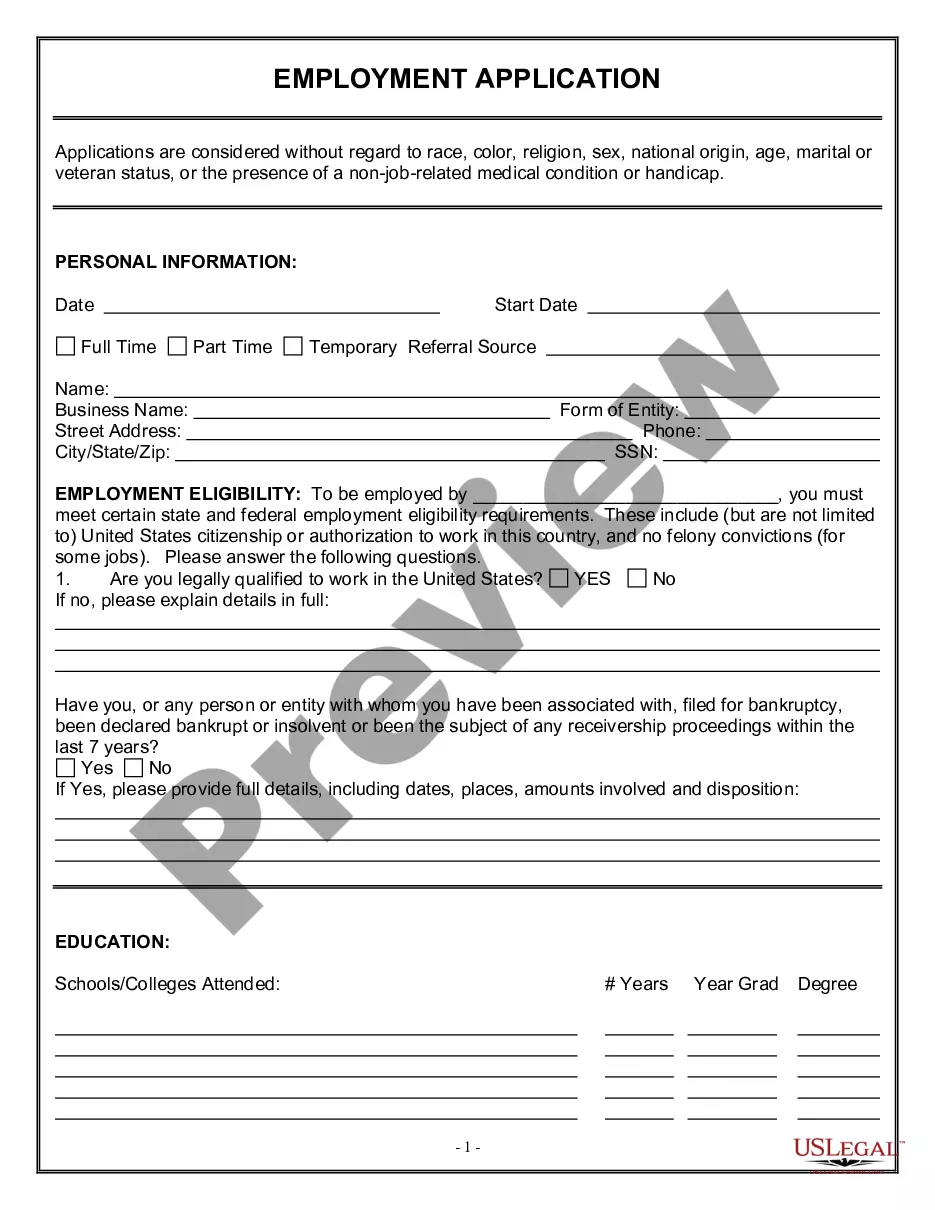

How to fill out Michigan Private Placement Of Common Stock?

If you want to full, acquire, or printing legal file web templates, use US Legal Forms, the largest collection of legal types, that can be found on-line. Use the site`s easy and hassle-free look for to get the paperwork you need. Different web templates for organization and personal reasons are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to get the Michigan Private placement of Common Stock in just a handful of click throughs.

When you are previously a US Legal Forms customer, log in in your bank account and then click the Acquire button to obtain the Michigan Private placement of Common Stock. You can also accessibility types you earlier saved inside the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape to the appropriate area/land.

- Step 2. Make use of the Preview option to examine the form`s articles. Do not overlook to read the information.

- Step 3. When you are not happy together with the kind, make use of the Look for discipline on top of the display to discover other variations from the legal kind web template.

- Step 4. Upon having located the shape you need, click on the Buy now button. Pick the prices plan you like and add your references to sign up for the bank account.

- Step 5. Process the financial transaction. You should use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Select the structure from the legal kind and acquire it on the gadget.

- Step 7. Total, modify and printing or sign the Michigan Private placement of Common Stock.

Every single legal file web template you acquire is yours for a long time. You possess acces to every kind you saved in your acccount. Go through the My Forms portion and decide on a kind to printing or acquire yet again.

Remain competitive and acquire, and printing the Michigan Private placement of Common Stock with US Legal Forms. There are many specialist and condition-specific types you can use to your organization or personal requires.

Form popularity

FAQ

In a non-brokered private placement, the investors place their money directly with the company. This saves a lot of money on fees for the company. Non-brokered financings are typically done by companies with access to good contacts and networks.

In contrast, an IPO entails the initial public offering of securities through a stock exchange. Private placements often have fewer investors, less liquidity, and less visibility than IPOs but are quicker, less expensive, and less regulated.

The value of the private placement offer or invitation for each person should be of an investment size of Rs. 20,000 of the face value of the securities. Private Placement ? Section 42 of Companies Act 2013 - TaxGuru taxguru.in ? company-law ? private-placement-se... taxguru.in ? company-law ? private-placement-se...

Is private placement good or bad? This distribution strategy is considered good, given the faster raising of funds, it ensures to a company. In addition, the maturities extend to a longer period, guaranteeing long-term returns. Private Placement - What Is It, Examples, Types, Rules, Advantage wallstreetmojo.com ? private-placement wallstreetmojo.com ? private-placement

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash. Alternative and Emerging Products | FINRA.org finra.org ? investing ? investment-products finra.org ? investing ? investment-products

If the entity conducting a private placement is a private company, the private placement offering has no effect on share price because there are no pre-existing shares.

Disadvantages of using private placements a limited number of potential investors, who may not want to invest substantial amounts individually. the need to place the bonds or shares at a substantial discount to compensate investors for their greater risk and longer-term returns.

There are two kinds of private placement?preferential allotment and qualified institutional placement. A listed company can issue securities to a select group of entities, such as institutions or promoters, at a particular price. This scenario is known as a preferential allotment. Private Placement - ClearTax cleartax.in ? glossary ? private-placement cleartax.in ? glossary ? private-placement