Michigan Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary

Description

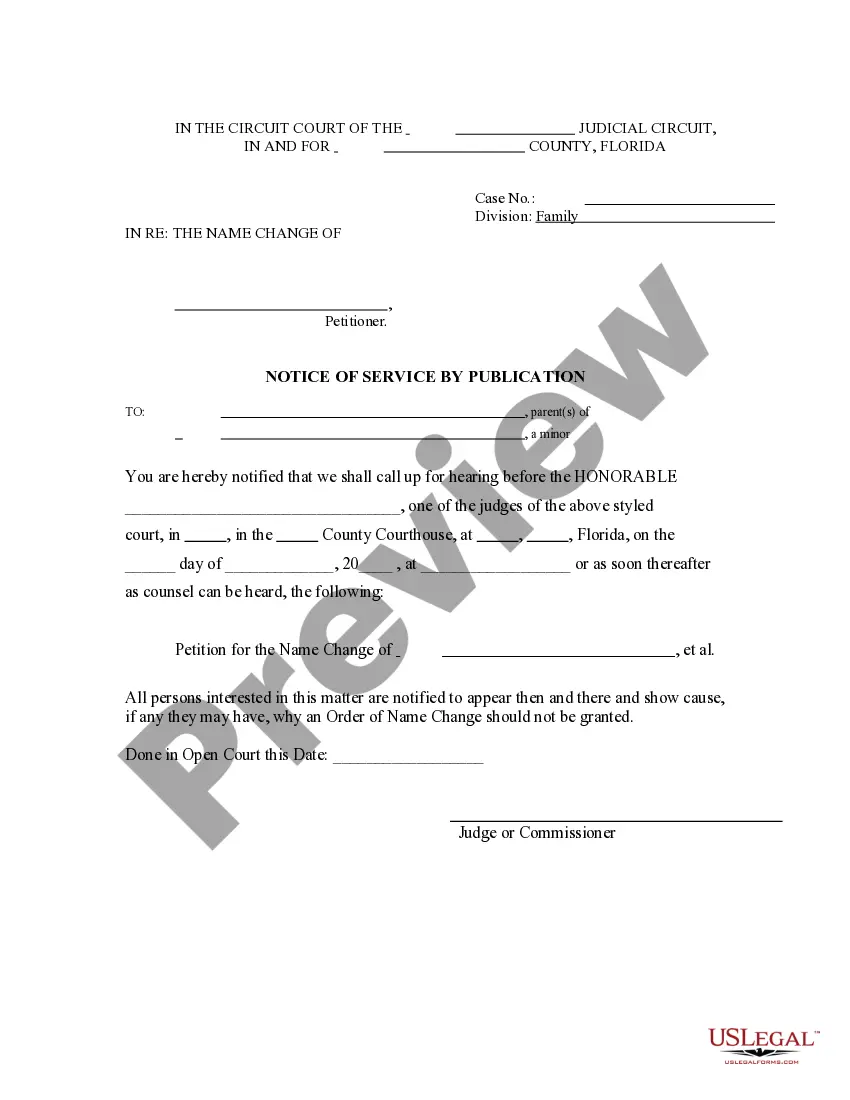

How to fill out Proposed Amendment To Articles Of Incorporation Regarding Distribution Of Stock Of A Subsidiary?

Discovering the right legitimate record format might be a have difficulties. Obviously, there are tons of themes available on the net, but how would you obtain the legitimate form you want? Use the US Legal Forms website. The service provides 1000s of themes, like the Michigan Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary, which you can use for enterprise and personal demands. Every one of the kinds are checked out by professionals and meet up with state and federal requirements.

When you are currently listed, log in to the profile and then click the Down load button to obtain the Michigan Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary. Use your profile to look from the legitimate kinds you might have bought formerly. Visit the My Forms tab of your respective profile and get an additional version in the record you want.

When you are a fresh end user of US Legal Forms, listed below are basic directions so that you can follow:

- Initial, be sure you have selected the proper form for your personal metropolis/region. It is possible to look over the shape utilizing the Review button and look at the shape explanation to guarantee this is basically the right one for you.

- In case the form will not meet up with your expectations, make use of the Seach discipline to get the appropriate form.

- Once you are certain that the shape would work, click the Purchase now button to obtain the form.

- Opt for the pricing prepare you would like and enter the necessary information and facts. Design your profile and pay for an order utilizing your PayPal profile or credit card.

- Pick the data file format and obtain the legitimate record format to the system.

- Total, change and print and indicator the received Michigan Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary.

US Legal Forms will be the biggest catalogue of legitimate kinds in which you can see a variety of record themes. Use the company to obtain professionally-created paperwork that follow condition requirements.

Form popularity

FAQ

You'll simply need to file a Certificate of Amendment to the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA). The use of the state-provided form is optional, which means you can draft your own amendments, provided you know how to do it correctly.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To make amendments to your Michigan corporation, file a Certificate of Amendment to the Articles of Incorporation with the state of Michigan Department of Licensing and Regulatory Affairs (LARA).

AN ACT to provide for the organization and regulation of corporations; to prescribe their duties, rights, powers, immunities and liabilities; to provide for the authorization of foreign corporations within this state; to prescribe the functions of the administrator of this act; to prescribe penalties for violations of ...

To formally change a business name in Michigan, you'll ultimately need to file either a Certificate of Amendment to the Articles of Organization if you own a Michigan limited liability company (LLC) or a Certificate of Amendment to the Articles of Incorporation if you own a Michigan corporation.

Corporate bylaws are required in Michigan. ing to MI Comp L § 450.1231, ?the initial bylaws of a corporation shall be adopted? at the first organizational meeting following incorporation. In other words, bylaws are legally necessary to form a corporation in Michigan.

Forming an LLC in Michigan costs $50?the state fee to file the Michigan Articles of Organization. You'll also need to pay a $25 annual report fee every year to keep your LLC active.