Michigan Reciprocal Assistance Agreement

Description

How to fill out Reciprocal Assistance Agreement?

You can spend time on the Internet searching for the legitimate file template that suits the state and federal requirements you need. US Legal Forms gives a huge number of legitimate varieties that are analyzed by pros. You can easily down load or print out the Michigan Reciprocal Assistance Agreement from your services.

If you already possess a US Legal Forms account, you can log in and then click the Acquire switch. After that, you can complete, edit, print out, or indicator the Michigan Reciprocal Assistance Agreement. Every single legitimate file template you get is yours eternally. To acquire another version of the bought type, check out the My Forms tab and then click the related switch.

If you are using the US Legal Forms website for the first time, adhere to the basic directions beneath:

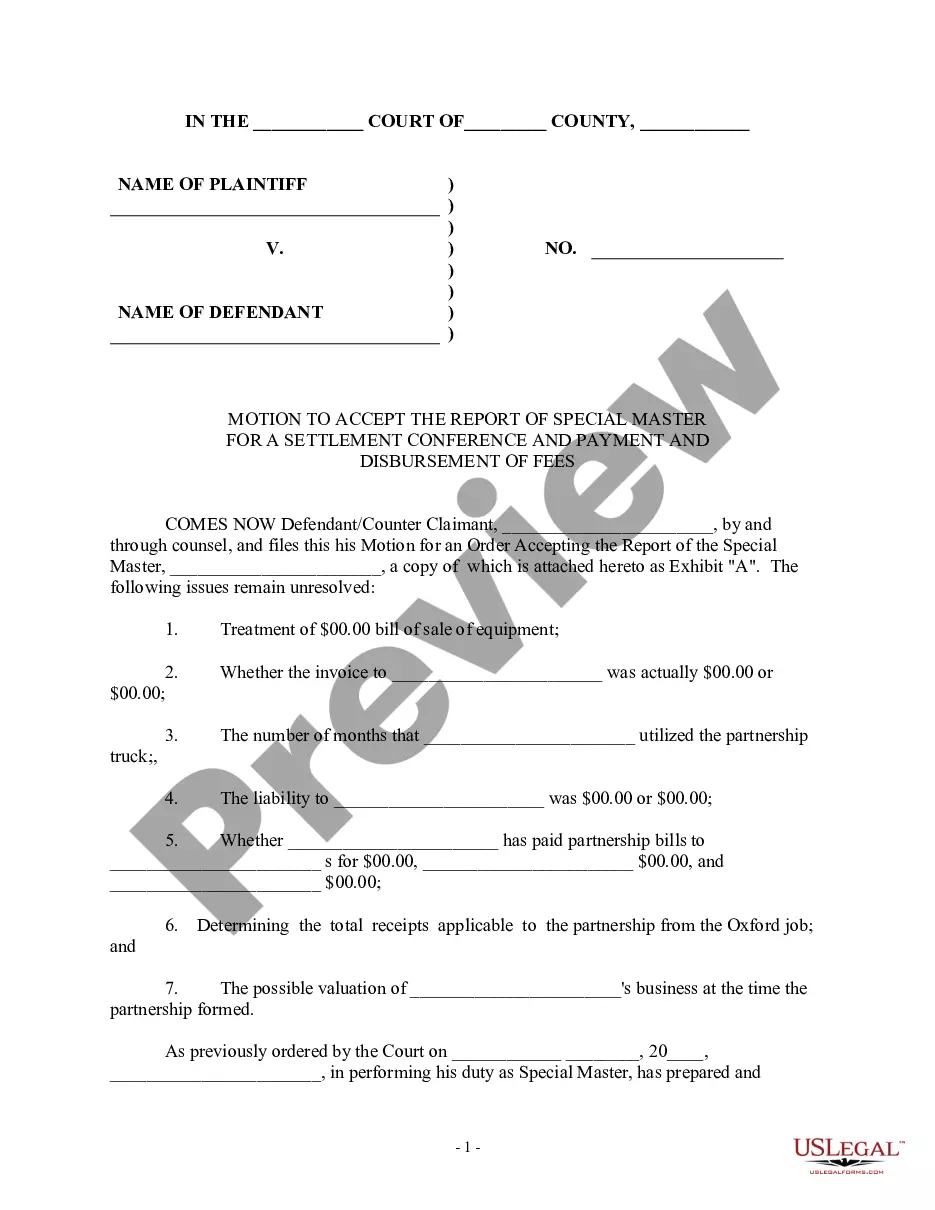

- Initially, make sure that you have chosen the correct file template for your state/metropolis of your choice. Look at the type description to ensure you have picked the appropriate type. If readily available, make use of the Review switch to search with the file template at the same time.

- If you would like locate another variation from the type, make use of the Search industry to obtain the template that suits you and requirements.

- After you have found the template you want, click Purchase now to continue.

- Pick the rates program you want, type in your qualifications, and register for an account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal account to fund the legitimate type.

- Pick the file format from the file and down load it in your system.

- Make alterations in your file if needed. You can complete, edit and indicator and print out Michigan Reciprocal Assistance Agreement.

Acquire and print out a huge number of file templates making use of the US Legal Forms web site, which offers the most important assortment of legitimate varieties. Use expert and status-distinct templates to deal with your organization or specific requires.

Form popularity

FAQ

The Home Heating Tax Credit (HHTC) is a state benefit available to eligible low-income households to help offset the cost of home heating. The credit is issued as a refund or energy draft. The maximum credit for a single person is $500. The claim must be postmarked by September 30, to receive credit.

TABLE A: 2022 Home Heating Credit (MI-1040CR-7) Standard Allowance EXEMPTIONSSTANDARD ALLOWANCEINCOME CEILING0-1$524$14,9572$706$20,1573$888$25,3574$1,069$30,5283 more rows

To date, the average credit is $253. Applicants do not need to file a Michigan income tax return to get the Home Heating Credit. The Home Heating Credit form can be found at .michigan.gov/taxes. Additional information about the credit can be found here.

The Home Heating Credit is designed to assist low-income families and seniors in paying their home heating costs. Homesteads can be a rented apartment or a mobile home on a lot in a mobile home park. Qualified disabled veterans or their spouses may be eligible for an increased credit.

The reciprocal agreements exempt nonresidents from income taxes imposed by each state on salaries, wages and other employee compensation. If you are a resident of one of these states, you are not required to pay Michigan income tax on wages earned in Michigan.

A reciprocal agreement, also called reciprocity, is an agreement between two states that allows residents of one state to request exemption from tax withholding in the other (reciprocal) state. This can save you the trouble of having to file multiple state returns.

You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions.

Gretchen Whitmer announced Friday. Almost 240,000 households who were enrolled in the Home Heating Credits program last year will receive the additional payment. "The Home Heating Credit helps keep families warm by covering select heating costs," Whitmer said in a press release.