Michigan Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

Are you presently in a situation the place you require paperwork for possibly business or person reasons virtually every day time? There are tons of authorized papers themes accessible on the Internet, but discovering types you can trust is not easy. US Legal Forms offers a huge number of type themes, such as the Michigan Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank, which are written to satisfy federal and state specifications.

If you are presently informed about US Legal Forms internet site and possess your account, basically log in. Next, you may obtain the Michigan Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank design.

If you do not provide an accounts and would like to start using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for the proper metropolis/county.

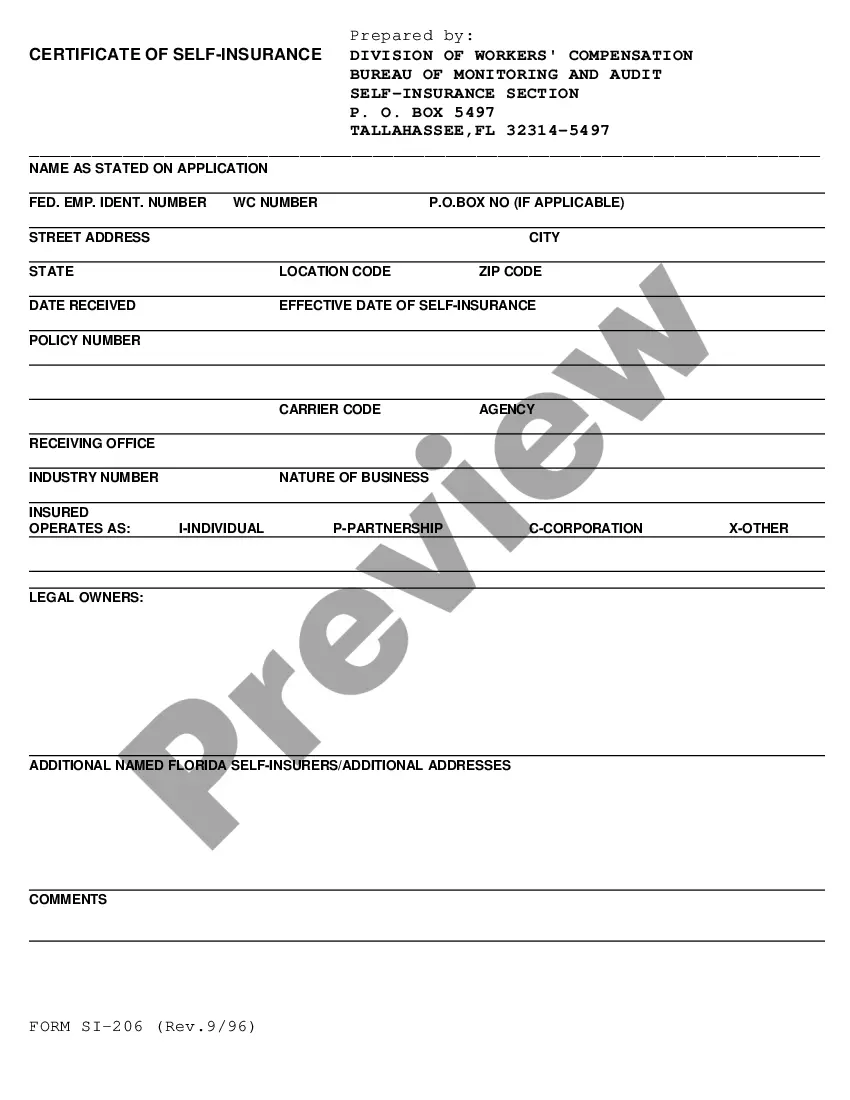

- Utilize the Review option to review the shape.

- See the information to ensure that you have selected the right type.

- If the type is not what you`re searching for, make use of the Lookup area to discover the type that suits you and specifications.

- Whenever you find the proper type, just click Purchase now.

- Opt for the pricing strategy you need, fill out the desired information to make your bank account, and pay money for the order using your PayPal or Visa or Mastercard.

- Choose a handy file format and obtain your version.

Get each of the papers themes you might have bought in the My Forms food selection. You may get a additional version of Michigan Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank whenever, if needed. Just go through the required type to obtain or printing the papers design.

Use US Legal Forms, the most substantial collection of authorized types, to save lots of time as well as prevent errors. The assistance offers appropriately made authorized papers themes that can be used for an array of reasons. Produce your account on US Legal Forms and start producing your lifestyle a little easier.