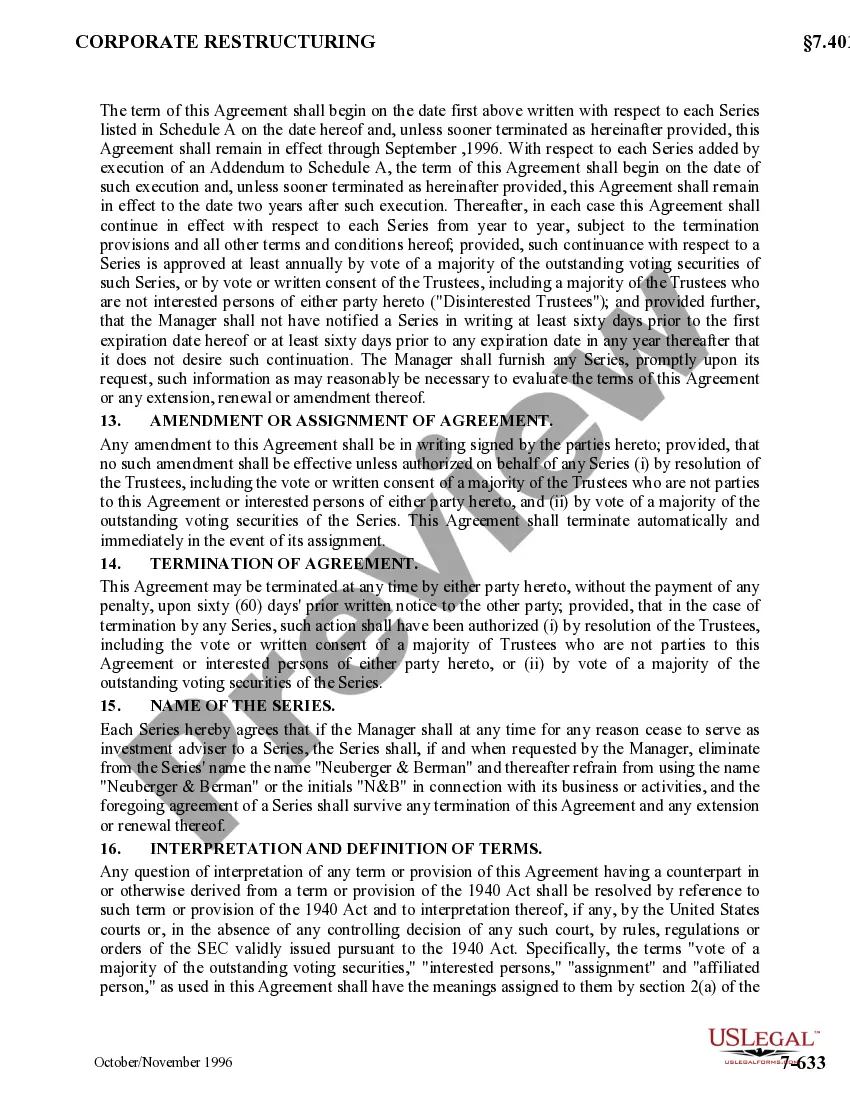

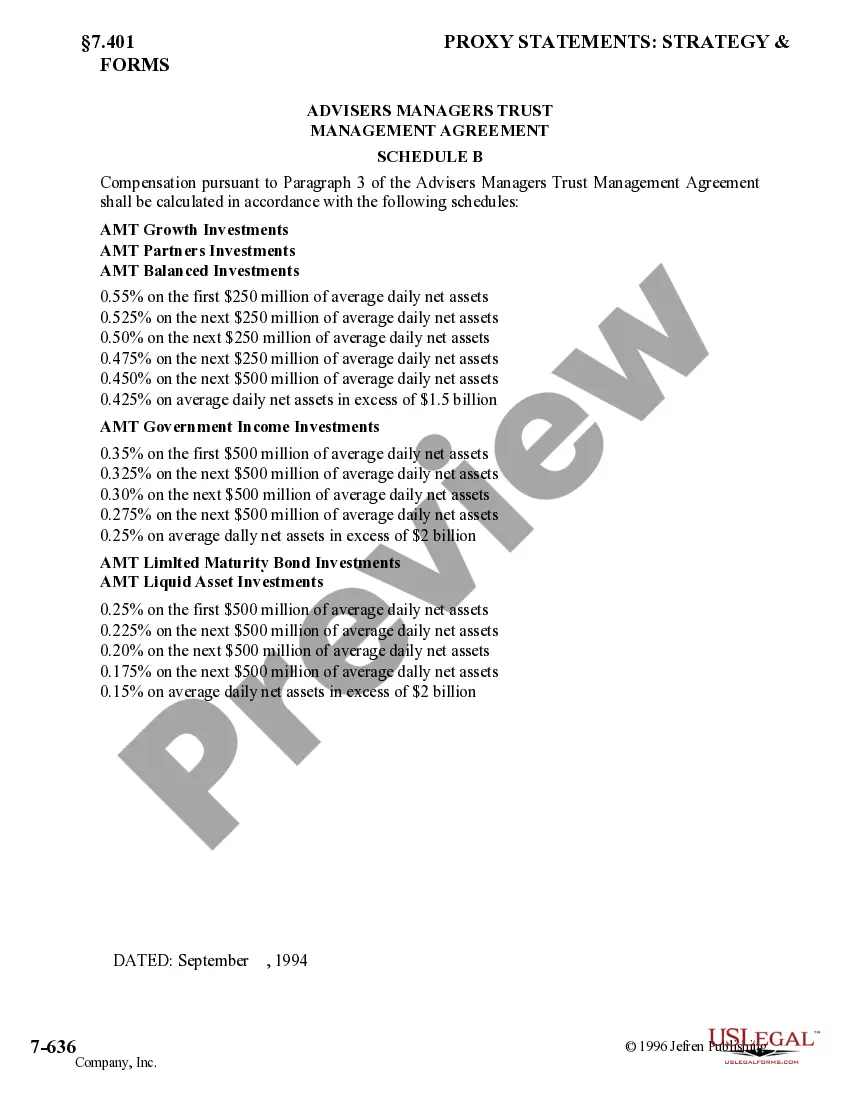

1. Introduction to the Michigan Management Agreement: The Michigan Management Agreement is a legally binding contract between Advisers Managers Trust and Berger and Berman Management Inc. It outlines the terms and conditions related to the management of investment funds and the provision of investment advisory services. 2. Key Parties Involved: The agreement involves two key parties: Advisers Managers Trust and Berger and Berman Management Inc. Advisers Managers Trust represents the interests of the investors, while Berger and Berman Management Inc. is responsible for managing the investment funds. 3. Purpose and Scope of the Agreement: The purpose of the Michigan Management Agreement is to define the roles, responsibilities, and obligations of both parties involved in the management of investment funds for the benefit of investors. It covers various aspects, including fund management, administrative expenses, compensation, termination clauses, and dispute resolution procedures. 4. Fund Management: Under the agreement, Berger and Berman Management Inc. assume responsibility for managing the investment funds in accordance with the investment objectives and guidelines established by Advisers Managers Trust. This includes making investment decisions, asset allocation, and implementing investment strategies. 5. Administrative Expenses: The agreement outlines the administrative expenses incurred during the management of funds and defines the responsibilities of both parties. It specifies how these expenses will be calculated, allocated, and reimbursed. 6. Compensation: The compensation structure for Berger and Berman Management Inc. is defined in the agreement. It typically includes a management fee, which is a percentage of the average daily net assets of the investment funds. The agreement may also outline performance-based incentives and any other applicable fees. 7. Termination: The Michigan Management Agreement includes provisions for termination by either party. It outlines the circumstances under which termination can occur, the notice period required, and the procedure for wind-down and transition of fund management responsibilities. 8. Dispute Resolution: In the event of any disputes or disagreements between the parties, the agreement provides a mechanism for resolution through arbitration or mediation. This ensures that any conflicts are handled promptly and efficiently. Different types of Michigan Management Agreements: The Michigan Management Agreement may vary depending on the specific investment products or services offered. Different types of agreements may include: a. Mutual Fund Management Agreement: This agreement specifically pertains to the management of mutual funds, including open-ended funds, closed-end funds, and exchange-traded funds (ETFs). b. Hedge Fund Management Agreement: In the case of hedge funds, this agreement caters to the unique investment strategies and requirements of these alternative investment vehicles. c. Private Equity Fund Management Agreement: For private equity funds, a separate agreement may be established to address the specific needs and characteristics associated with this asset class. d. Real Estate Investment Fund Management Agreement: In the case of real estate investment funds, the agreement may focus on the unique aspects of managing properties and real estate assets. It is important to note that the specific terms and conditions of these agreements may differ based on the investment products or services offered, as well as the preferences and requirements of both parties involved.

Michigan Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

How to fill out Michigan Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

If you need to full, down load, or printing lawful file web templates, use US Legal Forms, the greatest collection of lawful types, that can be found on the Internet. Take advantage of the site`s simple and practical lookup to discover the files you require. Various web templates for organization and individual purposes are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Michigan Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. in just a number of clicks.

In case you are previously a US Legal Forms customer, log in in your account and click the Obtain switch to find the Michigan Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. You may also access types you previously delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for your right area/country.

- Step 2. Take advantage of the Review choice to look through the form`s content material. Do not overlook to read through the explanation.

- Step 3. In case you are not satisfied with all the kind, take advantage of the Search field at the top of the screen to get other versions in the lawful kind template.

- Step 4. Once you have located the form you require, select the Get now switch. Select the costs plan you like and add your accreditations to sign up on an account.

- Step 5. Method the financial transaction. You can use your charge card or PayPal account to finish the financial transaction.

- Step 6. Choose the format in the lawful kind and down load it on your own gadget.

- Step 7. Total, edit and printing or sign the Michigan Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Each and every lawful file template you acquire is your own property eternally. You have acces to each and every kind you delivered electronically with your acccount. Select the My Forms section and pick a kind to printing or down load yet again.

Remain competitive and down load, and printing the Michigan Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. with US Legal Forms. There are thousands of skilled and condition-specific types you may use to your organization or individual requires.