A Michigan Complex Will — Credit Shelter Marital Trust for Spouse is a specific type of estate planning tool that can provide various benefits and protection for married couples in Michigan. This legal arrangement is designed to help individuals maximize the use of their estate tax exemptions while ensuring the financial security of their surviving spouse. Key features of a Michigan Complex Will — Credit Shelter Marital Trust for Spouse include: 1. Estate tax planning: The primary purpose of this trust is to minimize federal estate taxes upon the death of the first spouse. By utilizing the credit shelter trust, also known as a bypass trust or a family trust, the deceased spouse can allocate their estate tax exemption amount to shelter assets from estate tax, effectively reducing the overall tax burden. 2. Protecting the surviving spouse: The credit shelter marital trust allows the surviving spouse to benefit from income and use of trust assets during their lifetime. It ensures that the surviving spouse is financially supported and may provide a safety net in the event of unforeseen circumstances such as long-term care needs or financial challenges. 3. Preserving assets for future generations: Upon the passing of the surviving spouse, any remaining assets held in the credit shelter trust can be distributed to the beneficiaries specified by the deceased spouse, such as children, grandchildren, or other loved ones. This trust structure can help protect family wealth and ensure that assets are passed down according to the deceased spouse's wishes. Types of Michigan Complex Will — Credit Shelter Marital Trust for Spouse: 1. General Power of Appointment Trust: This type of trust gives the surviving spouse broad powers to appoint the assets within the trust, providing flexibility and control over the distribution of assets upon their death. 2. Qualified Terminable Interest Property Trust (TIP): With a TIP trust, the surviving spouse receives income from the trust during their lifetime, while having no power to direct the ultimate disposition of the trust's assets. This type of trust is often used when there are children from a previous marriage or in blended family situations. 3. Irrevocable Life Insurance Trust (IIT): In an IIT, life insurance policies are owned by the trust, and the death benefit proceeds are excluded from the taxable estate. This can be an effective strategy to provide liquidity to pay estate taxes or other costs, allowing other assets to pass through the credit shelter trust. In summary, a Michigan Complex Will — Credit Shelter Marital Trust for Spouse is a sophisticated estate planning tool that provides significant tax benefits and safeguards for married couples. It allows them to optimize their estate tax exemptions while ensuring the financial well-being of the surviving spouse and the preservation of assets for future generations.

Michigan Complex Will - Credit Shelter Marital Trust for Spouse

Description

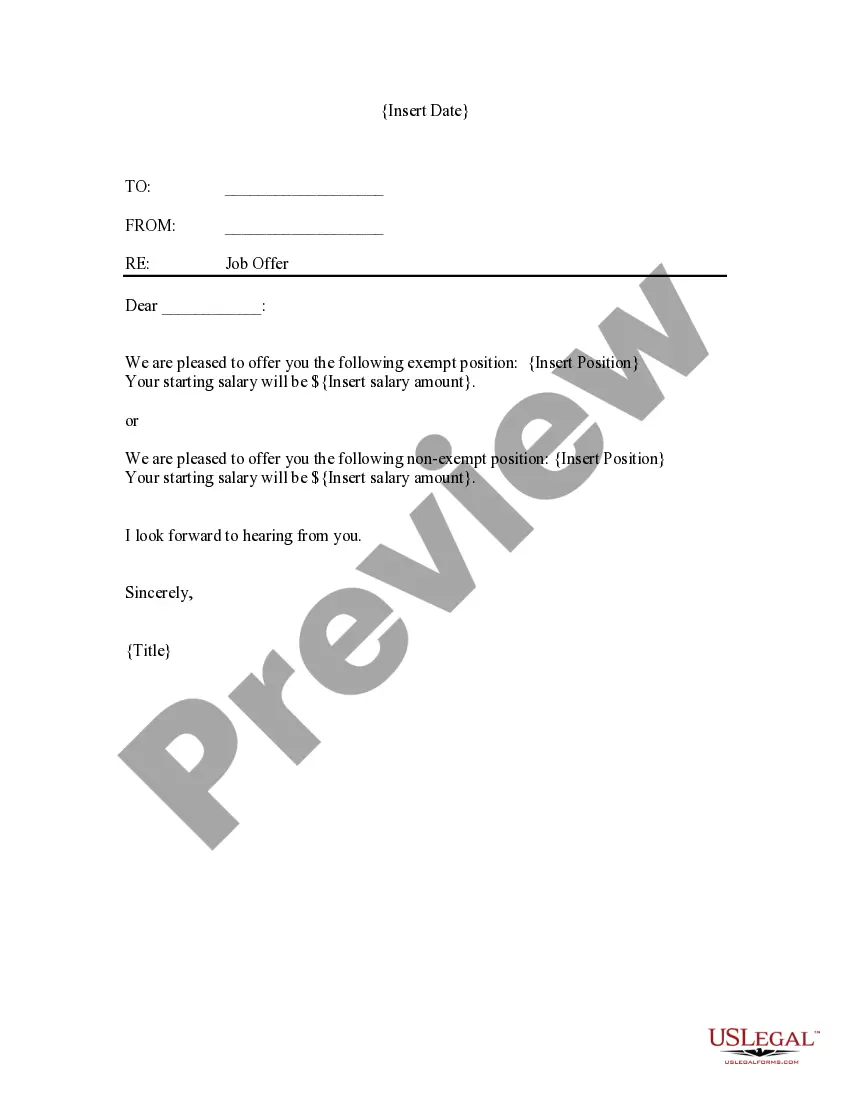

How to fill out Michigan Complex Will - Credit Shelter Marital Trust For Spouse?

If you need to comprehensive, acquire, or printing legal document layouts, use US Legal Forms, the biggest selection of legal forms, that can be found on the web. Make use of the site`s easy and hassle-free look for to obtain the paperwork you will need. A variety of layouts for company and person reasons are sorted by categories and claims, or keywords. Use US Legal Forms to obtain the Michigan Complex Will - Credit Shelter Marital Trust for Spouse in just a handful of mouse clicks.

In case you are already a US Legal Forms buyer, log in to your profile and click on the Obtain switch to get the Michigan Complex Will - Credit Shelter Marital Trust for Spouse. Also you can entry forms you earlier delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape to the appropriate area/country.

- Step 2. Utilize the Review choice to check out the form`s information. Never forget about to read the explanation.

- Step 3. In case you are unhappy with all the develop, utilize the Search field on top of the screen to discover other variations from the legal develop web template.

- Step 4. When you have identified the shape you will need, click on the Get now switch. Pick the costs strategy you like and include your accreditations to register for the profile.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Find the structure from the legal develop and acquire it on the device.

- Step 7. Complete, change and printing or indication the Michigan Complex Will - Credit Shelter Marital Trust for Spouse.

Each legal document web template you buy is yours forever. You may have acces to each develop you delivered electronically in your acccount. Click the My Forms section and select a develop to printing or acquire again.

Contend and acquire, and printing the Michigan Complex Will - Credit Shelter Marital Trust for Spouse with US Legal Forms. There are thousands of specialist and express-particular forms you can use for your company or person needs.