Michigan Complex Will — Max. Credit Shelter Marital Trust to Children is a type of estate planning strategy used in the state of Michigan that allows individuals to protect their assets and ensure the financial security of their children and spouse. This trust is created within a complex will and offers several benefits, including minimizing estate taxes, preserving wealth, and providing for the needs of both the surviving spouse and children. In a Michigan Complex Will — Max. Credit Shelter Marital Trust to Children, the individual's assets are first used to fund a credit shelter trust, also known as a bypass trust or a family trust. This trust is designed to utilize the federal estate tax exemption and shield a portion of the assets from being subject to estate taxes upon the death of the first spouse. The surviving spouse can still benefit from the assets held in the trust, such as receiving income generated from investments or utilizing the principal for healthcare or other needs. The remaining assets of the individual will be used to establish a marital trust, sometimes referred to as a spousal trust or a TIP trust (Qualified Terminable Interest Property). The surviving spouse has access to the income generated by this trust during their lifetime, and they may also have limited access to the principal if needed for specific purposes, such as healthcare or education expenses. Upon the death of the surviving spouse, any assets remaining in the marital trust will pass to the children or other designated beneficiaries. There are different variations of the Michigan Complex Will — Max. Credit Shelter Marital Trust to Children, depending on the individual's specific circumstances and goals. Some common types include: 1. Traditional Credit Shelter Trust: This type of trust focuses on maximizing the federal estate tax exemption amount by funding the credit shelter trust up to the exemption limit, with the remaining assets passing to the marital trust. 2. Formula Credit Shelter Trust: In this variation, the amount funded into the credit shelter trust is determined based on a formula, often tied to the federal estate tax exemption. This allows for flexibility in funding the trust based on changing exemption amounts. 3. Disclaimer Credit Shelter Trust: With this option, the surviving spouse has the opportunity to disclaim or refuse a portion of the assets bequeathed to them in the will. The disclaimed assets will then fund the credit shelter trust, maximizing the tax benefits. 4. TIP Credit Shelter Trust: This type of trust combines the advantages of a credit shelter trust with a qualified terminable interest property trust. It allows the surviving spouse to receive income generated by the trust during their lifetime while directing the remaining assets to the children or other beneficiaries in the future. In conclusion, a Michigan Complex Will — Max. Credit Shelter Marital Trust to Children is a comprehensive estate planning strategy that helps individuals protect their assets, minimize estate taxes, and provide for their spouse and children. The different variations of this trust offer flexibility in tailoring the plan to the specific needs and goals of the individual.

Michigan Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Michigan Complex Will - Max. Credit Shelter Marital Trust To Children?

If you wish to comprehensive, down load, or print out lawful file layouts, use US Legal Forms, the largest variety of lawful kinds, that can be found online. Use the site`s easy and practical search to obtain the papers you want. A variety of layouts for company and individual reasons are categorized by groups and states, or search phrases. Use US Legal Forms to obtain the Michigan Complex Will - Max. Credit Shelter Marital Trust to Children with a handful of click throughs.

If you are currently a US Legal Forms consumer, log in to your accounts and then click the Down load switch to have the Michigan Complex Will - Max. Credit Shelter Marital Trust to Children. You may also accessibility kinds you formerly saved in the My Forms tab of the accounts.

If you work with US Legal Forms the first time, follow the instructions listed below:

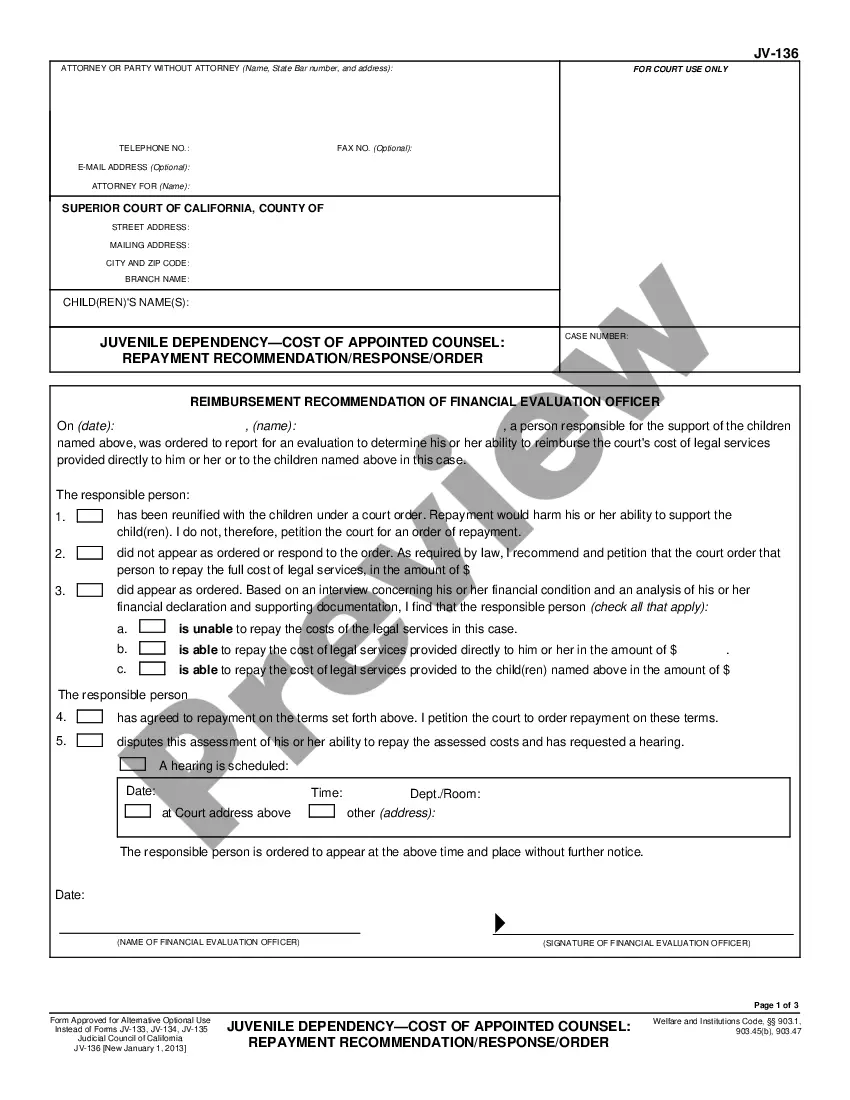

- Step 1. Be sure you have selected the shape to the correct area/land.

- Step 2. Make use of the Review option to check out the form`s information. Do not overlook to see the explanation.

- Step 3. If you are not happy with all the develop, take advantage of the Research field towards the top of the display screen to get other variations of the lawful develop format.

- Step 4. Once you have found the shape you want, select the Acquire now switch. Opt for the costs plan you like and add your accreditations to sign up for an accounts.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Find the structure of the lawful develop and down load it in your product.

- Step 7. Complete, edit and print out or indication the Michigan Complex Will - Max. Credit Shelter Marital Trust to Children.

Each lawful file format you buy is your own forever. You possess acces to every single develop you saved within your acccount. Click on the My Forms segment and decide on a develop to print out or down load once more.

Contend and down load, and print out the Michigan Complex Will - Max. Credit Shelter Marital Trust to Children with US Legal Forms. There are many professional and status-distinct kinds you can utilize for your personal company or individual demands.

Form popularity

FAQ

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A marital trust is an irrevocable trust that lets you transfer a deceased spouse's assets to the surviving spouse without incurring any taxes. The trust also protects assets from creditors and future spouses the surviving spouse may encounter.

Example of a Credit Shelter Trust After the husband dies, his $6 million estate and any income it generated passes free of estate tax to his wife because it falls below the federal exemption.

The credit shelter trust can also give the spouse a so-called ?five and five power,? which allows the spouse to withdraw the greater of $5,000 or 5 percent of the trust principal each year.

Disadvantages. Irrevocability: A Credit Shelter Trust is irrevocable, which means that the grantor cannot make changes, amendments, or terminate the trust after it is established. This lack of flexibility can be a disadvantage if the grantor's wishes or circumstances change over time.