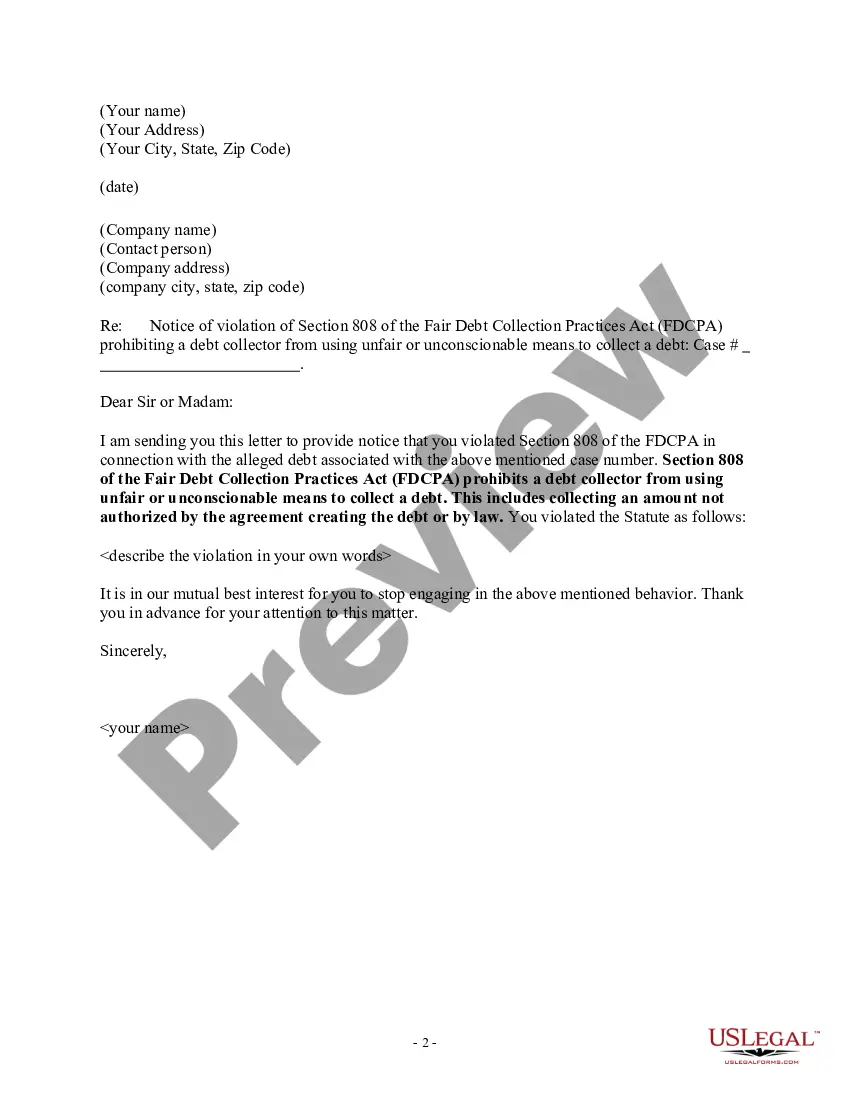

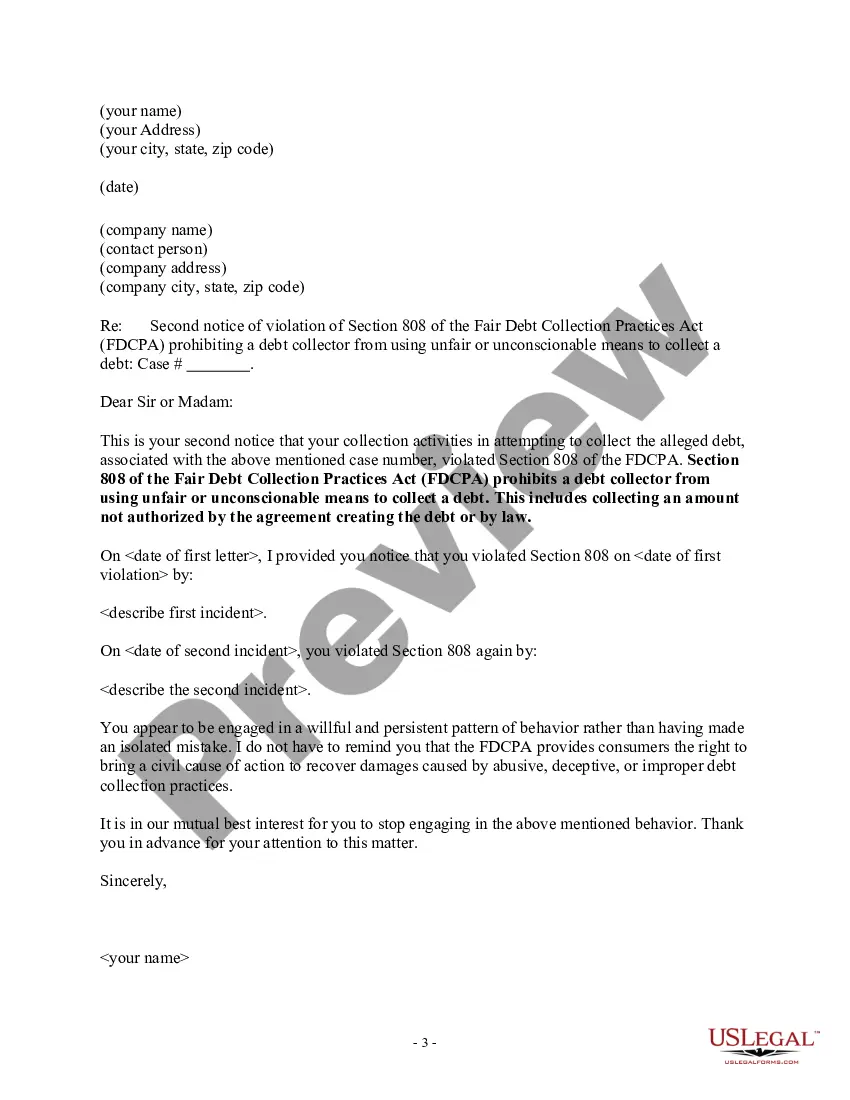

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Michigan Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

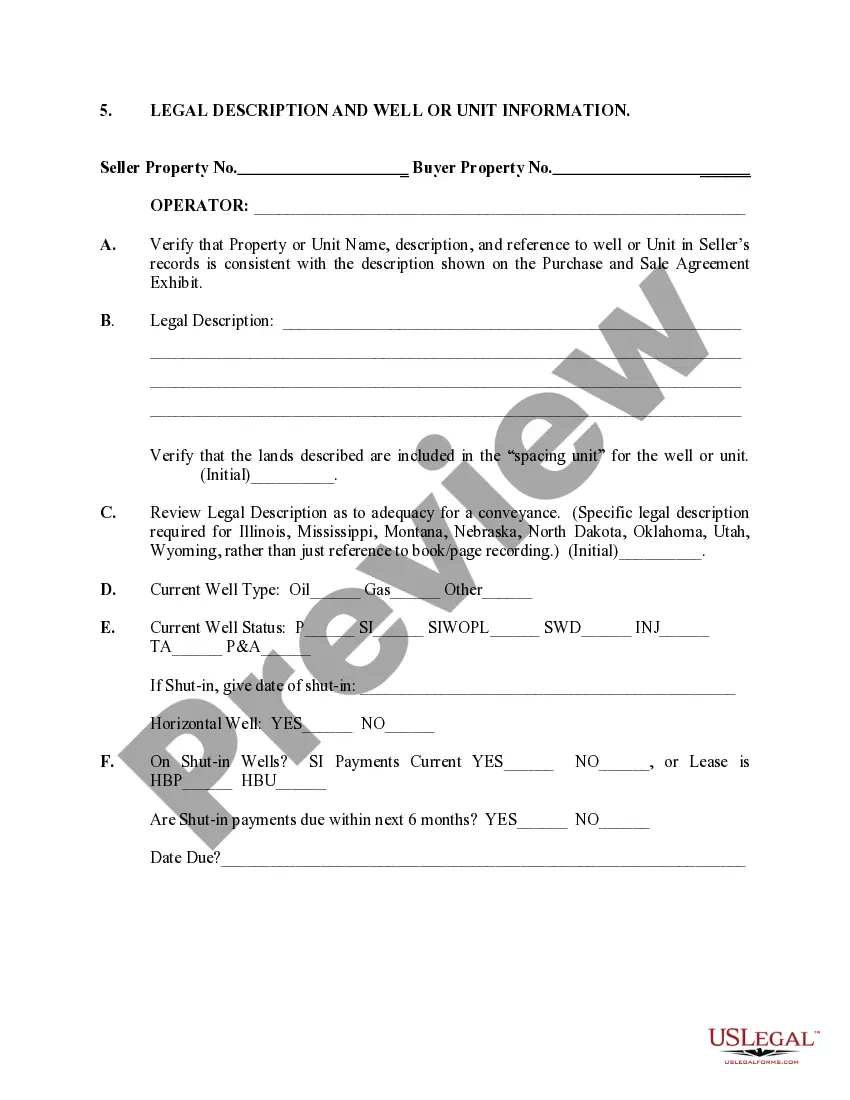

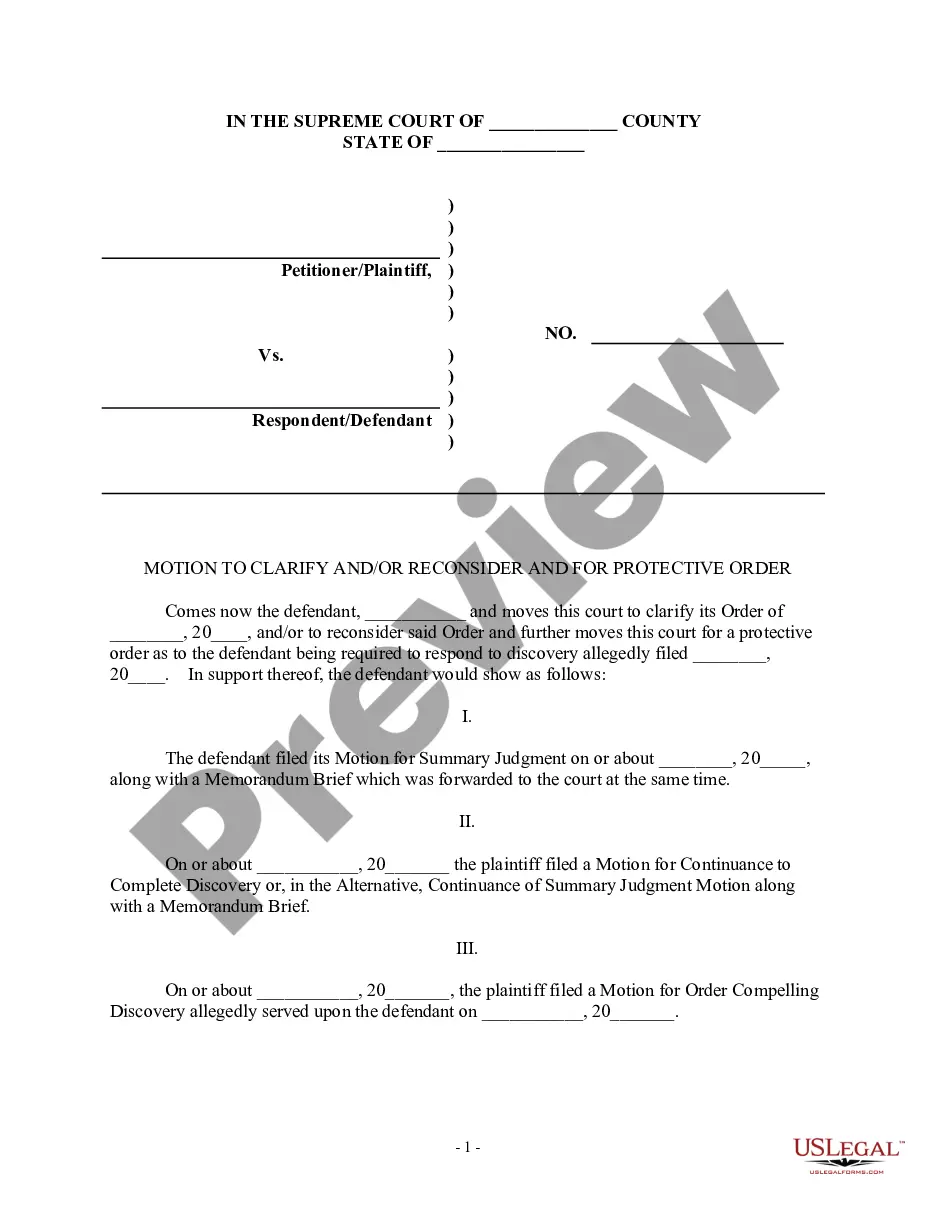

How to fill out Michigan Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Are you currently inside a situation the place you will need papers for either business or specific reasons nearly every day? There are a variety of legal papers layouts available on the Internet, but finding ones you can trust is not easy. US Legal Forms offers a large number of form layouts, much like the Michigan Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, that happen to be composed to fulfill state and federal requirements.

In case you are currently knowledgeable about US Legal Forms website and have an account, basically log in. Afterward, it is possible to down load the Michigan Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law design.

If you do not provide an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for the appropriate town/county.

- Make use of the Review switch to analyze the shape.

- See the explanation to ensure that you have chosen the appropriate form.

- In the event the form is not what you`re searching for, use the Search industry to obtain the form that suits you and requirements.

- When you find the appropriate form, click Purchase now.

- Select the pricing plan you desire, submit the necessary information to make your account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Select a practical file file format and down load your duplicate.

Discover each of the papers layouts you may have bought in the My Forms menus. You may get a further duplicate of Michigan Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law any time, if needed. Just click the required form to down load or produce the papers design.

Use US Legal Forms, one of the most extensive collection of legal kinds, to save lots of time and steer clear of faults. The service offers professionally manufactured legal papers layouts which you can use for a variety of reasons. Generate an account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Michigan has a statute of limitations of six years, which applies to all types of debts. This means that if a debt is more than six years overdue or hasn't been paid in more than six years, creditors cannot take legal action.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

Can a Debt Collector Take Money From Your Account Without Permission? Usually, a debt collector must obtain a court order before accessing your bank account. However, certain federal agencies, including the IRS, may be able to access your bank account without permission from a court.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

Debt collectors can ONLY withdraw funds from your bank account with YOUR permission. That permission often comes in the form of authorization for the creditor to complete automatic withdrawals from your bank account.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

While a creditor cannot easily look up your bank account balance at will, the creditor can serve the bank with a writ of garnishment without much expense. The bank in response typically must freeze the account and file a response stating the exact balance in any bank account held for the judgment debtor.