The Michigan Stockholders Agreement between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. is a legally binding document that outlines the rights, responsibilities, and obligations of the stockholders in relation to their respective interests in the corporation. This agreement is specific to Michigan and is tailored to the unique requirements and regulations within the state. The Agreement covers various important aspects, including governance, voting rights, transferability of shares, dividends and distributions, dispute resolution, and confidential information. It aims to establish a clear framework for the management and operation of the corporation while ensuring the protection of the stockholders' rights and interests. Keywords: Michigan Stockholders Agreement, America Online Inc., ME Acquisition Inc., MapQuest. Com Inc., legal document, rights, responsibilities, obligations, stockholders, corporation, governance, voting rights, transferability of shares, dividends, distributions, dispute resolution, confidential information, management, operation, protection. Different types of Michigan Stockholders Agreements between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. may include: 1. Majority Voting Agreement: This type of agreement may specify that important corporate decisions require the approval of a majority or specified percentage of the stockholders. It aims to ensure that decisions are made in the best interest of the corporation as a whole. 2. Drag-Along Agreement: This agreement allows a majority stockholder to require minority stockholders to sell their shares in the event of a sale or transfer of the corporation to a third party. It can help streamline the process of selling the corporation by allowing the majority stockholders to control the transaction. 3. Share Purchase Agreement: This agreement may outline the terms and conditions for the purchase or sale of shares between stockholders. It can cover aspects such as pricing, payment terms, and any restrictions or conditions on the sale of the shares. 4. Option Agreement: This type of agreement grants certain stockholders the option to purchase additional shares in the corporation at a predetermined price within a specified period. It provides stockholders with the opportunity to increase their ownership stake in the corporation. These are just a few examples of the different types of Michigan Stockholders Agreements that may exist between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. The specific terms and provisions of each agreement will vary depending on the goals and requirements of the parties involved.

Michigan Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc.

Description

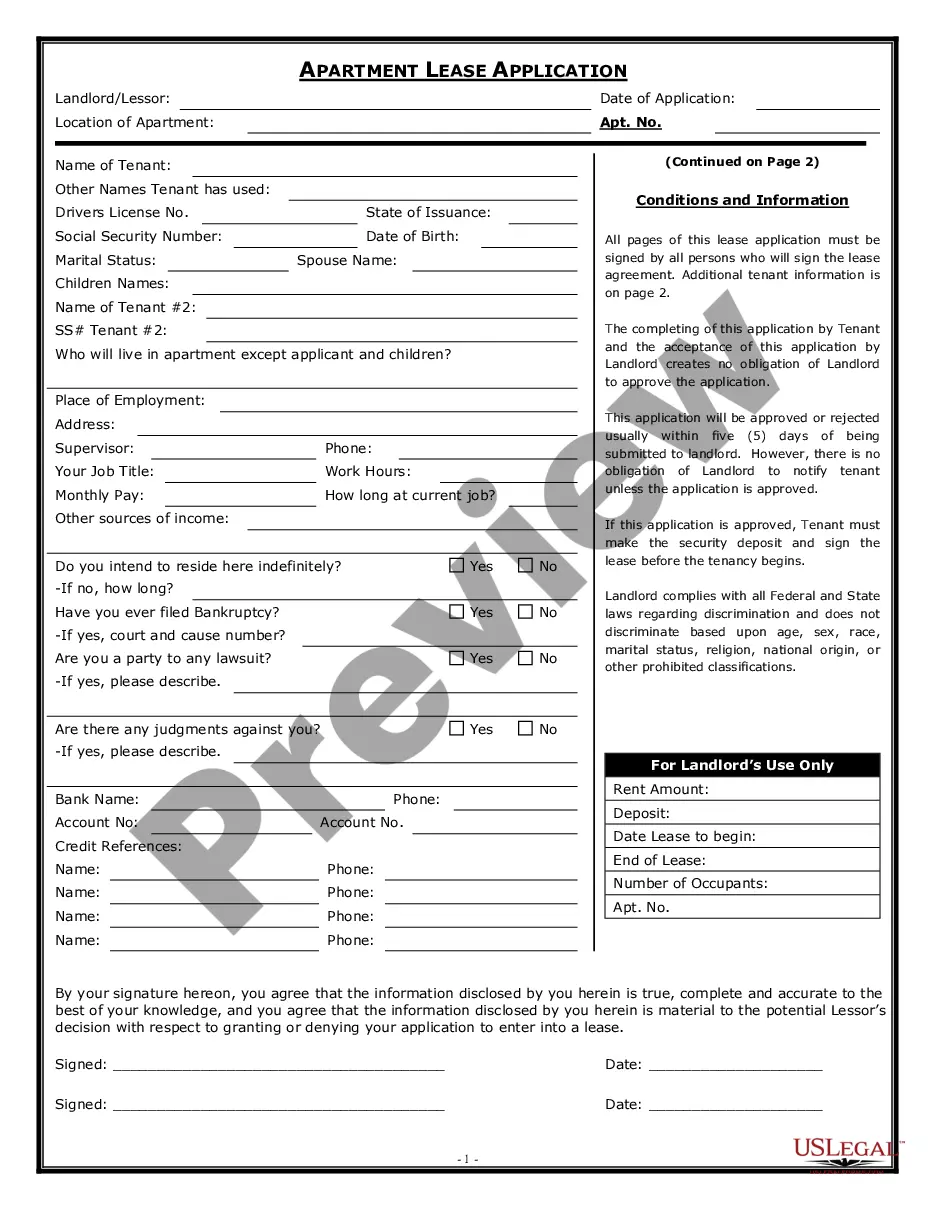

How to fill out Michigan Stockholders Agreement Between America Online, Inc., MQ Acquisition, Inc., And Mapquest.Com, Inc.?

Choosing the best legal record design can be a have a problem. Obviously, there are plenty of templates available online, but how will you discover the legal kind you need? Make use of the US Legal Forms website. The support provides a huge number of templates, including the Michigan Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc., that can be used for enterprise and personal demands. Every one of the varieties are checked by specialists and fulfill federal and state specifications.

If you are already listed, log in to your accounts and click on the Down load switch to have the Michigan Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc.. Make use of your accounts to check throughout the legal varieties you might have purchased previously. Proceed to the My Forms tab of your respective accounts and obtain an additional version of the record you need.

If you are a brand new end user of US Legal Forms, allow me to share simple guidelines that you can adhere to:

- Initial, be sure you have chosen the correct kind for your area/area. You may examine the shape while using Review switch and look at the shape outline to make certain it is the right one for you.

- If the kind is not going to fulfill your needs, make use of the Seach industry to get the correct kind.

- Once you are sure that the shape is suitable, click on the Acquire now switch to have the kind.

- Select the rates prepare you need and enter the needed information and facts. Create your accounts and pay money for the order with your PayPal accounts or bank card.

- Select the data file file format and download the legal record design to your product.

- Comprehensive, revise and print out and signal the attained Michigan Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc..

US Legal Forms is the largest local library of legal varieties where you can see various record templates. Make use of the service to download professionally-created paperwork that adhere to condition specifications.