Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York is a legal contract that outlines the terms and conditions of the investment advisory services provided by The Bank of New York (BNY) to the BNY Hamilton Large Growth CRT Fund. The agreement defines the roles and responsibilities of both parties involved and establishes the framework for the advisory services. It describes the investment objectives, strategies, and restrictions of the BNY Hamilton Large Growth CRT Fund, along with the specific investment guidelines and risk tolerance criteria to be followed. The agreement includes provisions regarding the compensation and fees payable to The Bank of New York for the advisory services rendered. It outlines the fee structure, billing methods, and any performance-based incentives or bonuses that may apply. Furthermore, the Michigan Investment Advisory Agreement covers the process for communication and reporting between the parties, including regular updates on portfolio performance, investment positions, and market analysis. It may specify the frequency and format of such reports. Additionally, the agreement addresses various legal and compliance matters, including the obligations of both parties to adhere to applicable laws, regulations, and industry standards. It may include provisions relating to confidentiality, dispute resolution, termination, and limitation of liability. Different types of Michigan Investment Advisory Agreements between BNY Hamilton Large Growth CRT Fund and The Bank of New York may include variations in the investment strategies employed or different fee structures. For example, there may be agreements that specifically focus on socially responsible investments or agreements that provide for alternative performance fee arrangements. Keywords: Michigan Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York, investment advisory services, investment objectives, investment strategies, investment guidelines, risk tolerance, compensation, fees, performance-based incentives, billing methods, communication, reporting, portfolio performance, market analysis, legal compliance, confidentiality, dispute resolution, termination, limitation of liability, socially responsible investments, alternative performance fee arrangements.

Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

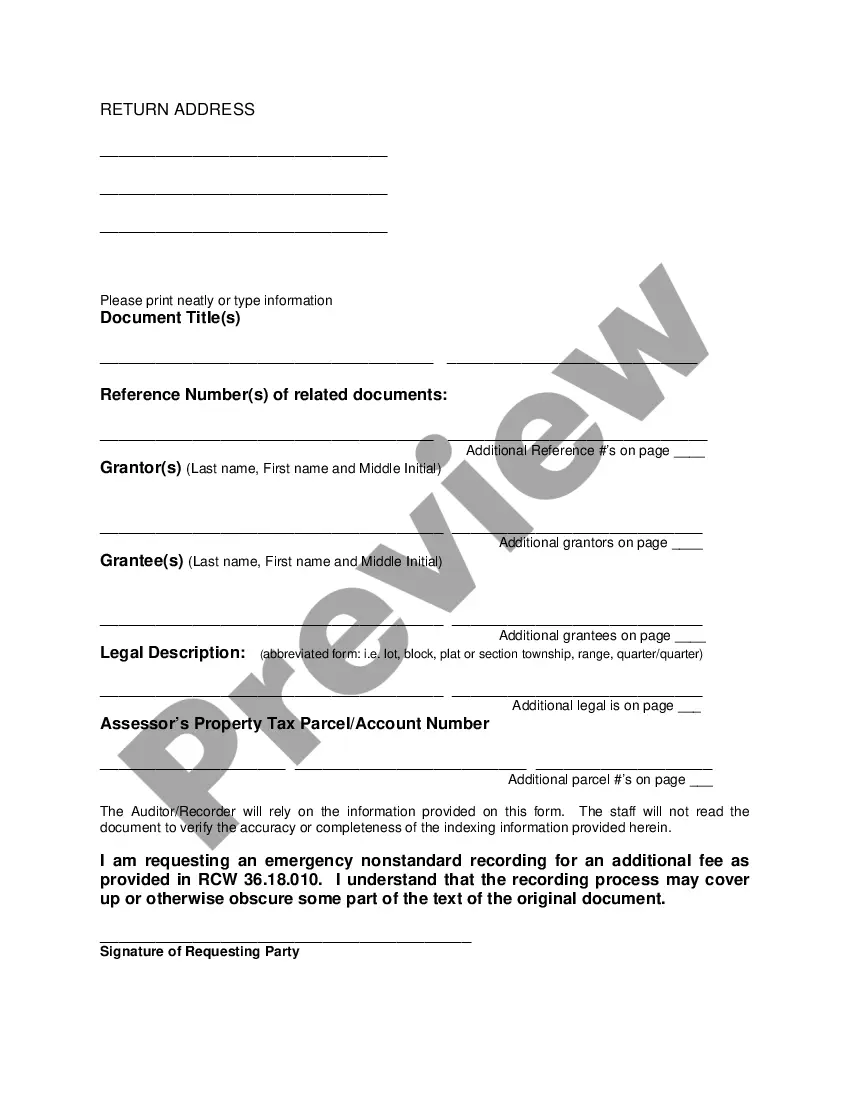

How to fill out Michigan Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

US Legal Forms - one of several biggest libraries of authorized varieties in the United States - gives an array of authorized record layouts you can down load or print out. While using site, you will get 1000s of varieties for organization and person purposes, categorized by types, claims, or keywords and phrases.You can get the most up-to-date models of varieties such as the Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York in seconds.

If you already have a monthly subscription, log in and down load Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York in the US Legal Forms local library. The Acquire button can look on every form you perspective. You have accessibility to all formerly delivered electronically varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, allow me to share simple guidelines to get you began:

- Be sure to have picked the right form for your metropolis/county. Click on the Review button to examine the form`s content. Read the form description to actually have chosen the proper form.

- In case the form doesn`t satisfy your requirements, take advantage of the Lookup area at the top of the display screen to get the the one that does.

- In case you are pleased with the form, affirm your choice by clicking the Get now button. Then, choose the costs program you want and give your credentials to sign up for an account.

- Method the deal. Make use of your charge card or PayPal account to finish the deal.

- Find the file format and down load the form in your system.

- Make adjustments. Fill out, edit and print out and indication the delivered electronically Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York.

Every single template you included in your account does not have an expiry date and is also the one you have eternally. So, in order to down load or print out another version, just proceed to the My Forms section and then click about the form you require.

Obtain access to the Michigan Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York with US Legal Forms, by far the most comprehensive local library of authorized record layouts. Use 1000s of expert and express-distinct layouts that satisfy your business or person needs and requirements.

Form popularity

FAQ

What Is an Advisor Fee? An advisor fee is a fee paid for professional advisory services on matters related to money, finances, and investments. It can be charged as a percentage of total assets or it may be associated with a broker-dealer transaction in the form of a commission.

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.

(11) ?Investment adviser? means any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities, or who, for compensation and as part of a regular ...

The investment advisory agreement should clearly outline the fee structure that the advisor will charge for their services. This may include a flat fee, a percentage of assets under management, or a performance-based fee. The agreement should also specify how the fee will be calculated and when it will be due.

Merrill Lynch Wealth Management is available to all level of investors, with no minimum account sizes for most types of advisory accounts in Merrill's Investment Advisory Program.