Michigan Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

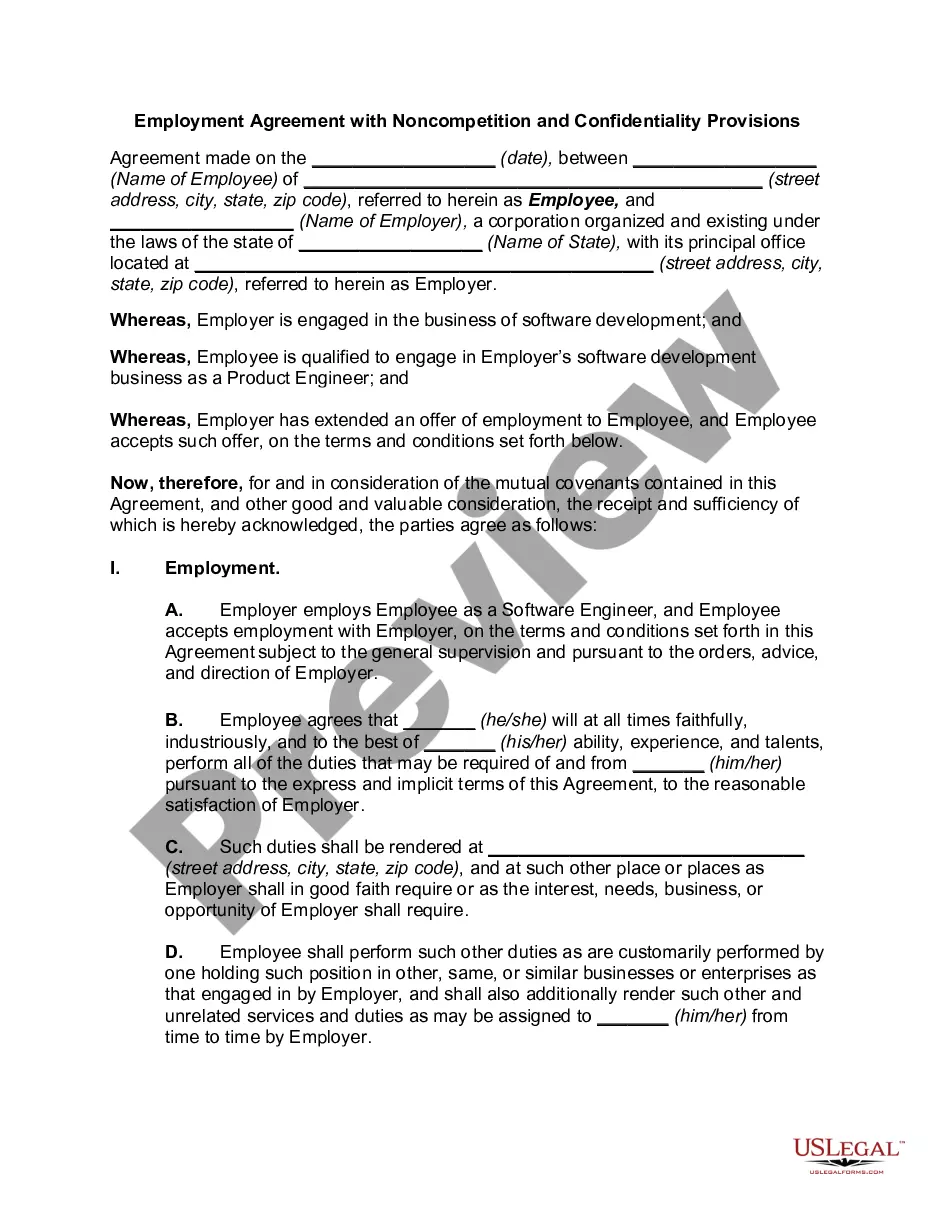

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

US Legal Forms - one of several most significant libraries of lawful varieties in America - delivers an array of lawful document themes it is possible to down load or print. Using the internet site, you can find thousands of varieties for enterprise and specific reasons, sorted by classes, states, or keywords and phrases.You can find the most up-to-date versions of varieties much like the Michigan Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association in seconds.

If you currently have a registration, log in and down load Michigan Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association from your US Legal Forms local library. The Download button will show up on each type you see. You have access to all earlier saved varieties inside the My Forms tab of the profile.

In order to use US Legal Forms the very first time, allow me to share easy recommendations to help you started out:

- Be sure you have selected the right type for your area/state. Click on the Review button to examine the form`s articles. See the type description to ensure that you have selected the right type.

- In the event the type does not match your demands, make use of the Research discipline towards the top of the screen to find the one who does.

- In case you are content with the form, verify your option by clicking on the Purchase now button. Then, pick the rates plan you prefer and offer your accreditations to sign up for an profile.

- Approach the purchase. Use your credit card or PayPal profile to perform the purchase.

- Find the file format and down load the form in your gadget.

- Make modifications. Load, change and print and signal the saved Michigan Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

Each design you included in your bank account lacks an expiry particular date which is your own property permanently. So, if you want to down load or print yet another duplicate, just visit the My Forms segment and click on on the type you need.

Get access to the Michigan Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association with US Legal Forms, by far the most extensive local library of lawful document themes. Use thousands of specialist and status-distinct themes that satisfy your business or specific needs and demands.

Form popularity

FAQ

A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.

Definition. Loan servicing is the process that a company, known as the loan servicer, goes through to collect payments, interest, and escrow (if needed) from borrowers of loans.

Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). For mortgages, there is a specific mortgage origination process. Loan servicing covers everything after disbursing the funds until the loan is fully paid off.

Loan servicing includes sending monthly payment statements, collecting monthly payments, maintaining records of payments and balances, collecting and paying taxes and insurance (and managing escrow funds), remitting funds to the note holder, and following up on any delinquencies.

Opens in a new tab. opens in a new tab. Servicing Agreements. Introduction. A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.