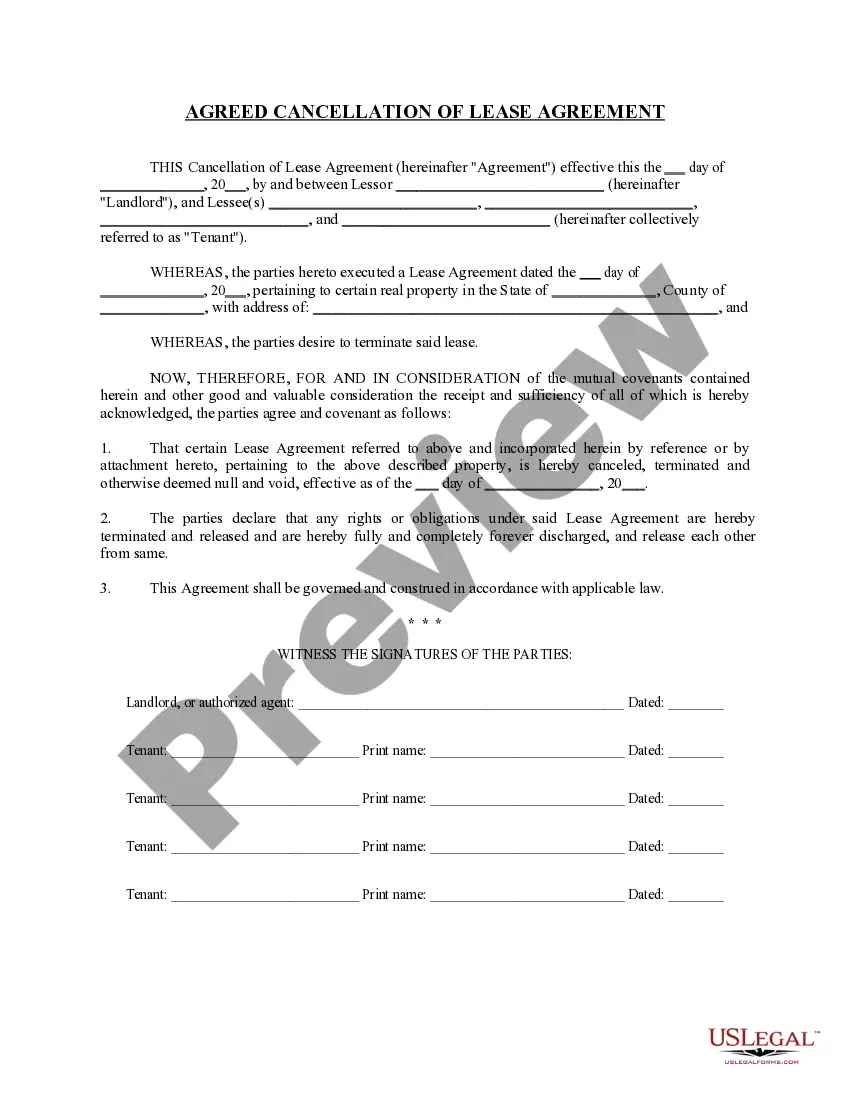

Michigan Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company

Description

How to fill out Call Agreement Between Kelso And Company, LP, Unilab Corporation And Bankers Trust Company?

US Legal Forms - one of several greatest libraries of lawful types in the USA - offers an array of lawful record layouts you are able to obtain or print. Using the web site, you will get a huge number of types for business and personal uses, sorted by categories, states, or key phrases.You can find the most recent models of types such as the Michigan Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company within minutes.

If you already have a membership, log in and obtain Michigan Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company through the US Legal Forms catalogue. The Download option will appear on each and every type you perspective. You have access to all previously saved types from the My Forms tab of your own account.

If you wish to use US Legal Forms initially, allow me to share basic directions to help you started:

- Ensure you have chosen the best type for your area/area. Select the Preview option to analyze the form`s articles. Read the type description to actually have selected the appropriate type.

- If the type doesn`t fit your demands, make use of the Research discipline towards the top of the display screen to get the one that does.

- In case you are happy with the form, validate your decision by simply clicking the Purchase now option. Then, opt for the pricing program you like and supply your references to sign up for an account.

- Approach the transaction. Make use of charge card or PayPal account to perform the transaction.

- Pick the format and obtain the form on your own device.

- Make modifications. Fill out, revise and print and indicator the saved Michigan Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company.

Every single format you included with your money does not have an expiration time which is yours permanently. So, if you wish to obtain or print one more version, just visit the My Forms portion and click on in the type you need.

Obtain access to the Michigan Call Agreement between Kelso and Company, LP, Unilab Corporation and Bankers Trust Company with US Legal Forms, one of the most comprehensive catalogue of lawful record layouts. Use a huge number of skilled and state-specific layouts that fulfill your company or personal requirements and demands.