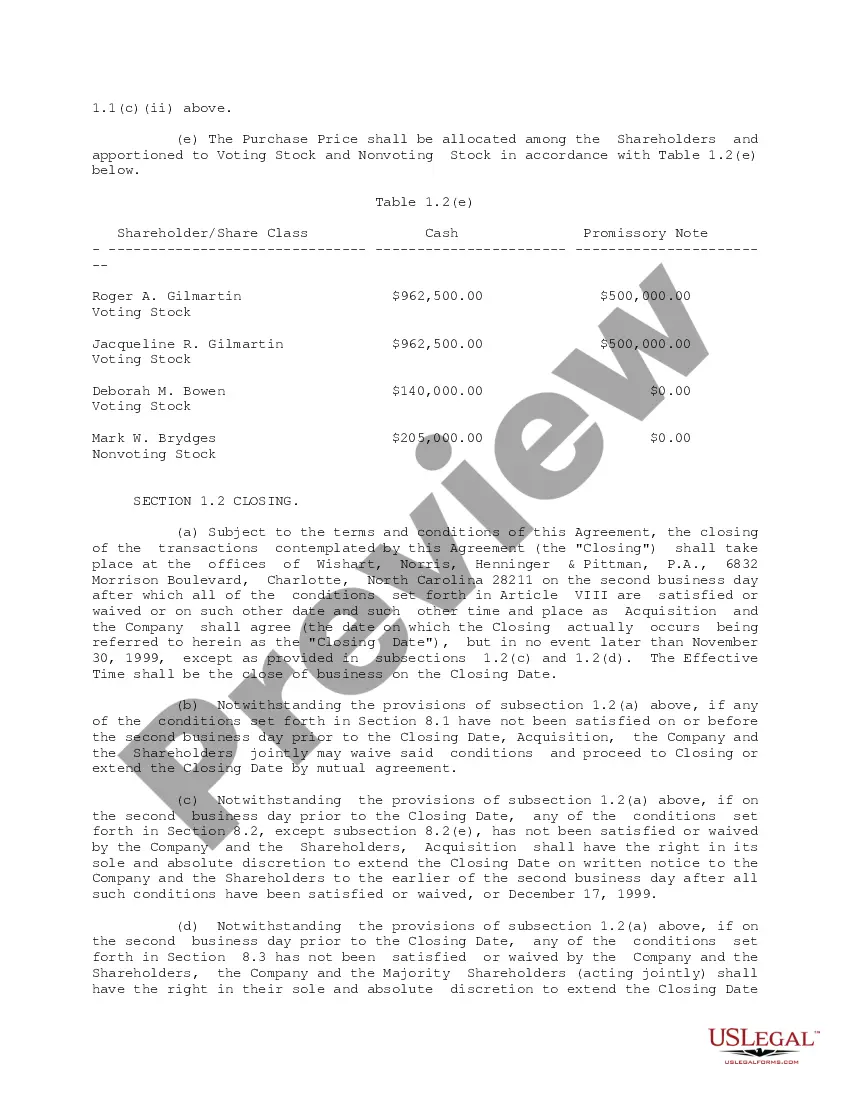

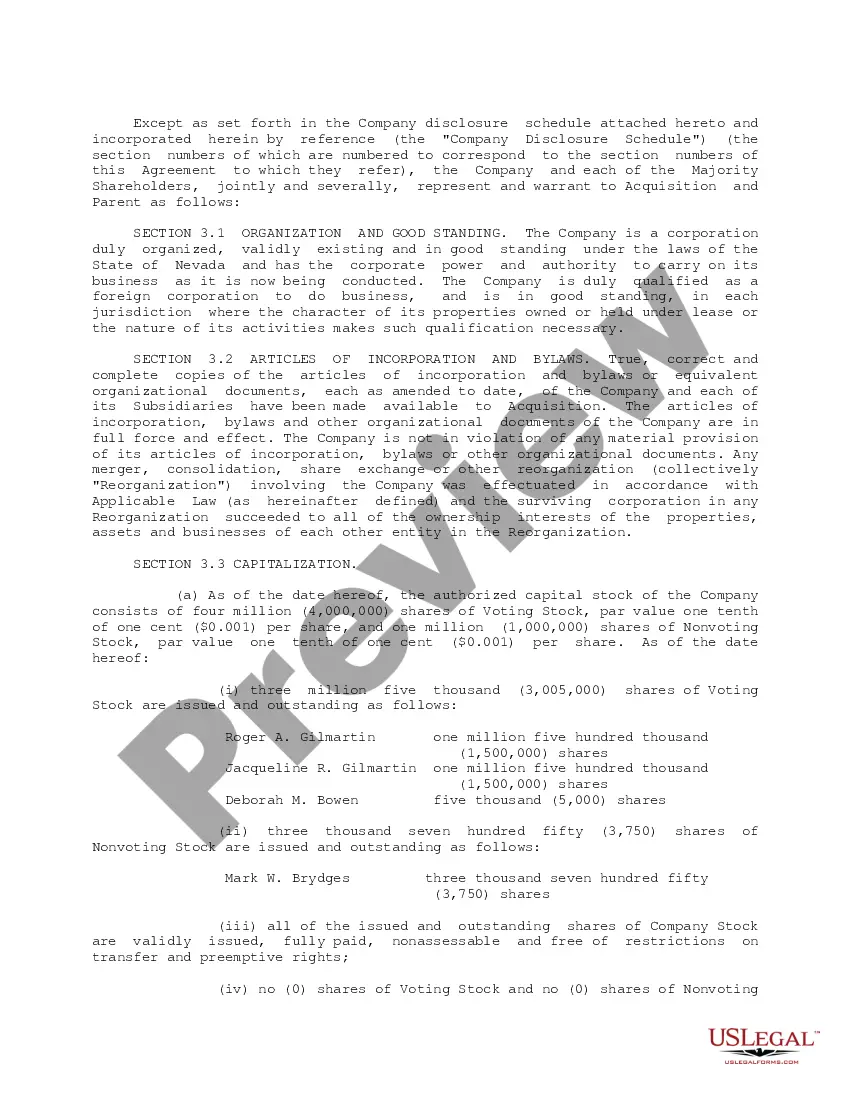

In Michigan, a Sample Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions for the purchase and sale of stock between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. This agreement is crucial in ensuring a smooth and transparent transaction between the parties involved. The Michigan Sample Purchase and Sale Agreement clearly define the rights, obligations, and responsibilities of each party and provides a framework for the transfer of ownership of stock. It typically covers essential details such as the purchase price, payment terms, closing conditions, representations and warranties, and post-closing obligations. There may be different types of Michigan Sample Purchase and Sale Agreements for the purchase and sale of stock between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp., depending on specific circumstances and objectives. For instance, they could include agreements for the sale of preferred stock, common stock, or even warrants. The purchase price is a critical component of the agreement and is usually negotiated between the buyer and the seller. It takes into account various factors such as the market value of the stock, the financial performance of the company, and any potential synergies resulting from the transaction. Payment terms within the agreement outline how and when the purchase price will be paid. This may include a lump sum payment upon closing or staggered payments over a certain period. These terms are essential for ensuring that both parties are clear on their financial obligations and expectations. Closing conditions are stipulated in the agreement and define the requirements that must be met before the stock sale can be completed. This may include obtaining necessary regulatory approvals, satisfactory due diligence, and the absence of any material adverse changes in the company's financial condition. Representations and warranties offered by both the buyer and the seller provide assurances regarding the accuracy and completeness of the information shared during the transaction. Any misrepresentations or breaches of these warranties can result in legal and financial consequences. Post-closing obligations may include provisions for transition assistance, non-compete agreements, or other commitments that are necessary for a smooth transfer of ownership and ongoing business operations. In conclusion, the Michigan Sample Purchase and Sale Agreement for the sale of stock between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. is a comprehensive document that safeguards the interests of all parties involved. It covers fundamental aspects such as purchase price, payment terms, closing conditions, representations and warranties, and post-closing obligations. Different types of agreements may exist depending on the specific stock being sold, such as common stock, preferred stock, or warrants.

Michigan Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.

Description

How to fill out Michigan Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

Have you been within a position that you need to have files for sometimes organization or personal functions just about every time? There are plenty of legal document layouts available on the net, but finding types you can depend on is not easy. US Legal Forms gives a large number of develop layouts, much like the Michigan Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp., which can be created to fulfill federal and state requirements.

If you are already acquainted with US Legal Forms site and possess a merchant account, basically log in. Afterward, you can download the Michigan Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. format.

If you do not come with an profile and wish to start using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is for the correct town/state.

- Make use of the Review switch to check the form.

- Look at the description to actually have selected the correct develop.

- In the event the develop is not what you`re seeking, use the Research area to get the develop that suits you and requirements.

- Whenever you get the correct develop, just click Acquire now.

- Select the rates program you desire, submit the specified information and facts to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Decide on a hassle-free file format and download your version.

Discover all the document layouts you might have purchased in the My Forms menu. You can obtain a extra version of Michigan Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. any time, if required. Just go through the essential develop to download or printing the document format.

Use US Legal Forms, probably the most substantial selection of legal forms, to conserve time as well as stay away from mistakes. The assistance gives expertly produced legal document layouts that can be used for a range of functions. Make a merchant account on US Legal Forms and start creating your daily life a little easier.