Michigan Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock

Description

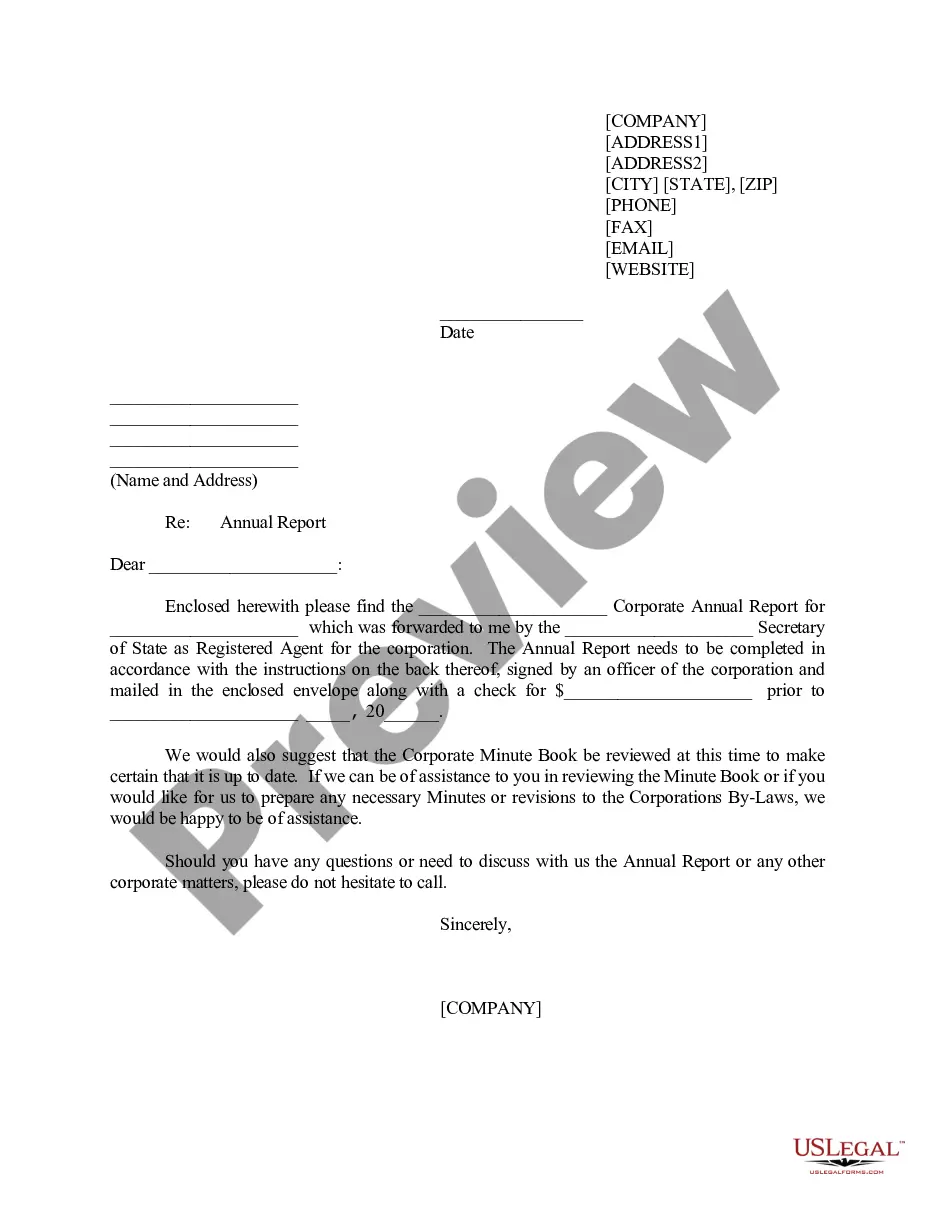

How to fill out Acquisition Agreement Between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. And Everford Comsec Ltd Regarding Exchange Of Company Stock?

If you want to comprehensive, acquire, or print out lawful record layouts, use US Legal Forms, the most important collection of lawful types, which can be found on-line. Take advantage of the site`s simple and handy look for to obtain the documents you want. Different layouts for organization and individual functions are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the Michigan Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock in a number of click throughs.

When you are currently a US Legal Forms customer, log in in your account and click the Download button to have the Michigan Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock. Also you can entry types you formerly delivered electronically inside the My Forms tab of your respective account.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the proper metropolis/land.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Never neglect to read through the explanation.

- Step 3. When you are unhappy together with the type, utilize the Look for discipline near the top of the display to find other variations in the lawful type template.

- Step 4. Once you have discovered the form you want, click the Purchase now button. Select the rates strategy you choose and add your accreditations to register for an account.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Choose the file format in the lawful type and acquire it on your device.

- Step 7. Full, modify and print out or indication the Michigan Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock.

Each and every lawful record template you acquire is your own property for a long time. You might have acces to every type you delivered electronically inside your acccount. Click on the My Forms segment and select a type to print out or acquire once more.

Remain competitive and acquire, and print out the Michigan Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock with US Legal Forms. There are thousands of skilled and status-distinct types you can utilize to your organization or individual demands.