Michigan Share Exchange Agreement is a legally binding contract entered into between ZC Acquisition Corp., Refer Corp., and the stockholders of Refer Corp., outlining the terms and conditions of a share exchange transaction. This agreement is designed to facilitate the transfer of shares from the stockholders of Refer Corp. to ZC Acquisition Corp. The Michigan Share Exchange Agreement governs the process of exchanging equity interests, ensuring that all parties involved understand their roles, rights, and obligations. It provides a comprehensive framework for the transaction, protecting the interests of both parties and ensuring a smooth transition. Keywords: 1. Michigan Share Exchange Agreement: The agreement is specific to Michigan state and serves as a legal document regulating share exchange transactions. 2. ZC Acquisition Corp.: This entity is the acquiring company seeking to obtain shares of Refer Corp. 3. Refer Corp.: This entity is the target company whose shares will be acquired by ZC Acquisition Corp. 4. Stockholders of Refer Corp.: Refers to the individuals or entities that hold shares in Refer Corp. 5. Share exchange transaction: The process of transferring ownership of shares from one entity to another. 6. Terms and conditions: Specifies the rights, responsibilities, and obligations of the parties involved. 7. Equity interests: Refers to ownership or ownership-related interests in the company, commonly in the form of shares. 8. Roles and responsibilities: Defines the roles and responsibilities of each party involved in the share exchange transaction. 9. Rights and obligations: Outlines the privileges, rights, and obligations of the parties. 10. Smooth transition: Ensures a seamless exchange of shares to minimize disruptions to the operations of Refer Corp. Different types of Michigan Share Exchange Agreements between ZC Acquisition Corp., Refer Corp., and the stockholders of Refer Corp. may include variations based on: 1. Consideration: The agreed-upon form of consideration for the acquired shares, which can be cash, stock, or a combination thereof. 2. Pricing: The valuation method used to determine the exchange ratio or the price per share during the share exchange transaction. 3. Voting rights: The extent of voting rights and future management participation of the stockholders of Refer Corp. in ZC Acquisition Corp. 4. Escrow and indemnification provisions: The provisions related to potential breaches of representations and warranties and the financial remedies available to the parties. 5. Termination conditions: The circumstances under which the share exchange agreement may be terminated, including regulatory approval, material adverse changes, or failure to fulfill certain conditions. 6. Confidentiality and non-disclosure: The agreement's provisions regarding the confidential information of both parties and restrictions on disclosure to third parties. 7. Dispute resolution: The process to settle any conflicts or disputes arising out of the share exchange agreement, often through arbitration or mediation. It is important to note that the specific types and details of the Michigan Share Exchange Agreement may vary depending on the individual circumstances and negotiations between the parties involved. Consulting legal professionals or reviewing the specific agreement for ZC Acquisition Corp., Refer Corp., and its stockholders is crucial for an accurate understanding of the variations in these agreements.

Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp.

Description

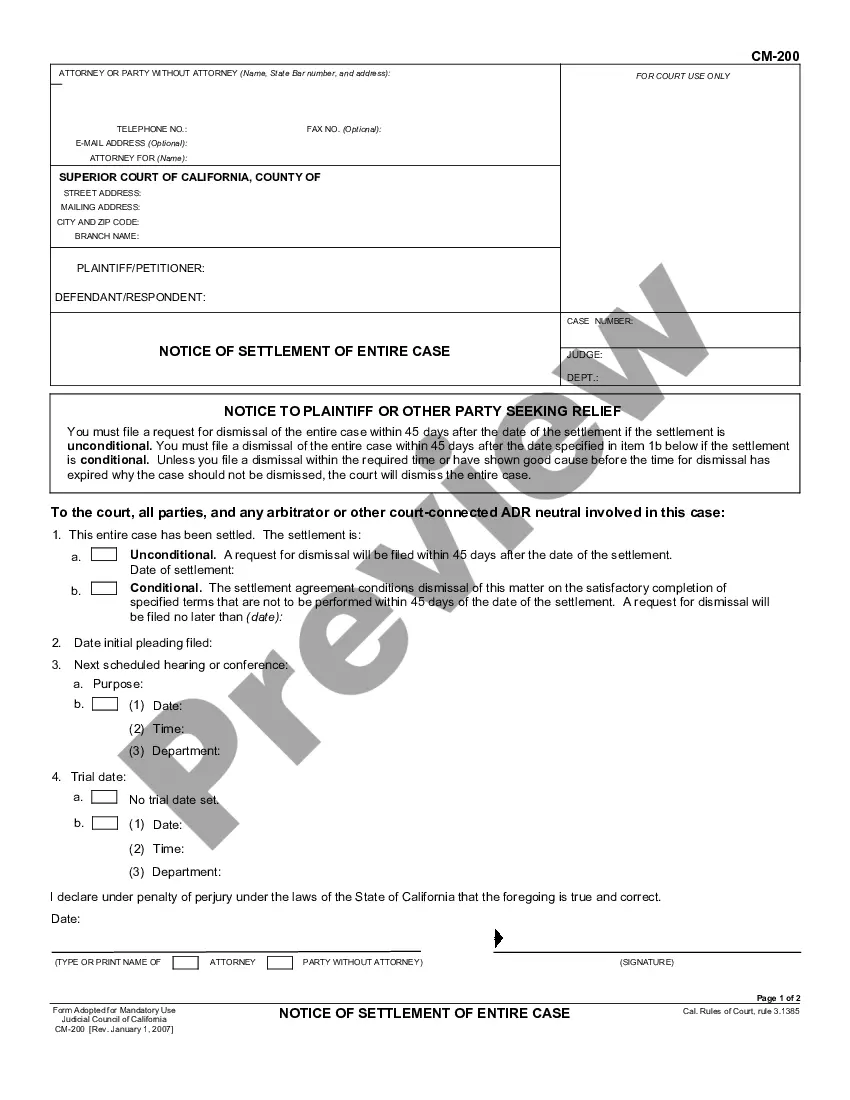

How to fill out Michigan Share Exchange Agreement Between ZC Acquisition Corp., Zefer Corp. And The Stockholders Of Zefer Corp.?

Have you been within a situation that you need to have papers for both enterprise or person purposes virtually every day time? There are a lot of authorized file themes available online, but locating types you can rely on isn`t effortless. US Legal Forms offers thousands of form themes, such as the Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp., that are published to satisfy state and federal demands.

Should you be presently acquainted with US Legal Forms site and also have an account, basically log in. Afterward, you may acquire the Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. template.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for your right area/region.

- Use the Preview option to analyze the form.

- See the information to ensure that you have selected the right form.

- If the form isn`t what you`re searching for, use the Look for area to discover the form that meets your needs and demands.

- Whenever you discover the right form, just click Get now.

- Pick the costs program you want, fill in the necessary information to create your account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free document formatting and acquire your version.

Find all the file themes you might have purchased in the My Forms food list. You may get a more version of Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. any time, if possible. Just select the necessary form to acquire or print the file template.

Use US Legal Forms, by far the most extensive variety of authorized kinds, in order to save efforts and prevent errors. The assistance offers skillfully produced authorized file themes that you can use for a selection of purposes. Produce an account on US Legal Forms and begin generating your life a little easier.