Michigan Documentation Required to Confirm Accredited Investor Status

Description

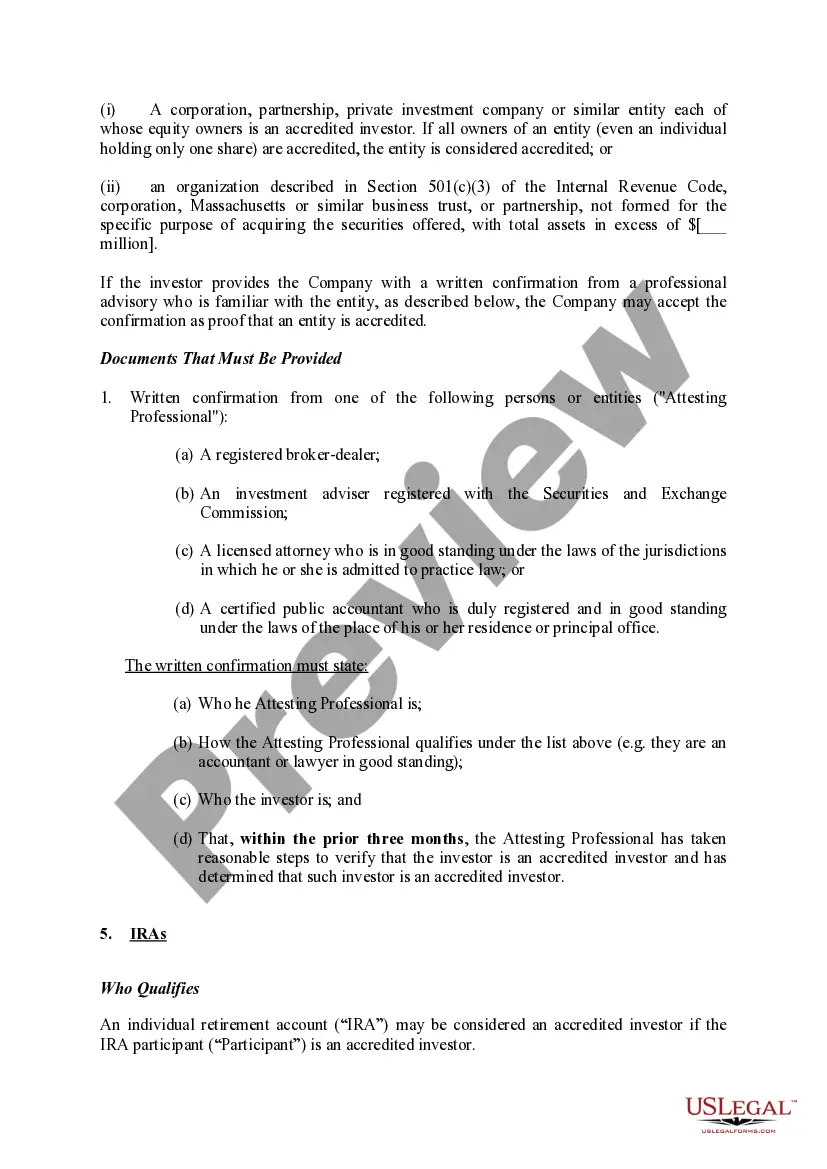

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

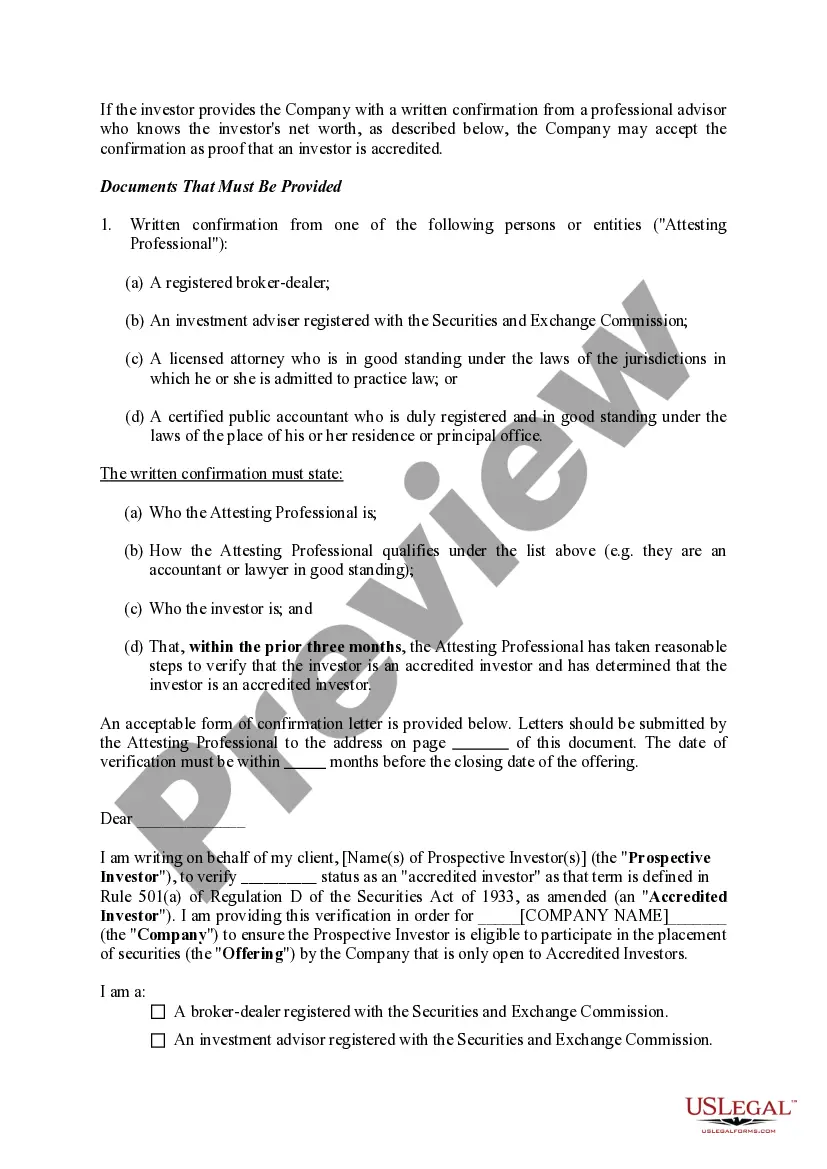

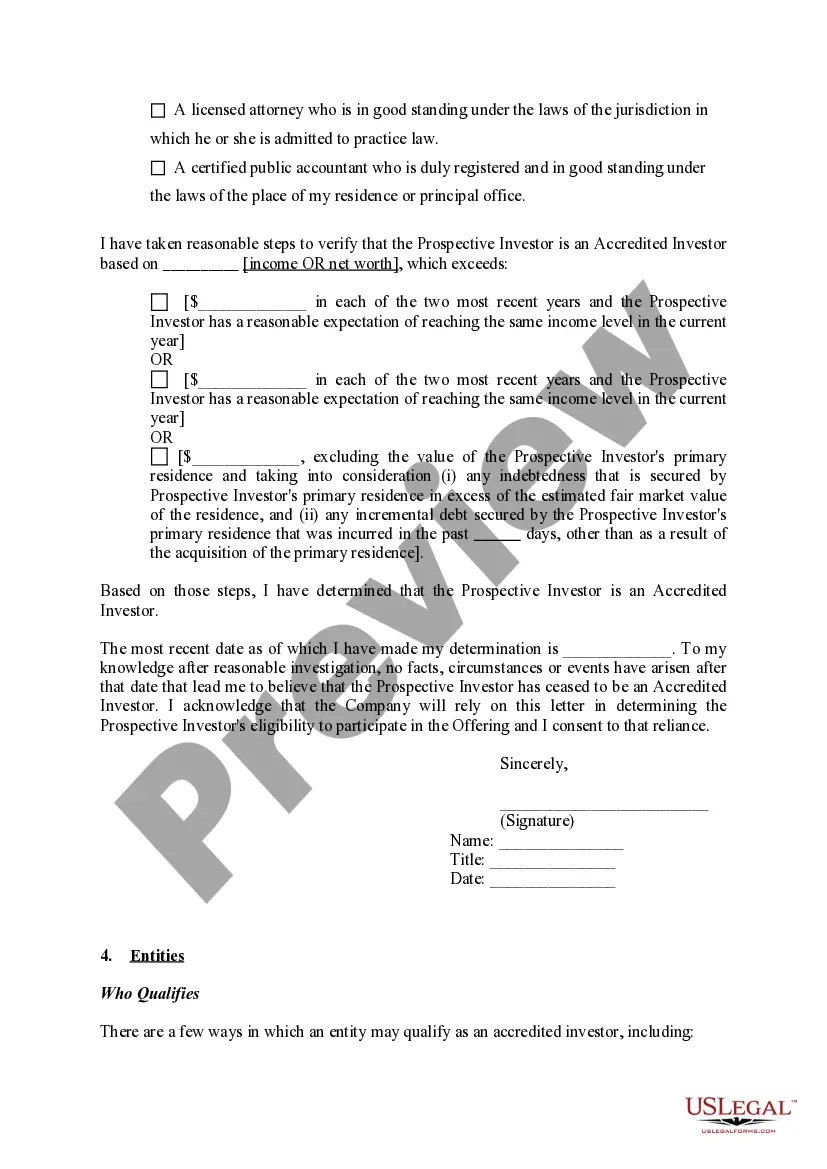

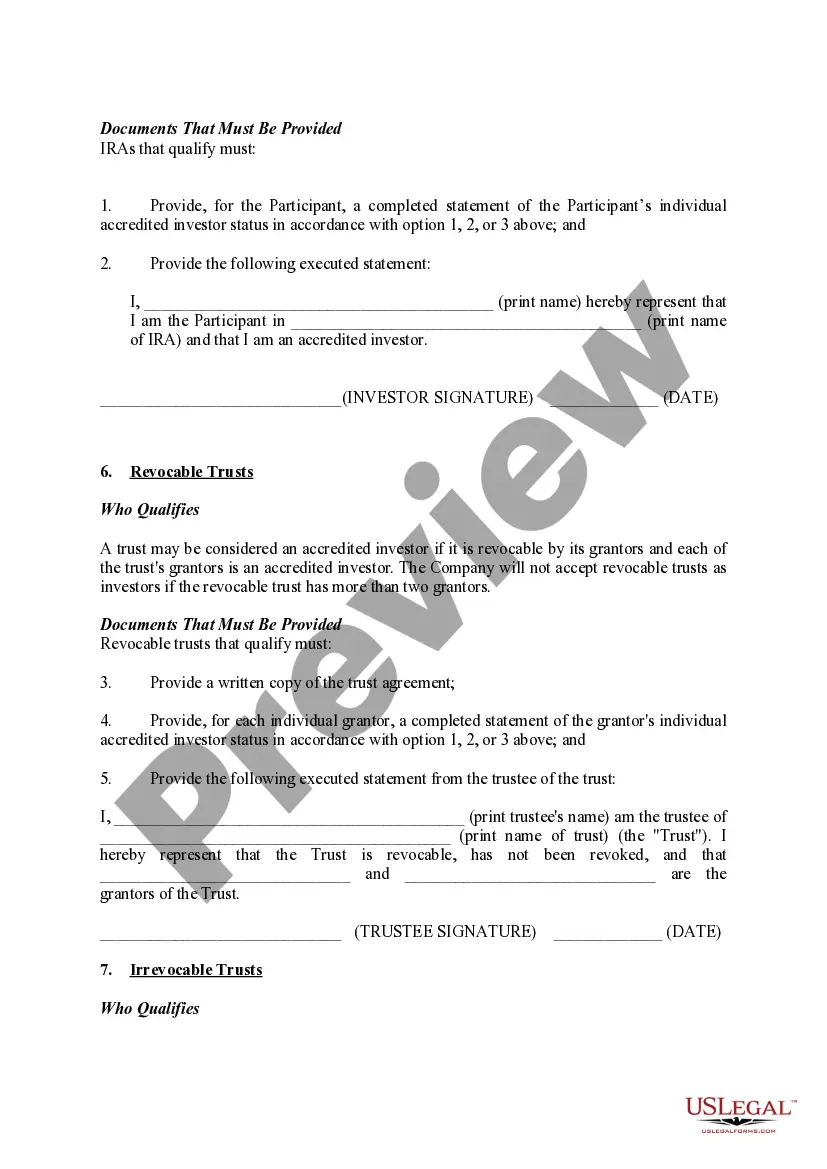

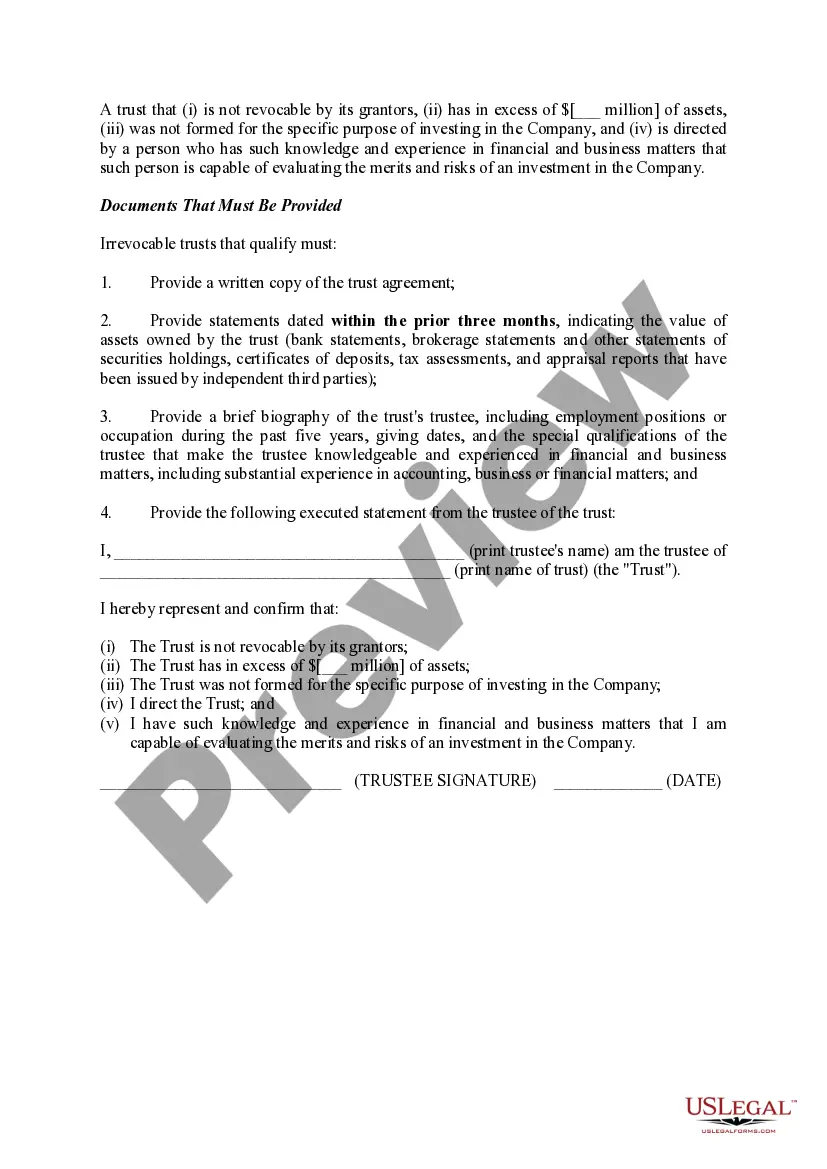

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

US Legal Forms - among the biggest libraries of lawful types in the States - gives a variety of lawful record layouts you may acquire or printing. Making use of the site, you can find thousands of types for business and individual uses, sorted by classes, suggests, or keywords.You can get the latest variations of types much like the Michigan Documentation Required to Confirm Accredited Investor Status in seconds.

If you have a membership, log in and acquire Michigan Documentation Required to Confirm Accredited Investor Status from your US Legal Forms local library. The Obtain switch will appear on each form you view. You get access to all in the past delivered electronically types in the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed below are basic recommendations to help you get started:

- Be sure to have picked the best form for your area/region. Go through the Preview switch to analyze the form`s content material. Browse the form outline to actually have chosen the right form.

- If the form does not fit your specifications, use the Search industry at the top of the display screen to discover the the one that does.

- In case you are pleased with the form, validate your selection by visiting the Get now switch. Then, choose the pricing program you prefer and give your credentials to sign up for the account.

- Process the deal. Utilize your bank card or PayPal account to complete the deal.

- Pick the file format and acquire the form on the gadget.

- Make modifications. Fill out, modify and printing and signal the delivered electronically Michigan Documentation Required to Confirm Accredited Investor Status.

Every template you included with your bank account lacks an expiry date and is the one you have eternally. So, in order to acquire or printing one more copy, just proceed to the My Forms segment and then click about the form you require.

Get access to the Michigan Documentation Required to Confirm Accredited Investor Status with US Legal Forms, probably the most substantial local library of lawful record layouts. Use thousands of professional and state-particular layouts that meet up with your organization or individual needs and specifications.

Form popularity

FAQ

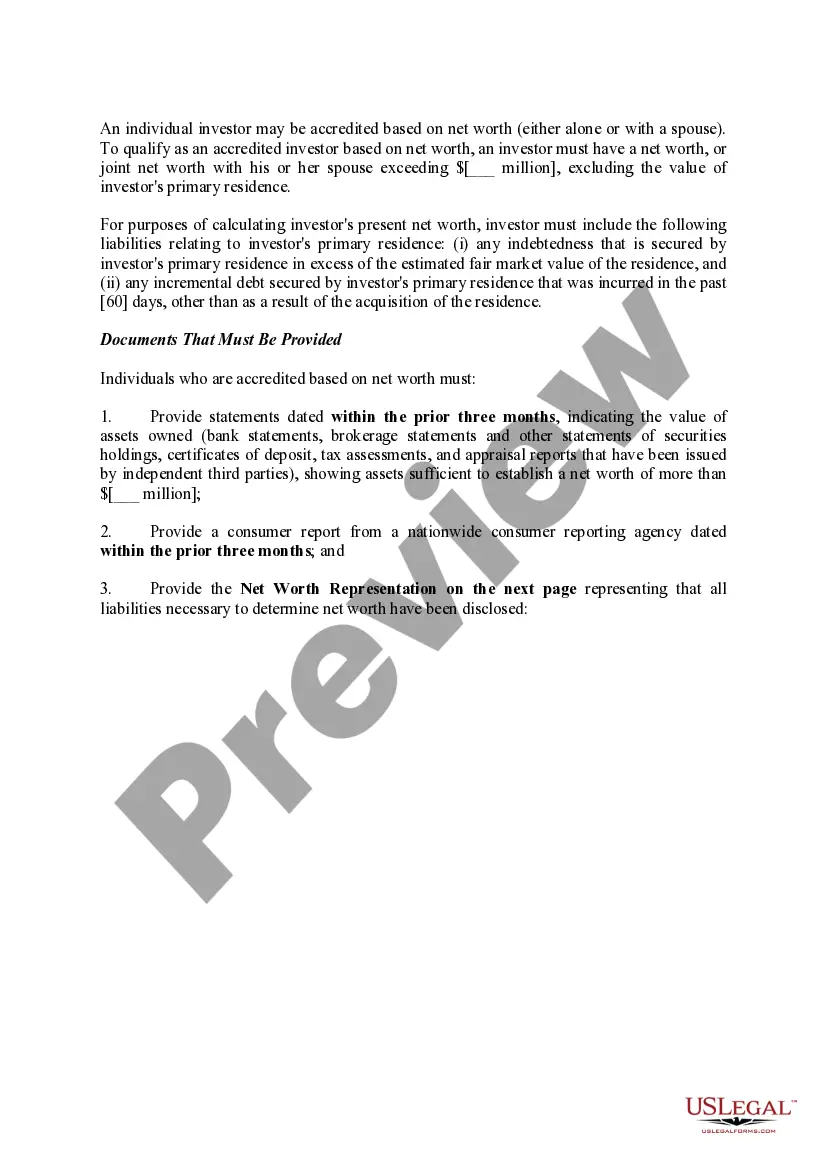

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

Examples of supporting documents Latest statement from brokerage houses showing net personal assets For net equity of property: Title deeds free of encumbrances. Latest housing loan statement For income: Salary Slip.

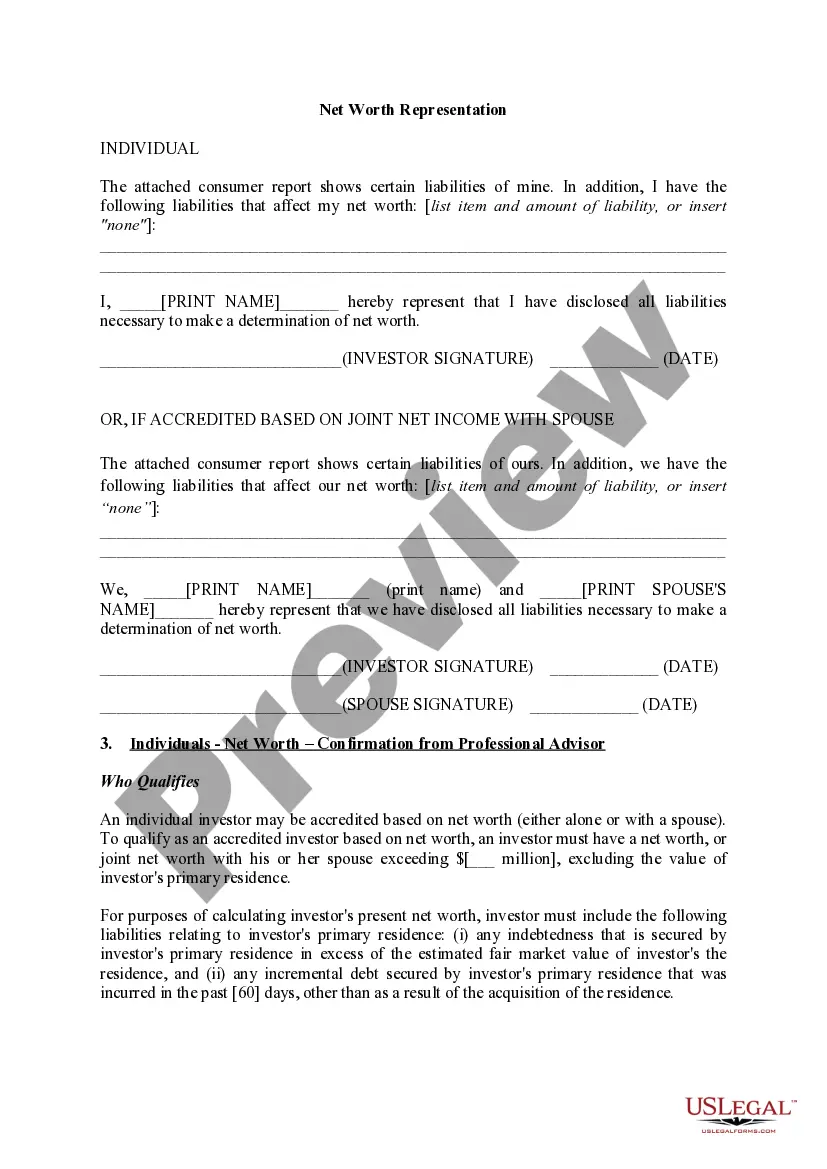

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

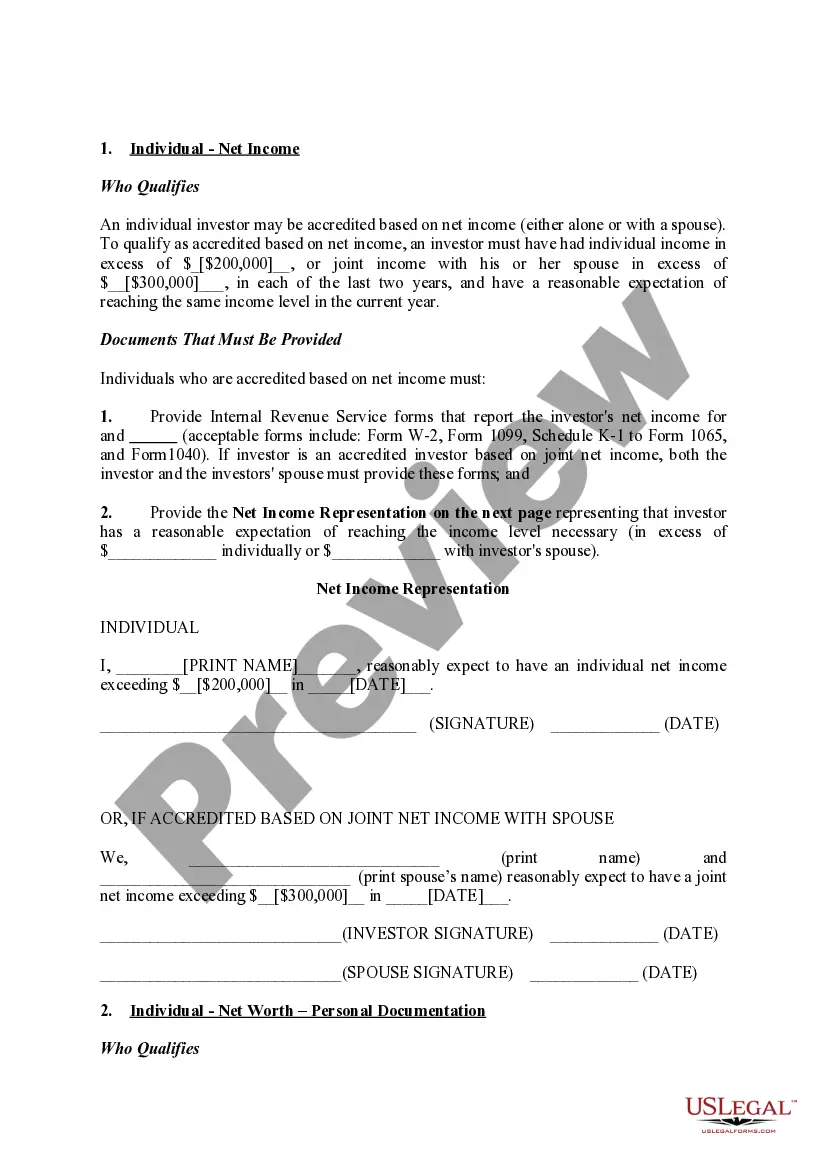

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.