Michigan Term Sheet — Convertible Debt Financing is a legal document used in the state of Michigan to outline the terms and conditions of a convertible debt financing agreement. This type of financing is commonly used by startups and early-stage companies to obtain funding for their business activities. It involves offering investors a debt instrument that can later be converted into equity under specific conditions. The Michigan Term Sheet — Convertible Debt Financing outlines various aspects of the agreement, including the principal amount of the loan, the interest rate, repayment terms, and conversion details. It is essential to understand the nuances and different elements of this document to ensure a mutually beneficial agreement between the company and investors. The keywords relevant to this topic are: 1. Michigan Term Sheet: This refers to the legal document specific to the state of Michigan. It outlines the terms and conditions of convertible debt financing. 2. Convertible Debt Financing: This is a type of financing where investors provide funds to a company in the form of a loan, which can be converted into equity at a later stage. It allows companies to raise capital without immediately diluting their ownership. 3. Startups: Convertible debt financing is commonly utilized by startups and early-stage companies as they often face challenges obtaining traditional bank loans due to insufficient collateral or limited operating history. 4. Early-stage Companies: Aside from startups, early-stage companies with growth potential can also benefit from convertible debt financing. It offers them an alternative source of capital to fund operations and fuel growth. 5. Funding: Convertible debt financing provides a crucial funding option for companies seeking capital injections. It allows them to secure immediate financial support while potentially offering investors the opportunity for future equity participation. 6. Debt Instrument: The convertible debt agreement is structured as a loan, with specific terms regarding interest rates, repayment schedule, and maturity. Investors initially lend money to the company as debt, which can convert into equity in the future. 7. Equity Conversion: The term sheet outlines the conditions under which the debt can be converted into equity. Typically, it includes triggers like a future funding round or a predefined valuation event such as an IPO, acquisition, or change of control. Some types of Michigan Term Sheet — Convertible Debt Financing include: 1. Simple Agreement for Future Equity (SAFE): This is a less complex form of convertible debt financing that is commonly used in startup ecosystems. It does not bear interest or have a maturity date, simplifying the terms compared to traditional convertible debt. 2. Traditional Convertible Debt: This is a more standard form of convertible debt financing, where the loan has an interest rate, maturity date, and defined terms for conversion into equity. In conclusion, the Michigan Term Sheet — Convertible Debt Financing is an essential legal document that outlines the terms and conditions of a convertible debt agreement in the state of Michigan. It enables startups and early-stage companies to secure funding from investors in the form of debt, which can later be converted into equity under specific circumstances. It is crucial for both parties involved to understand the various keywords and types of convertible debt financing to ensure a transparent and mutually beneficial agreement.

Michigan Term Sheet - Convertible Debt Financing

Description

How to fill out Michigan Term Sheet - Convertible Debt Financing?

If you want to full, download, or print legal document themes, use US Legal Forms, the most important assortment of legal kinds, that can be found on the Internet. Take advantage of the site`s easy and practical lookup to get the paperwork you want. Various themes for business and person reasons are sorted by categories and states, or keywords. Use US Legal Forms to get the Michigan Term Sheet - Convertible Debt Financing in just a number of clicks.

Should you be already a US Legal Forms consumer, log in to the account and then click the Obtain option to have the Michigan Term Sheet - Convertible Debt Financing. You may also entry kinds you formerly saved inside the My Forms tab of your account.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that proper town/region.

- Step 2. Utilize the Preview option to check out the form`s information. Do not neglect to read the outline.

- Step 3. Should you be not satisfied with the form, make use of the Research discipline near the top of the display screen to locate other types of the legal form design.

- Step 4. Upon having discovered the form you want, click the Purchase now option. Opt for the prices plan you prefer and include your references to sign up to have an account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Find the structure of the legal form and download it on your own product.

- Step 7. Complete, revise and print or indication the Michigan Term Sheet - Convertible Debt Financing.

Each and every legal document design you acquire is your own property permanently. You may have acces to every form you saved within your acccount. Go through the My Forms segment and select a form to print or download once again.

Compete and download, and print the Michigan Term Sheet - Convertible Debt Financing with US Legal Forms. There are millions of skilled and state-specific kinds you can utilize to your business or person needs.

Form popularity

FAQ

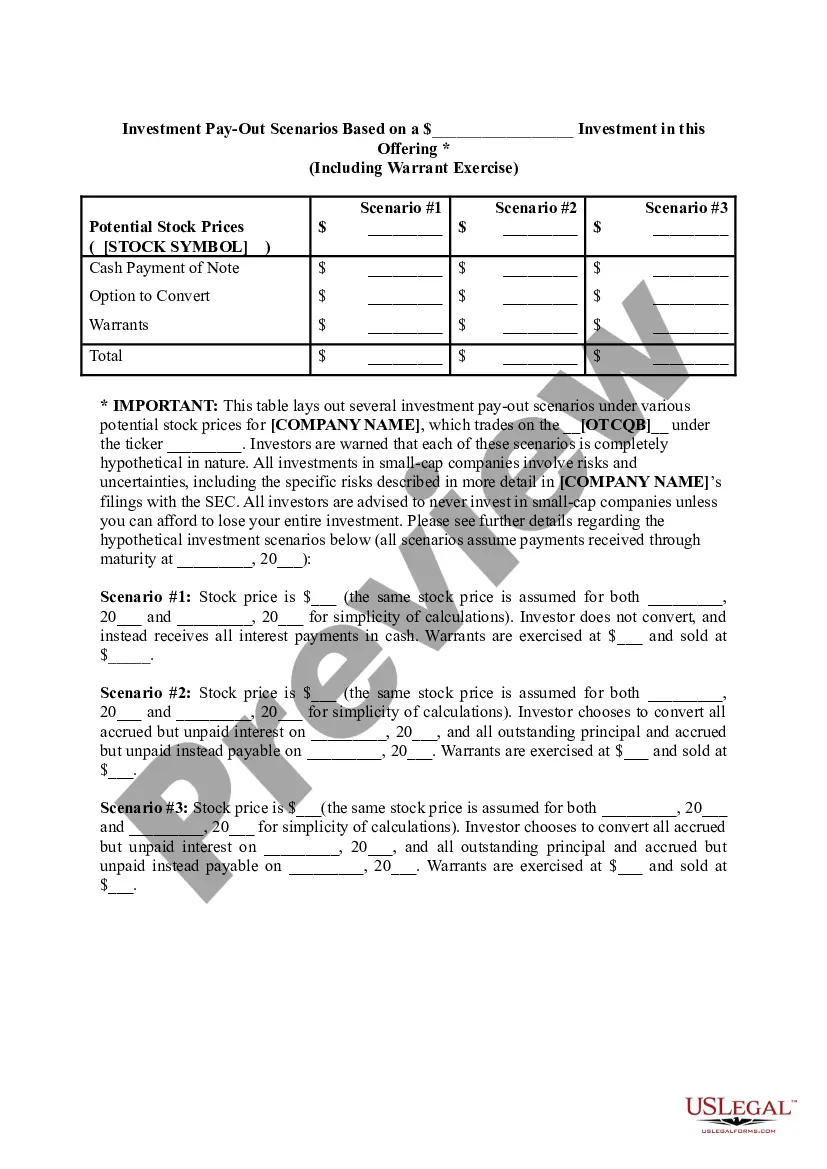

EXAMPLE: A startup company with 1,000,000 shares of common stock closes a seed funding round of $1,000,000 in the form of a convertible note, with a valuation cap of $5,000,000 pre-money valuation on the next round of financing.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Repayment Method With most convertible debt, you will repay the investment by converting the entire value to stock. Some investors, though, may also include language that obligates you to pay back a certain percentage of the original investment as cash and the remainder as stock.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Example of convertible debt ABC Company raises $1,000,000 in convertible debt financing from an investor with the following conversion privileges and a callable option: Conversion privileges?The loan can be converted into 20,000 common shares in ABC Company at $50 per share within 3 years.

Convertible notes are recorded as debt on the company's balance sheet up until the conversion event. After conversion, they become equity in the company. As debt instruments, convertible notes also have a maturity date and can earn interest (two key differences with SAFEs, as outlined further down).

The terms of your convertible notes will usually require the company to notify the noteholder prior to entering into documents to give effect to an exit event. Usually, the noteholder can choose whether they want to: recover their loan amount (plus any interest) in cash; or. convert that amount into shares.

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity.