The Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on is a legal document that provides comprehensive information regarding the implementation of a remuneration plan for shares in the state of Michigan. This notice aims to outline the details, restrictions, and guidelines associated with such a plan, ensuring compliance with Michigan state laws and regulations. Under this notice, Michigan employers are obligated to provide a thorough description of the remuneration plan for shares with restriction on, which includes various types. These types may include: 1. Restricted Stock Units (RSS): RSS are a form of equity compensation where employees receive notional units that represent a certain number of company shares. The employees can convert these units into actual shares after completing specific vesting criteria outlined in the remuneration plan. 2. Stock Options: Stock options provide employees with the right to purchase a specified number of company shares at a predetermined price (exercise price) within a particular timeframe. These options may have restrictions on their transferability or exercise dates, which are detailed in the remuneration plan. 3. Performance Shares: Performance shares are awarded based on predetermined performance goals and metrics. These shares are typically subject to a vesting period and may have certain restrictions on transferability until specific performance targets are achieved. 4. Phantom Stock: Phantom stock is a form of remuneration that mimics the value of actual stock. Employees will receive cash or equivalent value based on the appreciation of the company's stock over time. Similar to other types of shares, phantom stock may also entail various restrictions and conditions outlined within the remuneration plan. The Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on provides a detailed explanation of each type, addressing the rules, procedures, and limitations associated with them. It emphasizes the importance of adhering to state laws and regulations while implementing these remuneration plans, ensuring transparency and fair treatment for all employees. To maintain compliance with Michigan state regulations, employers are advised to seek legal counsel or refer to official guidelines and updates provided by regulatory authorities when drafting the notice and implementing remuneration plans for shares with restrictions on.

Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

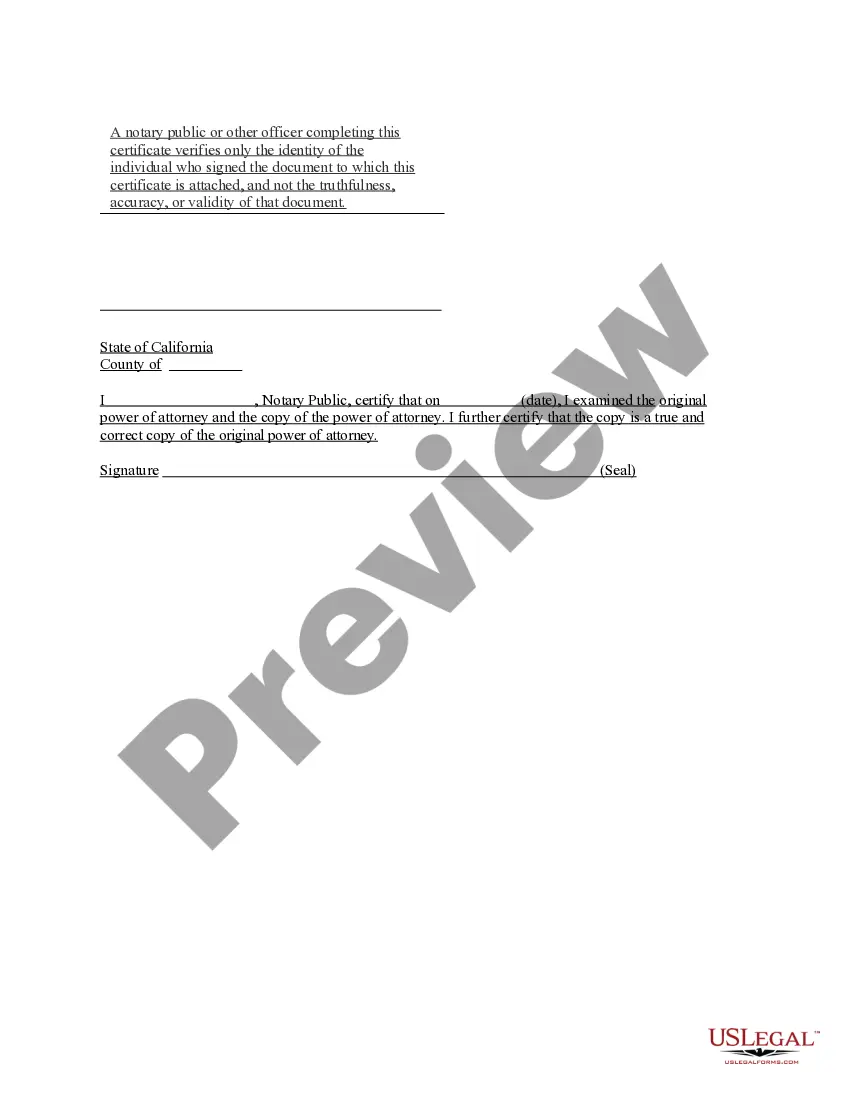

How to fill out Michigan Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

You may spend hrs on-line searching for the legal file web template that meets the federal and state demands you need. US Legal Forms supplies thousands of legal types which can be analyzed by specialists. You can easily obtain or print the Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on from our service.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Obtain button. Afterward, it is possible to total, change, print, or sign the Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on. Every single legal file web template you buy is your own property permanently. To acquire yet another backup for any obtained kind, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms site for the first time, follow the straightforward recommendations under:

- Initial, make sure that you have chosen the correct file web template to the county/city of your choosing. See the kind information to make sure you have selected the appropriate kind. If readily available, use the Preview button to appear throughout the file web template also.

- In order to get yet another version from the kind, use the Look for industry to discover the web template that meets your requirements and demands.

- Upon having found the web template you desire, click Buy now to move forward.

- Find the prices strategy you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal accounts to purchase the legal kind.

- Find the structure from the file and obtain it in your system.

- Make alterations in your file if needed. You may total, change and sign and print Michigan Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Obtain and print thousands of file layouts using the US Legal Forms website, which provides the greatest assortment of legal types. Use expert and status-specific layouts to tackle your organization or specific needs.