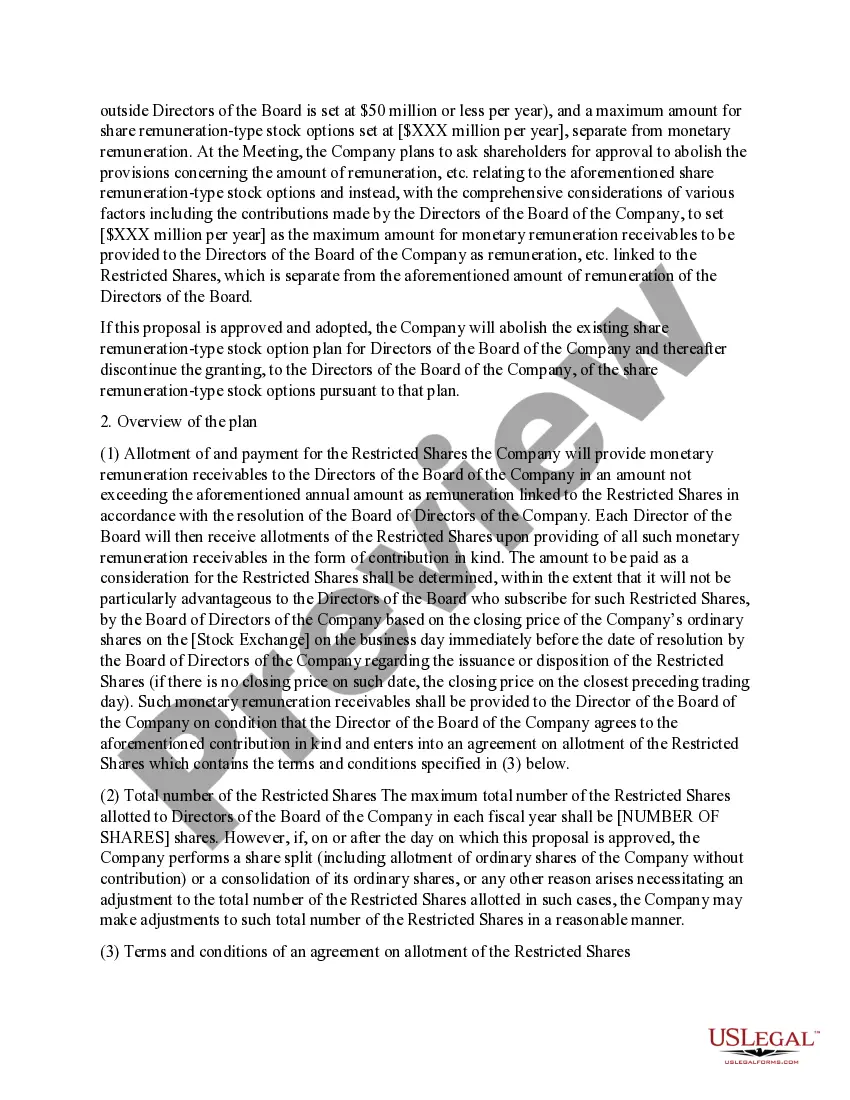

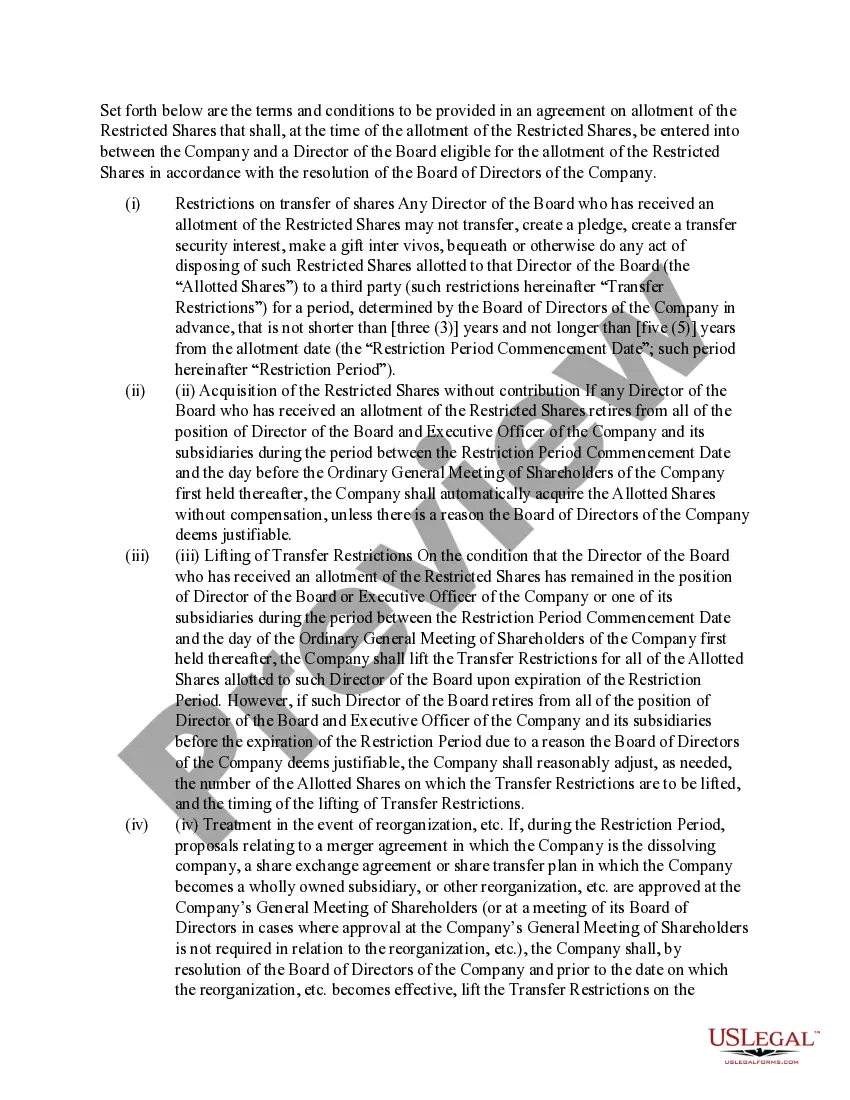

Michigan Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

You are able to commit several hours on-line searching for the legal document web template which fits the state and federal requirements you require. US Legal Forms supplies a large number of legal kinds that happen to be reviewed by specialists. You can easily download or printing the Michigan Notice Regarding Introduction of Restricted Share-Based Remuneration Plan from the assistance.

If you currently have a US Legal Forms profile, you can log in and click on the Download button. After that, you can comprehensive, change, printing, or signal the Michigan Notice Regarding Introduction of Restricted Share-Based Remuneration Plan. Every legal document web template you acquire is your own property permanently. To obtain one more version of the bought kind, visit the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms site the very first time, stick to the straightforward recommendations listed below:

- Initial, ensure that you have chosen the best document web template for your area/metropolis of your choice. Read the kind information to make sure you have picked the proper kind. If offered, use the Review button to check through the document web template at the same time.

- If you wish to locate one more model of your kind, use the Look for area to get the web template that meets your requirements and requirements.

- After you have identified the web template you desire, simply click Purchase now to proceed.

- Select the pricing program you desire, type in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You should use your credit card or PayPal profile to purchase the legal kind.

- Select the format of your document and download it to your gadget.

- Make changes to your document if possible. You are able to comprehensive, change and signal and printing Michigan Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

Download and printing a large number of document web templates using the US Legal Forms Internet site, that offers the greatest variety of legal kinds. Use skilled and state-specific web templates to handle your company or person needs.

Form popularity

FAQ

As of , 36 states and one locality had enacted a PTET, including seven states in 2023, in four of which a PTET is effective retroactively to 2022 ? Indiana; Iowa (with its Department of Revenue on , requesting comments on needed guidance by June 7, 2023); Kentucky; and West Virginia ? while ...

This form is a supporting schedule used to report member information for a flow-through entity filing the Flow-through Entity Tax Annual Return (Form 5772). All taxpayers must complete this schedule and submit with their return.

States With Reciprocal Agreements StateReciprocal Agreement StatesKentuckyIllinois, Indiana, Michigan, Ohio, West Virginia, Wisconsin, VirginiaMarylandDistrict of Columbia, Pennsylvania, Virginia, West VirginiaMichiganWisconsin, Indiana, Kentucky, Illinois, Ohio, MinnesotaMinnesotaMichigan, North Dakota13 more rows ?

All Michigan FTE returns, including Form 5772, must be submitted electronically through Michigan Treasury Online (MTO). Michigan FTE tax returns submitted outside MTO will not be accepted.

Effective January 1, 2021, the Michigan flow-through entity (FTE) tax is levied on certain electing entities with business activity in Michigan. The Michigan FTE tax: is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity.

The elective PTE tax rate is tied to Michigan's individual tax rate, which is currently 4.25%. Individual owners of electing PTEs may claim a refundable credit for their allocated share of the tax as reported to the member by the electing PTE.

HB 5376 amends the Michigan Income Tax Act to impose a flow-through entity tax on electing flow-through entities with business activity in the state. Flow-through entities may make a three-year binding election to file a return and pay the flow-through entity tax on behalf of their members.

Michigan has a flat 4.25 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Michigan has a 6.00 percent corporate income tax rate. Michigan has a 6.00 percent state sales tax rate and does not levy any local sales taxes.