Michigan Graphic Artist Agreement - Self-Employed Independent Contractor

Description

How to fill out Michigan Graphic Artist Agreement - Self-Employed Independent Contractor?

Discovering the right authorized document web template might be a have difficulties. Obviously, there are tons of layouts accessible on the Internet, but how would you get the authorized develop you will need? Make use of the US Legal Forms site. The assistance provides a huge number of layouts, such as the Michigan Graphic Artist Agreement - Self-Employed Independent Contractor, that can be used for business and personal needs. Every one of the forms are checked by specialists and satisfy federal and state requirements.

In case you are presently signed up, log in for your profile and click on the Obtain option to have the Michigan Graphic Artist Agreement - Self-Employed Independent Contractor. Make use of profile to search from the authorized forms you possess purchased earlier. Go to the My Forms tab of your respective profile and obtain yet another backup of the document you will need.

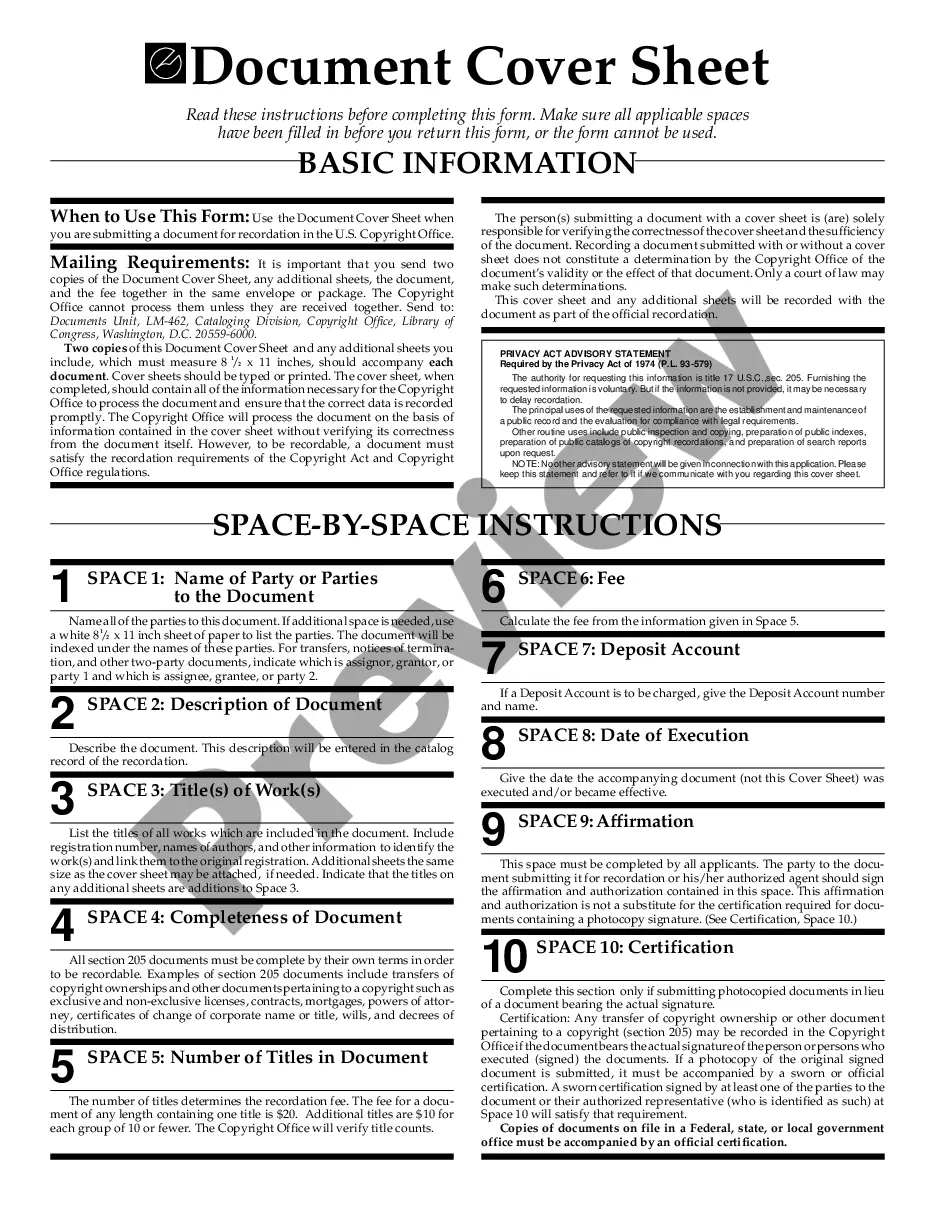

In case you are a fresh customer of US Legal Forms, listed below are basic instructions that you should adhere to:

- First, make certain you have selected the right develop to your area/county. It is possible to examine the shape making use of the Preview option and browse the shape explanation to ensure it will be the best for you.

- In case the develop is not going to satisfy your requirements, take advantage of the Seach discipline to discover the right develop.

- Once you are certain that the shape is proper, click the Acquire now option to have the develop.

- Opt for the prices plan you need and enter the needed information. Build your profile and buy your order using your PayPal profile or charge card.

- Pick the data file structure and acquire the authorized document web template for your product.

- Complete, edit and produce and indicator the acquired Michigan Graphic Artist Agreement - Self-Employed Independent Contractor.

US Legal Forms is definitely the biggest catalogue of authorized forms where you can discover different document layouts. Make use of the company to acquire expertly-made paperwork that adhere to express requirements.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

An individual who performs services for remuneration under an exclusive contract that provides for the individual's control and direction by a person, firm, or corporation possessing a public service permit or by a certificated motor carrier transporting goods or property for hire is presumed to be covered by the

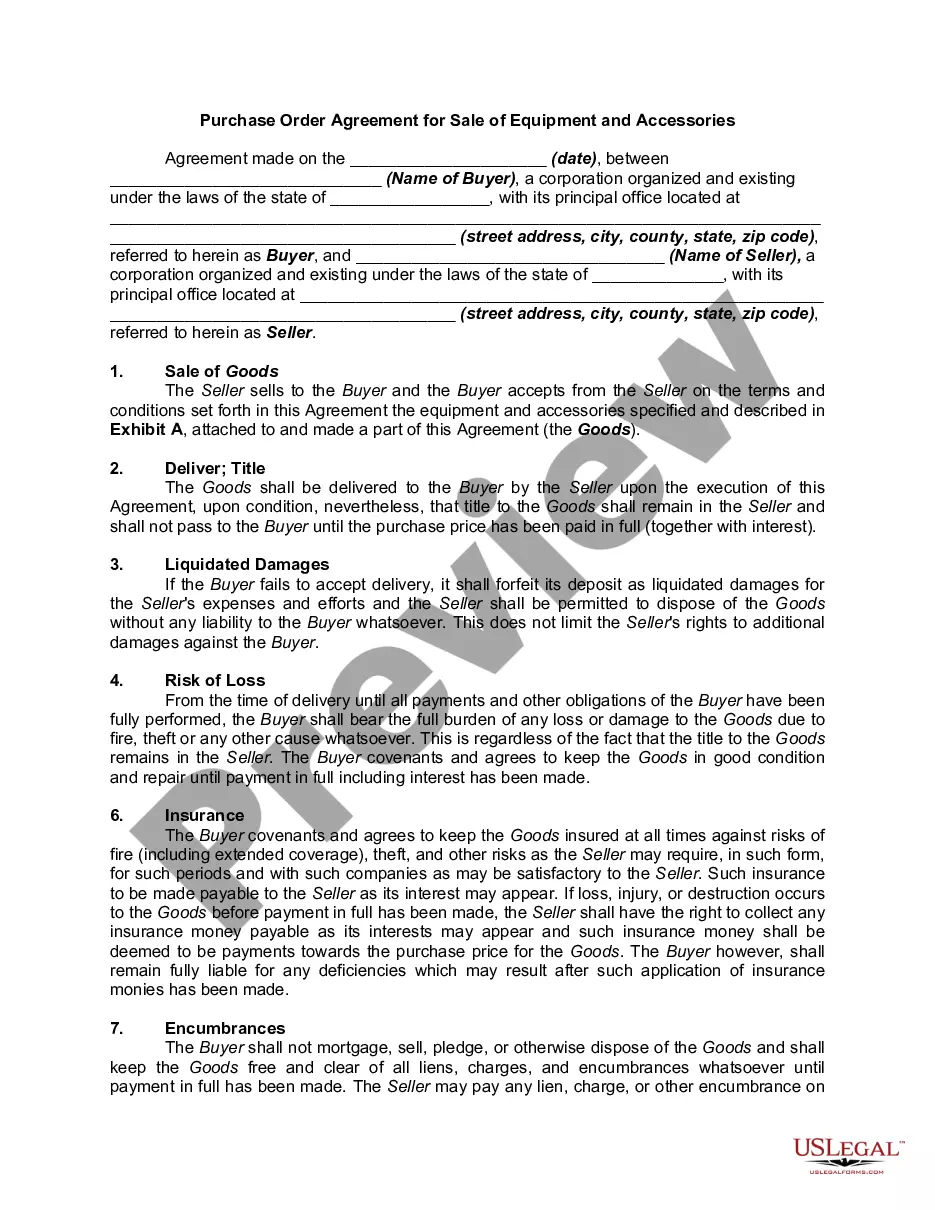

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

4 answers. Artists/event hosts are called and hired as independent contractors, but by legal definition they are not. An independent contractor makes their own schedule and sets the pay for the job.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

employed person is not entitled to unemployment benefits. What court cases have said: The fact that both the employer and the employee state that there is an independent contractor relationship, or the fact that there is actually a written contract, is not binding.