Michigan Telephone Systems Service Contract - Self-Employed

Description

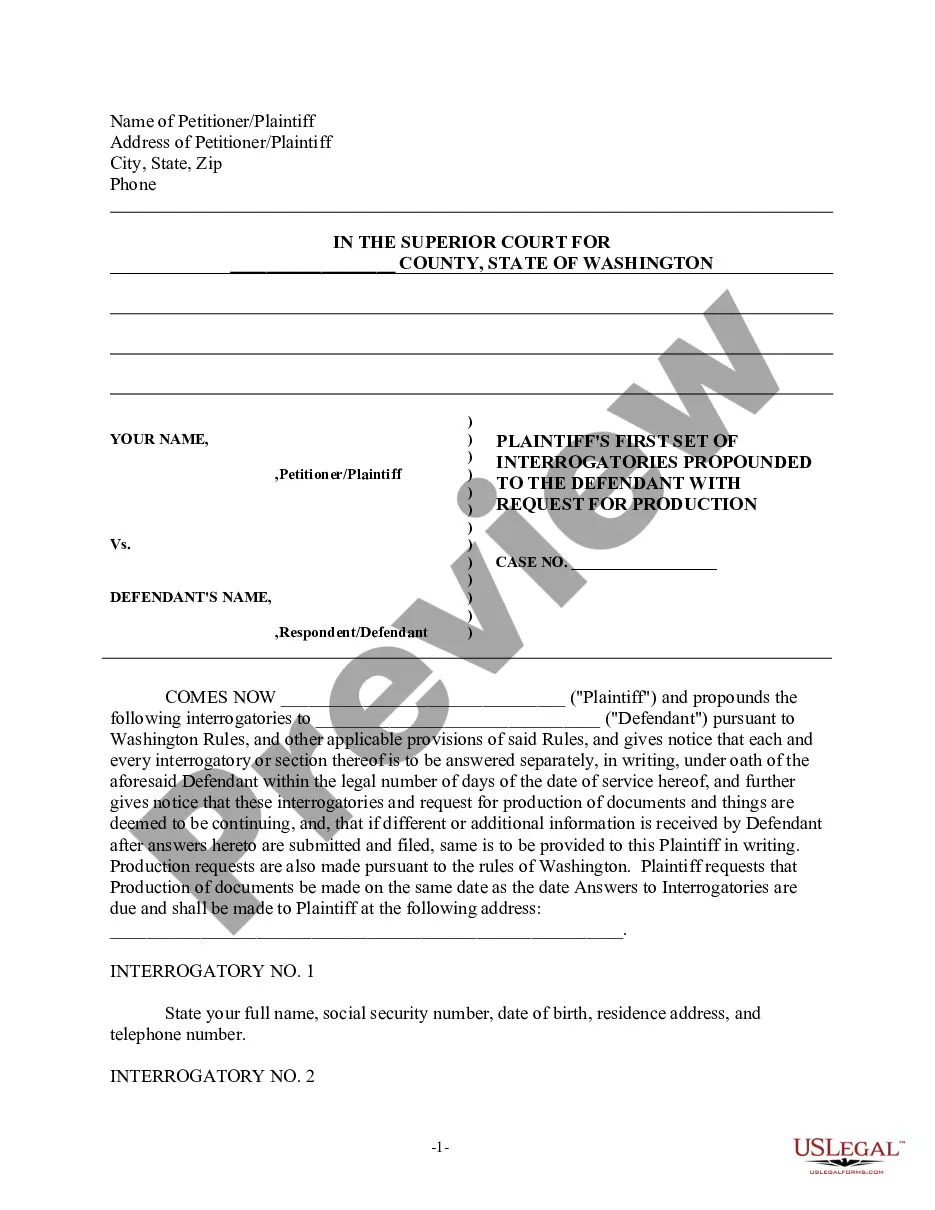

How to fill out Michigan Telephone Systems Service Contract - Self-Employed?

If you wish to total, down load, or printing lawful record templates, use US Legal Forms, the most important variety of lawful forms, which can be found online. Make use of the site`s basic and practical search to find the documents you need. Various templates for organization and person uses are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Michigan Telephone Systems Service Contract - Self-Employed in just a number of clicks.

If you are already a US Legal Forms client, log in to your accounts and then click the Download switch to get the Michigan Telephone Systems Service Contract - Self-Employed. You can even access forms you formerly downloaded in the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for your appropriate town/land.

- Step 2. Utilize the Review option to look through the form`s information. Do not neglect to see the explanation.

- Step 3. If you are unhappy together with the kind, utilize the Search area near the top of the screen to discover other versions of your lawful kind template.

- Step 4. Upon having found the form you need, go through the Purchase now switch. Choose the costs program you choose and add your references to register for an accounts.

- Step 5. Approach the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Find the formatting of your lawful kind and down load it on your device.

- Step 7. Complete, change and printing or sign the Michigan Telephone Systems Service Contract - Self-Employed.

Each lawful record template you purchase is your own property eternally. You possess acces to each and every kind you downloaded with your acccount. Click on the My Forms area and choose a kind to printing or down load once more.

Remain competitive and down load, and printing the Michigan Telephone Systems Service Contract - Self-Employed with US Legal Forms. There are many specialist and express-particular forms you may use to your organization or person demands.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

A 'self-employed contractor' is a person who is genuinely in business for themselves (ie s/he takes responsibility for the success or failure of the business) and is neither an employee nor a worker.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Is Self-Employment? A self-employed person does not work for a specific employer who pays them a consistent salary or wage. Self-employed individuals, or independent contractors, earn income by contracting with a trade or business directly.

By definition, a contractor is an individual who works for someone else (individual or company) as a non-employee. It's also a way of being self-employed. However, while a contractor may be self-employed, a self-employed person might not be an independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.