Michigan Self-Employed Wait Staff Services Contract

Description

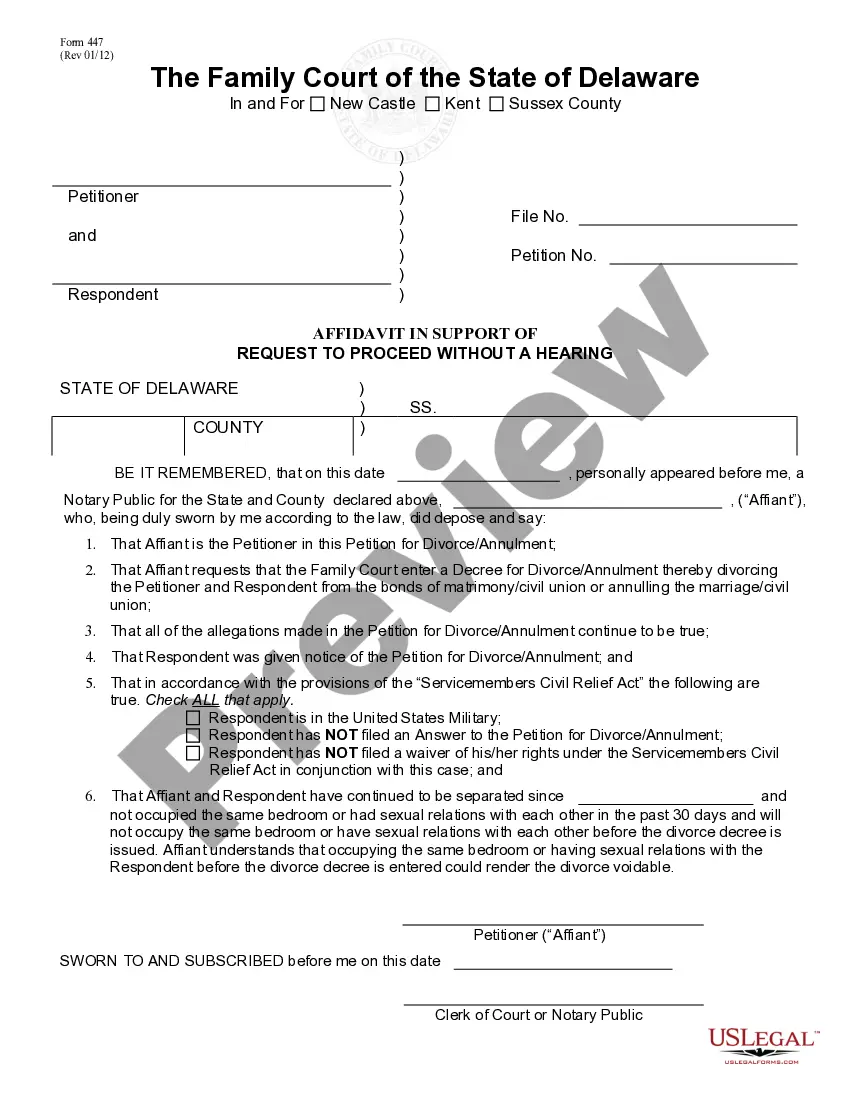

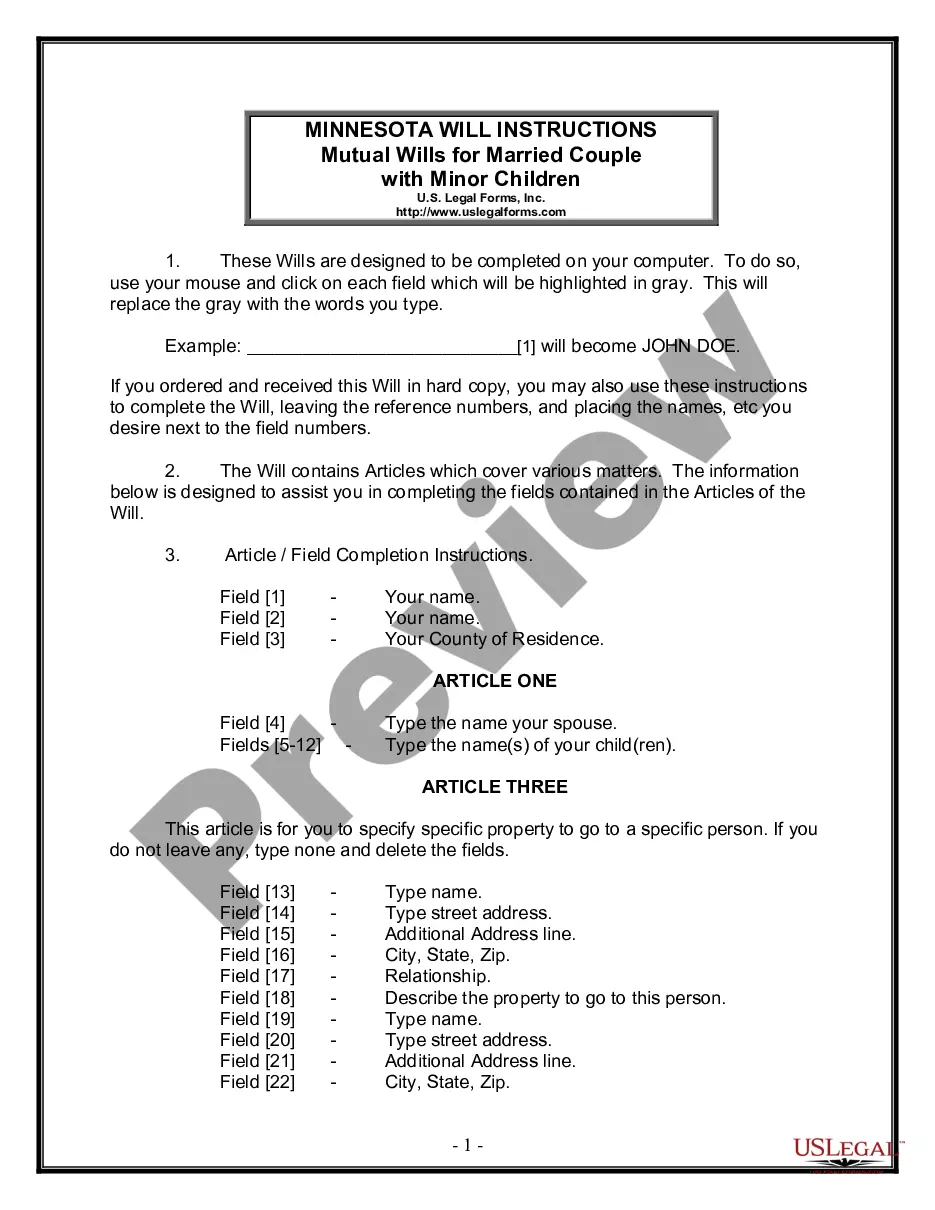

How to fill out Michigan Self-Employed Wait Staff Services Contract?

Choosing the best legal document format might be a struggle. Obviously, there are tons of layouts available on the Internet, but how can you get the legal develop you need? Utilize the US Legal Forms website. The service provides thousands of layouts, like the Michigan Self-Employed Wait Staff Services Contract, that can be used for enterprise and personal needs. Every one of the forms are examined by professionals and meet state and federal requirements.

In case you are currently authorized, log in in your bank account and click the Download option to obtain the Michigan Self-Employed Wait Staff Services Contract. Make use of bank account to look from the legal forms you might have purchased previously. Go to the My Forms tab of your bank account and obtain one more copy of the document you need.

In case you are a fresh customer of US Legal Forms, here are basic recommendations that you should comply with:

- Very first, make certain you have chosen the appropriate develop for the city/state. You may check out the shape making use of the Review option and look at the shape explanation to make certain this is the best for you.

- If the develop does not meet your requirements, make use of the Seach field to find the right develop.

- Once you are sure that the shape is suitable, click on the Purchase now option to obtain the develop.

- Select the rates strategy you would like and type in the required details. Build your bank account and buy an order making use of your PayPal bank account or credit card.

- Choose the data file file format and acquire the legal document format in your product.

- Full, change and produce and signal the attained Michigan Self-Employed Wait Staff Services Contract.

US Legal Forms may be the biggest collection of legal forms that you can find different document layouts. Utilize the company to acquire skillfully-manufactured paperwork that comply with express requirements.

Form popularity

FAQ

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A Restraint of Trade clause can never be inserted in a true Independent Contractor agreement - it is quite simply unenforceable. You cannot restrain your plumber or painter or electrician from taking on other work, or from the painting the buildings of companies in opposition to you.

Since they're not deemed employees, you don't pay them wages or a salary. Instead, you pay the 1099 worker according to the agreement you strike with them. In addition, you don't have to worry about withholding income taxes, withholding and paying Social Security and Medicare taxes, or paying unemployment taxes.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

Recently, one client inquired, Can my assistant be an independent contractor? The short answer is NO. Under current law, there are no circumstances under which someone who is an assistant should be classified as an independent contractor.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

An individual who performs services for remuneration under an exclusive contract that provides for the individual's control and direction by a person, firm, or corporation possessing a public service permit or by a certificated motor carrier transporting goods or property for hire is presumed to be covered by the

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

A tax form called a 1099 is used when a business-owner pays another business (a Virtual Assistant, for example) for services totaling more than $600 in a calendar year. A business owner is required to send that business a 1099 at the end of the year.