Michigan Gift Deed of Mineral Interest with No Warranty

Description

How to fill out Gift Deed Of Mineral Interest With No Warranty?

Are you inside a place where you need to have files for both company or person uses nearly every day? There are plenty of legitimate file layouts available on the net, but getting ones you can trust is not effortless. US Legal Forms gives a large number of kind layouts, much like the Michigan Gift Deed of Mineral Interest with No Warranty, which can be published to satisfy state and federal needs.

If you are previously informed about US Legal Forms site and have an account, basically log in. Following that, you can obtain the Michigan Gift Deed of Mineral Interest with No Warranty web template.

If you do not provide an profile and need to begin using US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is for that proper metropolis/area.

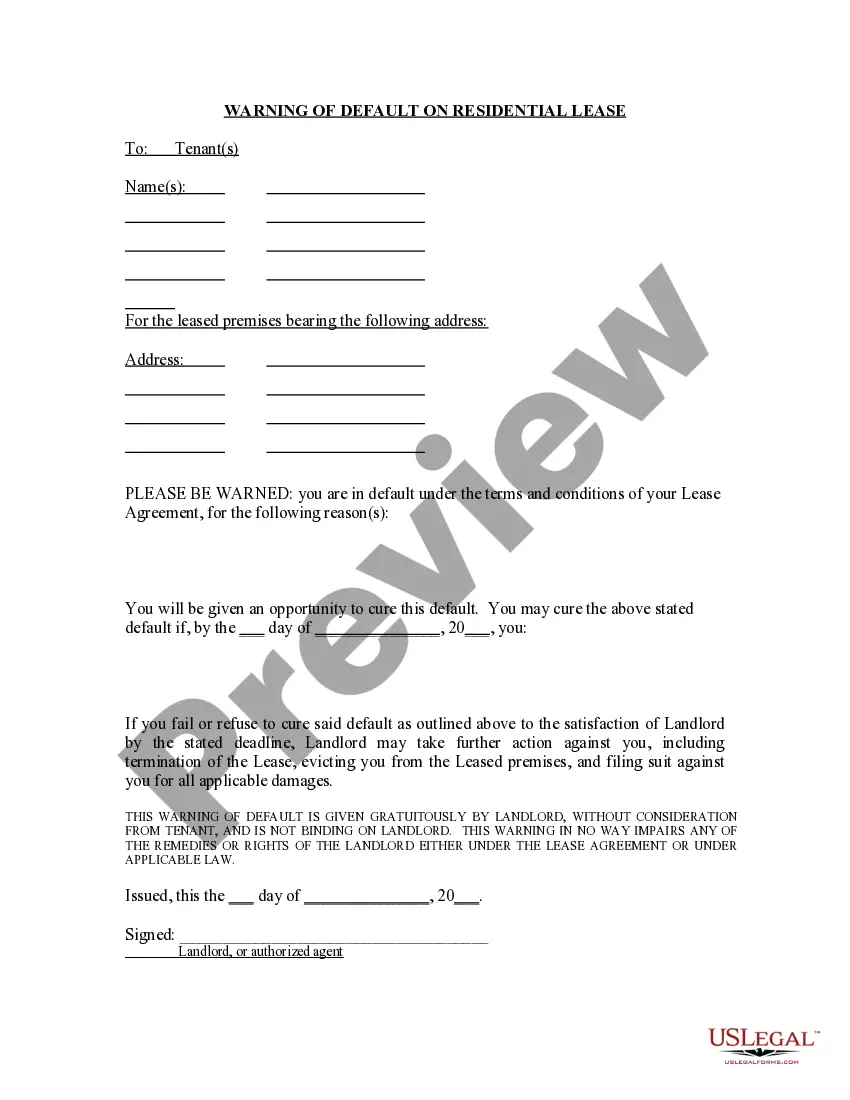

- Use the Review option to examine the form.

- Look at the information to actually have chosen the appropriate kind.

- When the kind is not what you are looking for, make use of the Lookup area to find the kind that meets your requirements and needs.

- Once you obtain the proper kind, click Purchase now.

- Opt for the costs strategy you desire, fill out the desired info to make your bank account, and pay for the transaction utilizing your PayPal or bank card.

- Pick a hassle-free document formatting and obtain your copy.

Find each of the file layouts you have bought in the My Forms food list. You may get a additional copy of Michigan Gift Deed of Mineral Interest with No Warranty whenever, if needed. Just select the needed kind to obtain or print the file web template.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save lots of efforts and prevent faults. The support gives appropriately manufactured legitimate file layouts that can be used for a variety of uses. Make an account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Quitclaim Deed A deed used to transfer any interest in real property that the grantor may have. It contains no warranties of any kind.

How do I add someone to my deed? We recommend that you consult an attorney or real estate professional for assistance in preparing the proper document that will convey the type of interest you want a particular person or entity to have in your property.

Quitclaim Deed This type of deed conveys whatever interest the grantor currently has in the property?if any. No warranties or promises regarding the quality of the title are made. If the grantor has a good title, the quitclaim deed is essentially as effective as a general warranty deed.

How to Create a Michigan Warranty Deed Form The parties' names; An accurate legal description of the property; A statement of consideration; and. The co-ownership form the new owners will use to hold title (if there are multiple new owners).

The completed document will include the purchase price that was paid to the grantor, a description of the property, the contact information for the grantor and grantee, the grantor's signature, and a notary acknowledgment.

The grantor is the owner transferring the real estate, while the grantee is the individual or organization receiving the property. In Michigan, a deed must be signed by the grantor, notarized, and recorded to the Register of Deeds for the property transfer to be considered valid and effective.

RECORDING REQUIREMENTS Documents must be on white paper with black ink and have a 10-point minimum type size. The title or type of document must be identified on the first line of print. The property tax identification number and the commonly known address of the property should be on the document.