A Michigan Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer is a legal document that allows the transfer of mineral rights from one party to another, with the granter reserving certain executive rights related to the conveyed interest. This type of deed is specifically used in Michigan and is important for individuals involved in mining operations or those who own land containing valuable minerals. The Michigan Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer provides a detailed description of the transaction, including the parties involved — the grantor (current owner) and the grantee (the new owner). The deed outlines the terms and conditions under which the mineral rights are being transferred. One of the key elements is the granter's reservation of executive rights in the interest conveyed. This means that while the grantee acquires the rights to the minerals on the specified property, the granter retains certain executive rights such as the authority to lease, sell, or otherwise exploit the minerals. These reserved executive rights ensure that the granter maintains control and involvement in any mining or extraction activities related to the conveyed interest. Several types of Michigan Mineral Deeds with Granter Reserving Executive Rights in the Interest Conveyed — Transfer can exist depending on the specific circumstances and intentions of the parties involved. These may include: 1. Full Mineral Deed with Granter Reserving Executive Rights: This type of deed transfers the complete ownership of mineral rights to the grantee, while the granter retains the executive rights in the conveyed interest. 2. Partial Mineral Deed with Granter Reserving Executive Rights: In this case, only a portion of the mineral rights is transferred to the grantee, while the granter reserves the executive rights in the conveyed interest. 3. Temporary Mineral Deed with Granter Reserving Executive Rights: This deed allows the transfer of mineral rights for a limited period, after which the ownership reverts to the granter, who retains the executive rights throughout the term of the conveyance. 4. Non-Exclusive Mineral Deed with Granter Reserving Executive Rights: This type of deed does not provide an exclusive arrangement, allowing the granter to transfer the same mineral rights to other parties while retaining the executive rights. It is crucial to consult with a qualified attorney or legal professional specializing in mineral rights before executing any Michigan Mineral Deed with Granter Reserving Executive Rights in the Interest Conveyed — Transfer. Understanding the specific type of deed required and the implications of reserving executive rights is essential to protect the interests of all parties involved in the transfer of mineral rights.

Michigan Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

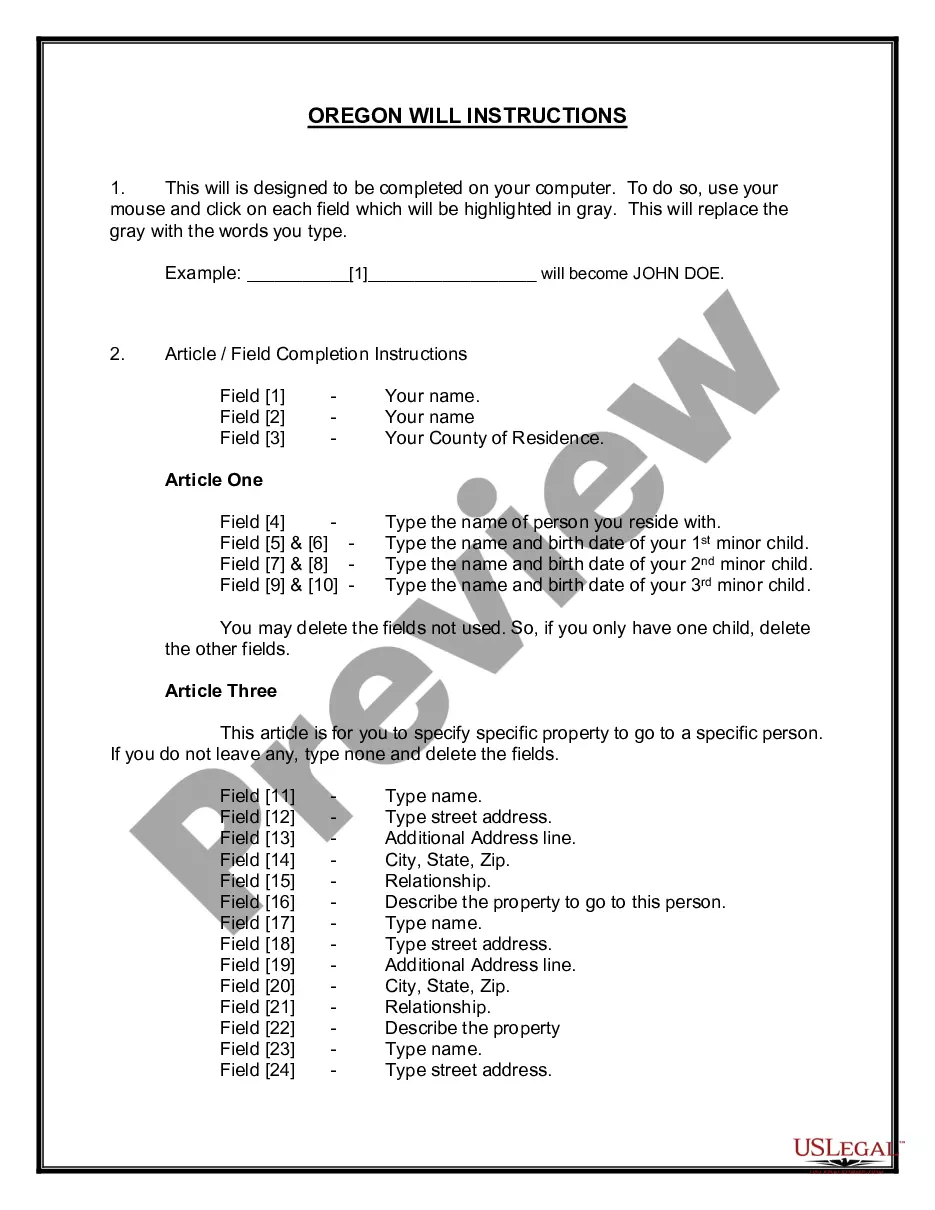

How to fill out Michigan Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

If you have to full, obtain, or print authorized record templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on-line. Use the site`s simple and practical research to get the documents you require. Various templates for organization and personal functions are categorized by classes and states, or key phrases. Use US Legal Forms to get the Michigan Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer in just a few clicks.

In case you are previously a US Legal Forms customer, log in in your account and click on the Down load key to obtain the Michigan Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. You may also accessibility forms you previously delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for the correct city/nation.

- Step 2. Utilize the Review method to look through the form`s information. Do not forget about to read through the information.

- Step 3. In case you are unsatisfied with all the form, make use of the Search industry near the top of the monitor to locate other versions of the authorized form template.

- Step 4. Once you have identified the shape you require, click the Get now key. Opt for the prices prepare you favor and add your accreditations to sign up for an account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Find the format of the authorized form and obtain it on your system.

- Step 7. Total, change and print or indication the Michigan Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Each and every authorized record template you purchase is yours permanently. You may have acces to each form you delivered electronically within your acccount. Go through the My Forms portion and choose a form to print or obtain yet again.

Compete and obtain, and print the Michigan Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer with US Legal Forms. There are millions of expert and status-particular forms you can use for the organization or personal requirements.

Form popularity

FAQ

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

People sell their mineral rights for a variety of reasons. Some need immediate cash, while others are seeking to improve the quality of their lives. Most want to sell while their minerals still have value and to avoid burdening their heirs with the learning curve and management duties.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

What are Outstanding and Reserved mineral rights? Outstanding mineral rights are owned by a party other than the surface owner at the time the surface was conveyed to the United States. Reserved mineral rights are those rights held by the surface owner at the time the surface was conveyed to the United States.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

As the landowner, you own both your land and the minerals beneath your land. Therefore you have the right to negotiate an acceptable lease or to refuse an offer, unless the mineral rights were severed from the surface rights by a previous owner and were never purchased by you.