The Michigan Release of Oil and Gas Lease by Present Lessee is a legal document that outlines the termination and relinquishment of an existing oil and gas lease in the state of Michigan. This release is commonly executed when the current lessee no longer wishes to continue operating under the terms of the lease agreement. Keywords: Michigan, Release of Oil and Gas Lease, Present Lessee, termination, relinquishment, existing lease agreement. Different Types of Michigan Release of Oil and Gas Lease by Present Lessee: 1. Voluntary Release: This type of release occurs when the current lessee willingly decides to terminate the lease agreement before its scheduled expiration date. This release is typically initiated by the lessee and requires mutual agreement and consent from all involved parties. 2. Mutual Release: A mutual release of oil and gas lease is executed when both the present lessee and the lessor mutually agree to terminate the lease agreement. Both parties relinquish their rights and obligations, releasing each other from any further liabilities or claims. 3. Forced Release: In some circumstances, a release of oil and gas lease by the present lessee may be initiated by external factors or legal reasons. This could include instances where environmental issues arise, financial difficulties occur, or any breach of contract by either party is identified. 4. Partial Release: In certain situations, a lessee may seek to release only a portion of the leased land, while retaining the rights to the remaining area. This partial release allows for the lessee to focus on specific areas of interest or concerns. 5. Temporary Release: Temporary releases of oil and gas leases can be executed when there is a need to suspend operations for a specific period. This could be due to seasonal restrictions, lack of resources, or any other valid reason. Once the designated time period expires, the lease agreement may resume or be terminated permanently. It is essential to consult with legal professionals or industry experts familiar with the specific laws and regulations in Michigan when drafting or executing a Release of Oil and Gas Lease by Present Lessee.

Michigan Release of Oil and Gas Lease by Present Lessee

Description

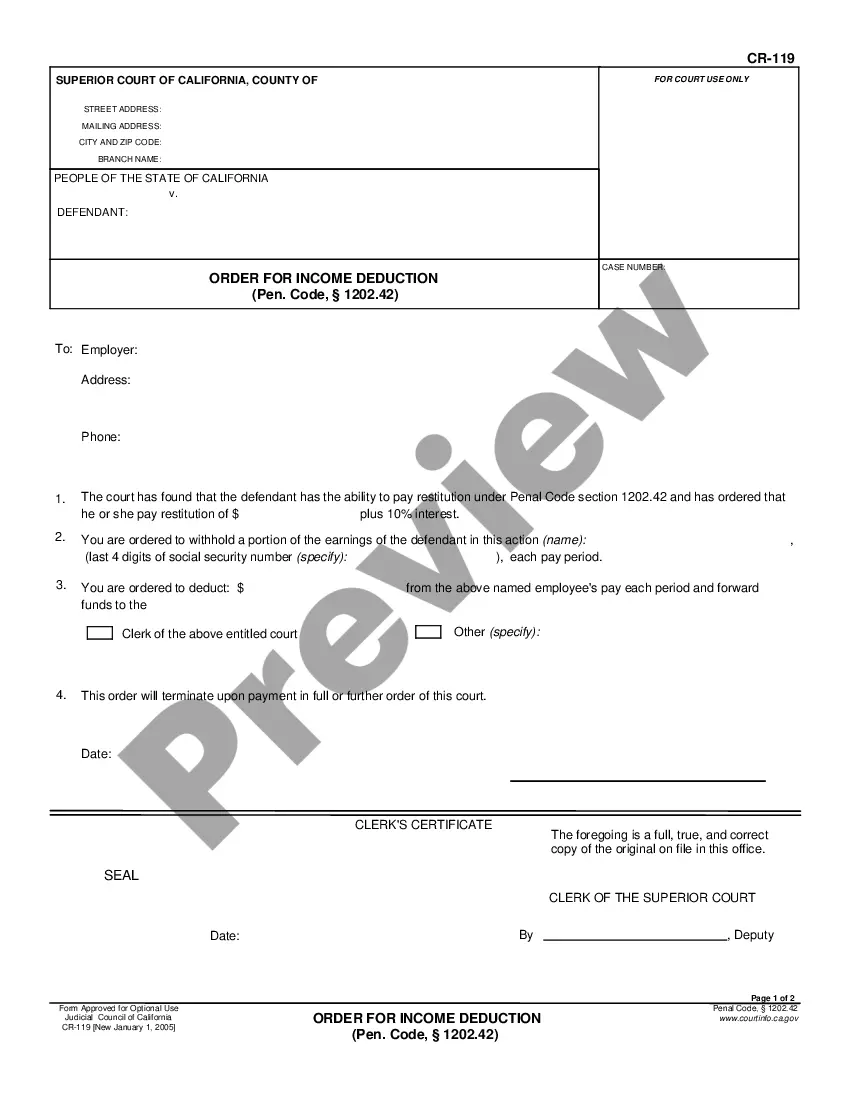

How to fill out Michigan Release Of Oil And Gas Lease By Present Lessee?

Are you presently within a placement where you need papers for both company or personal reasons virtually every day? There are a lot of legal document templates accessible on the Internet, but locating ones you can rely on is not easy. US Legal Forms gives thousands of kind templates, much like the Michigan Release of Oil and Gas Lease by Present Lessee, which are written to meet federal and state specifications.

Should you be presently acquainted with US Legal Forms site and have a merchant account, just log in. After that, it is possible to download the Michigan Release of Oil and Gas Lease by Present Lessee format.

Unless you have an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is to the proper area/county.

- Utilize the Review button to check the form.

- Look at the description to ensure that you have selected the proper kind.

- In case the kind is not what you are seeking, take advantage of the Research field to find the kind that meets your requirements and specifications.

- When you find the proper kind, click on Purchase now.

- Select the rates program you desire, fill in the necessary details to produce your bank account, and buy an order making use of your PayPal or Visa or Mastercard.

- Choose a handy file formatting and download your duplicate.

Discover all the document templates you possess bought in the My Forms menu. You may get a more duplicate of Michigan Release of Oil and Gas Lease by Present Lessee whenever, if required. Just select the required kind to download or produce the document format.

Use US Legal Forms, the most extensive collection of legal kinds, to save lots of time as well as stay away from mistakes. The assistance gives appropriately created legal document templates which can be used for a range of reasons. Generate a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Royalty Income Tax Rates Oil & gas mineral royalties are treated as ordinary income and are taxed at your marginal (highest) tax rate. The income is in addition to your hard earned pay checks, so prepare to pay a larger percentage than you pay out of your monthly salary.

To report royalty income, you will have fill in Schedule E as well as your Form 1040. If you have received income from royalties, use Form 1099-MISC at the end of the year. Report all other payments you receive as well. This includes rent payments for your lease and bonuses you received as part of the agreement.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Here is how to enter this in TurboTax: Login and continue your return. Select Federal from the left side menu. On the Income & Expenses summary, look for Rental Properties and Royalties (Sch E), click Edit/ Add to the right. Answer the first question Yes. Add or Edit your Royalty property.

Taxpayers who own land that contains valuable natural resources should be aware that arranging for the development of the resources by means of a lease creates tax consequences. So to answer the landowners who ask ?are oil and gas royalties taxable?? the answer yes, they are taxable.

A surrender clause is a part of an oil and gas lease that allows the person leasing the land to give up their rights to some or all of the land they are leasing. This means they can stop using that land and won't have to do anything else related to it.

RELEASE: releases of property rights and/or other legal rights that the owner would otherwise be entitled to under law. RELEASE LEASE: releases of oil & gas lease rights that a person would otherwise be entitled to under law.

Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.