Michigan Affidavit of Heirship for Small Estates

Description

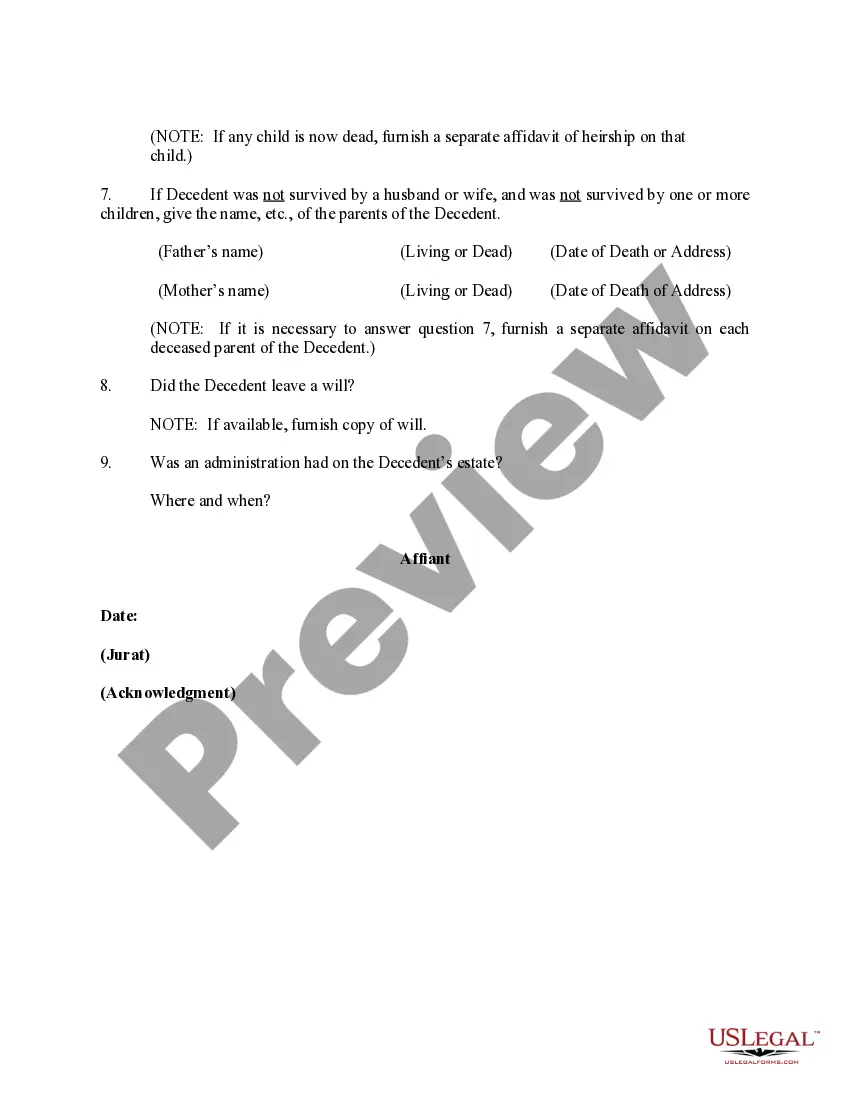

How to fill out Affidavit Of Heirship For Small Estates?

Choosing the best lawful record template could be a struggle. Naturally, there are tons of themes available online, but how will you obtain the lawful develop you will need? Utilize the US Legal Forms site. The assistance gives thousands of themes, for example the Michigan Affidavit of Heirship for Small Estates, that can be used for organization and private requires. All the forms are inspected by experts and meet state and federal needs.

Should you be currently registered, log in to the accounts and click the Download key to get the Michigan Affidavit of Heirship for Small Estates. Make use of your accounts to look from the lawful forms you might have purchased previously. Proceed to the My Forms tab of your accounts and have an additional backup of the record you will need.

Should you be a brand new user of US Legal Forms, listed here are easy instructions that you should adhere to:

- Very first, be sure you have selected the right develop for your city/region. You may examine the shape utilizing the Review key and read the shape explanation to ensure it will be the best for you.

- If the develop is not going to meet your requirements, utilize the Seach field to discover the proper develop.

- Once you are positive that the shape is proper, click the Acquire now key to get the develop.

- Opt for the pricing plan you want and type in the needed information and facts. Build your accounts and pay for the order making use of your PayPal accounts or Visa or Mastercard.

- Select the document structure and down load the lawful record template to the product.

- Full, edit and printing and signal the acquired Michigan Affidavit of Heirship for Small Estates.

US Legal Forms is the most significant library of lawful forms that you will find different record themes. Utilize the company to down load appropriately-manufactured files that adhere to condition needs.

Form popularity

FAQ

What Are Michigan's Requirements For The Small Estate Affidavit? As part of the affidavit, the person filling out the paperwork, known as ?the affiant,? must provide certain information, including the deceased person's personal information, date of death, and a list of the deceased's property and debts.

The dollar limit can change each year. If a person dies in 2023, an estate must be valued at $27,000 or less to be small. If a person died in 2022, an estate must be valued at $25,000 or less. If a person died in 2020 or 2021, an estate must be valued at $24,000 or less.

A claim is barred if proper notice is given and the claim is not presented in a timely fashion. If the notice requirements have not been met, a claim is barred 3 years after the decedent's death.

To use this process, all of the following must be true about the estate: It does not include real property. It has a value less than or equal to the limits for a small estate ($27,000 for decedents who died in 2023) There is not an application for a personal representative filed or granted.

The law doesn't require all heirs to agree, although the process is complex and usually requires the help of an attorney.

Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

Michigan law (MCL 700.3982) allows small estates to be probated using an expedited process if the balance of the gross estate after payment of the decedent's funeral and burial expenses is $15,000 or less.