The Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option is a legal document that outlines the transfer of ownership from the assignor to the assignee, regarding a particular overriding royalty interest in an oil, gas, or mineral lease in the state of Michigan. This agreement provides the assignee with the option to convert the assigned overriding royalty interest into a working interest, making them an active participant in the production and exploration activities. This type of agreement is common in the energy industry as it allows for flexible arrangements in royalty interests. There can be various types of Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest agreements, depending on the specific terms and conditions mentioned within the document. Some common variations include: 1. Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option — Fixed Term: This agreement specifies a fixed period during which the assignee has the option to convert their royalty interest into a working interest. This duration is typically agreed upon by both parties and may vary from lease to lease. 2. Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option — Clean Title: This type of agreement ensures that the assignor possesses a clean and marketable title to the overriding royalty interest being assigned. This provision protects the assignee from any potential legal disputes or claims that may arise in relation to the assigned interest. 3. Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option — Fractional Interest: In this variation, the assignor assigns only a portion or fraction of their overriding royalty interest to the assignee, providing them with proportional benefits and ownership rights. This type of agreement is often beneficial when multiple parties wish to share ownership in a lease. 4. Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option — Percentage-based Conversion: This agreement allows the assignee to convert their assigned overriding royalty interest to a working interest based on a specific percentage. Typically, the assignee has the option to convert a predetermined portion of the assigned interest, providing them with more control over their participation in the lease. In conclusion, the Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option is an essential legal document in the energy industry that provides flexibility regarding ownership rights. The variations mentioned above demonstrate the different terms and conditions that can be included in such agreements to suit the needs and preferences of the parties involved.

Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option

Description

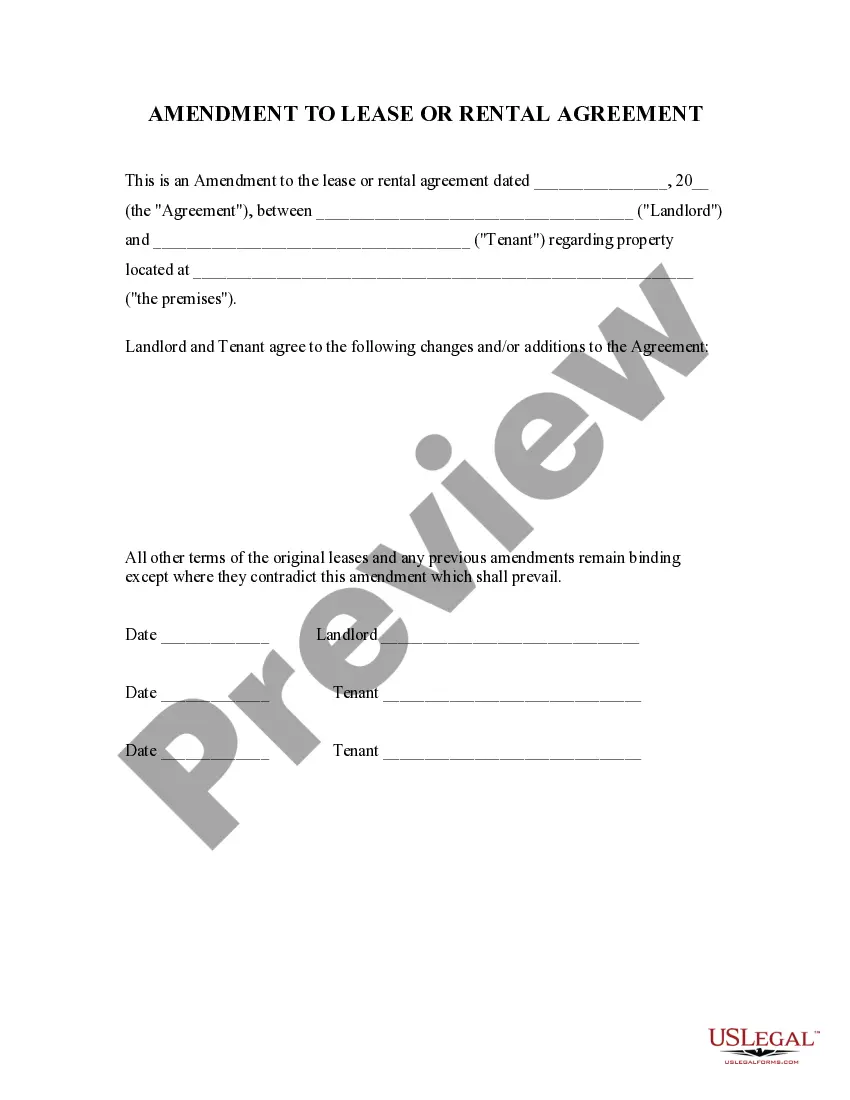

How to fill out Michigan Assignment Of Overriding Royalty Interest Convertible To A Working Interest At Assignee's Option?

If you need to comprehensive, down load, or print authorized record layouts, use US Legal Forms, the most important collection of authorized forms, which can be found on the web. Make use of the site`s simple and easy convenient research to obtain the paperwork you require. Various layouts for enterprise and person uses are sorted by classes and claims, or key phrases. Use US Legal Forms to obtain the Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option in a few clicks.

When you are presently a US Legal Forms consumer, log in for your account and then click the Download key to obtain the Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option. Also you can entry forms you formerly downloaded from the My Forms tab of your account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the form to the proper area/region.

- Step 2. Use the Preview option to look through the form`s content. Do not neglect to see the description.

- Step 3. When you are unhappy together with the form, utilize the Search field at the top of the monitor to locate other types from the authorized form template.

- Step 4. When you have found the form you require, select the Get now key. Select the prices prepare you choose and include your references to sign up on an account.

- Step 5. Method the transaction. You may use your credit card or PayPal account to perform the transaction.

- Step 6. Choose the file format from the authorized form and down load it on your own gadget.

- Step 7. Comprehensive, modify and print or indication the Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option.

Every single authorized record template you get is yours permanently. You have acces to each form you downloaded with your acccount. Click on the My Forms portion and select a form to print or down load once again.

Be competitive and down load, and print the Michigan Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option with US Legal Forms. There are many expert and condition-distinct forms you may use for your personal enterprise or person needs.