Michigan Correction Assignment to Correct Amount of Interest is a legal process that aims to rectify erroneous or inaccurate interest calculations in a financial transaction or debt agreement. When interest calculations in a contract or agreement are incorrect, it can lead to substantial financial implications for both parties involved. The correction assignment is a crucial mechanism to ensure fairness and accuracy in interest calculations in the state of Michigan. This assignment is typically initiated by the party discovering the error, either the creditor or the debtor, and it requires a formal legal procedure to correct the interest amount. It involves the filing of necessary documents with the appropriate court, presenting evidence of the incorrect interest calculation, and providing supporting documentation. The assignment may also require notification to the other party involved, allowing them the opportunity to respond or dispute the correction process. There are various types of Michigan Correction Assignments to Correct Amount of Interest, depending on the nature of the financial transaction or debt agreement. Some common types include: 1. Mortgage Correction Assignment: This type of correction assignment is relevant in cases where the mortgage lender or borrower identifies an error in the interest calculation related to a mortgage loan. It rectifies any mistakes made in determining the interest amount, which could impact monthly payments or the overall term of the loan. 2. Credit Card Correction Assignment: Credit card transactions often involve the application of interest rates to outstanding balances. In cases where errors are discovered in the interest calculation, a correction assignment can be initiated to rectify the inaccuracies and adjust the credit card balance accordingly. 3. Personal Loan Correction Assignment: When individuals borrow money through personal loans, interest is typically charged on the principal amount. Errors in the calculation of interest on personal loans can significantly impact the repayment amount and duration. The correction assignment process seeks to correct these errors and ensure fair treatment for both the borrower and the lender. 4. Business Loan Correction Assignment: Similar to personal loans, business loans also involve interest calculations based on the principal amount borrowed. If errors are identified in the interest calculation, a correction assignment can be pursued to rectify the inaccuracies, ensuring accurate interest charges and repayments. In summary, Michigan Correction Assignment to Correct Amount of Interest is a legal process designed to remedy errors in interest calculations. It is essential for ensuring fair and accurate financial transactions and debt agreements. The assignment process varies depending on the type of financial transaction involved, such as mortgage loans, credit card balances, personal loans, or business loans.

Michigan Correction Assignment to Correct Amount of Interest

Description

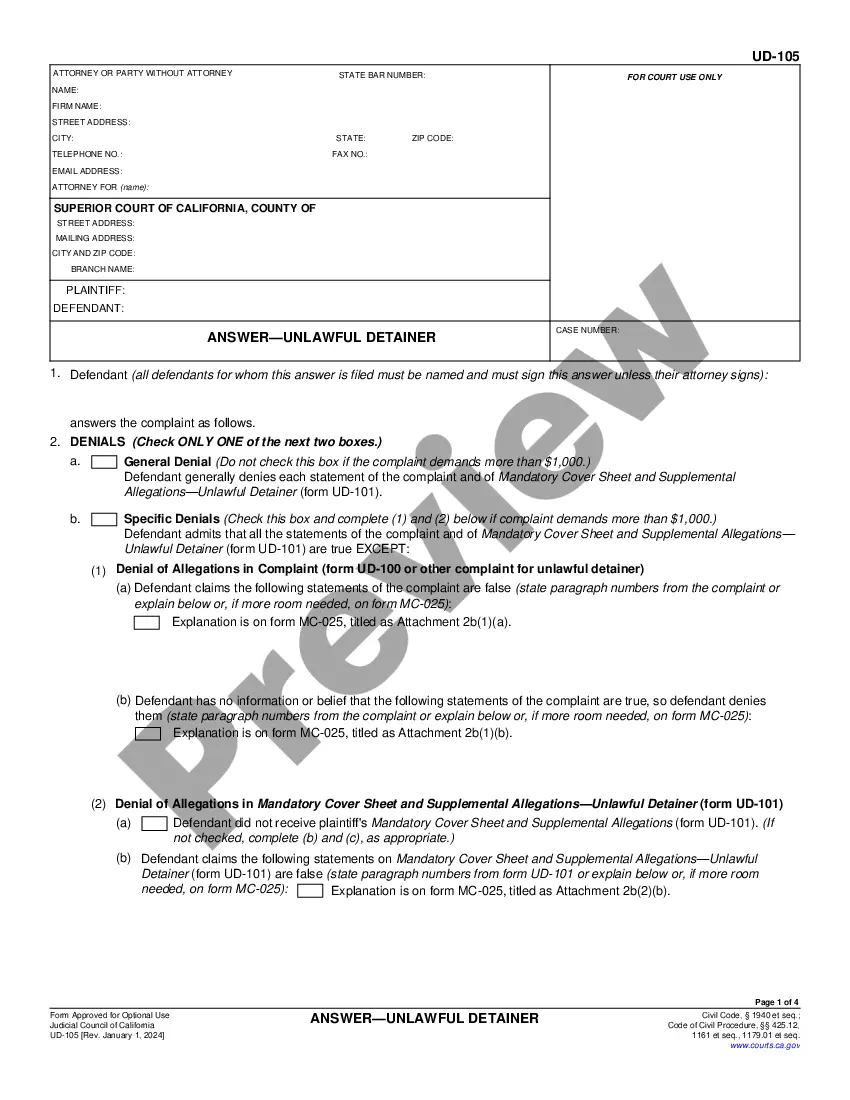

How to fill out Michigan Correction Assignment To Correct Amount Of Interest?

If you want to complete, download, or produce legitimate file layouts, use US Legal Forms, the biggest variety of legitimate types, that can be found on the Internet. Utilize the site`s easy and convenient search to get the papers you require. Different layouts for business and individual purposes are sorted by classes and says, or keywords. Use US Legal Forms to get the Michigan Correction Assignment to Correct Amount of Interest in just a handful of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your bank account and click on the Down load button to have the Michigan Correction Assignment to Correct Amount of Interest. You can even gain access to types you formerly acquired inside the My Forms tab of your own bank account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for the right metropolis/land.

- Step 2. Make use of the Preview method to look over the form`s information. Do not neglect to learn the description.

- Step 3. Should you be not happy using the develop, use the Research industry at the top of the display to discover other models from the legitimate develop web template.

- Step 4. After you have found the form you require, click on the Purchase now button. Pick the costs strategy you choose and put your qualifications to register to have an bank account.

- Step 5. Process the deal. You should use your bank card or PayPal bank account to accomplish the deal.

- Step 6. Select the structure from the legitimate develop and download it on the system.

- Step 7. Comprehensive, modify and produce or indication the Michigan Correction Assignment to Correct Amount of Interest.

Every legitimate file web template you get is yours eternally. You have acces to every single develop you acquired within your acccount. Go through the My Forms section and decide on a develop to produce or download once more.

Contend and download, and produce the Michigan Correction Assignment to Correct Amount of Interest with US Legal Forms. There are thousands of professional and state-specific types you can utilize for the business or individual demands.