Michigan Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

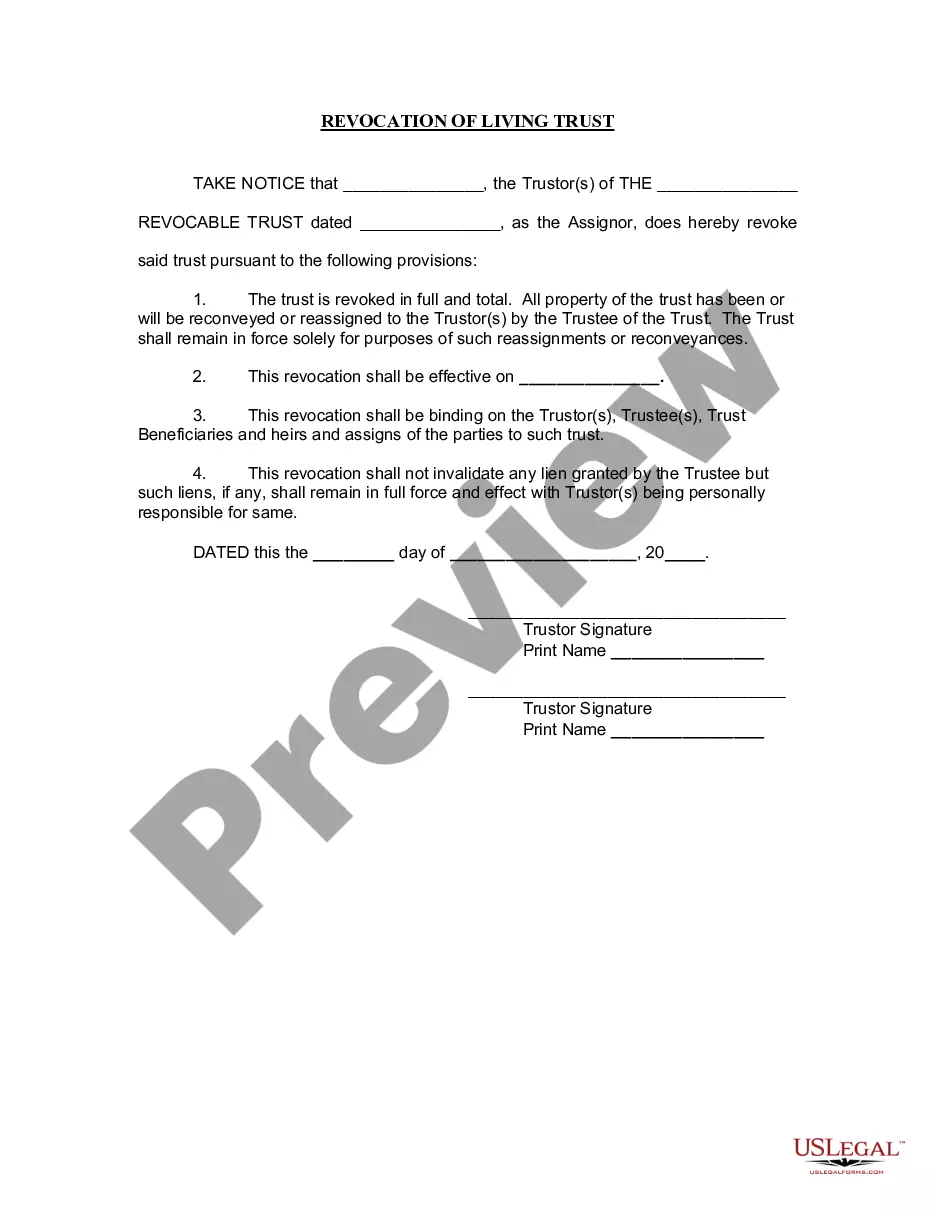

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

US Legal Forms - among the largest libraries of lawful forms in the USA - delivers an array of lawful record templates it is possible to download or produce. Utilizing the web site, you can find a large number of forms for organization and personal uses, categorized by classes, says, or search phrases.You can get the most recent versions of forms such as the Michigan Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest within minutes.

If you have a registration, log in and download Michigan Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest from the US Legal Forms collection. The Acquire switch can look on every kind you perspective. You get access to all formerly saved forms inside the My Forms tab of your profile.

If you would like use US Legal Forms the first time, listed below are straightforward guidelines to help you get began:

- Make sure you have selected the best kind to your city/area. Go through the Preview switch to review the form`s content material. See the kind explanation to ensure that you have selected the right kind.

- If the kind doesn`t suit your requirements, use the Search industry near the top of the display screen to get the one who does.

- If you are pleased with the form, validate your selection by visiting the Buy now switch. Then, select the prices plan you prefer and offer your accreditations to register for the profile.

- Approach the financial transaction. Make use of your credit card or PayPal profile to accomplish the financial transaction.

- Choose the file format and download the form in your system.

- Make alterations. Complete, modify and produce and signal the saved Michigan Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Each and every format you included in your bank account lacks an expiry date and is also your own property eternally. So, in order to download or produce another duplicate, just check out the My Forms portion and click on around the kind you will need.

Gain access to the Michigan Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest with US Legal Forms, the most substantial collection of lawful record templates. Use a large number of professional and express-particular templates that meet your company or personal demands and requirements.

Form popularity

FAQ

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.