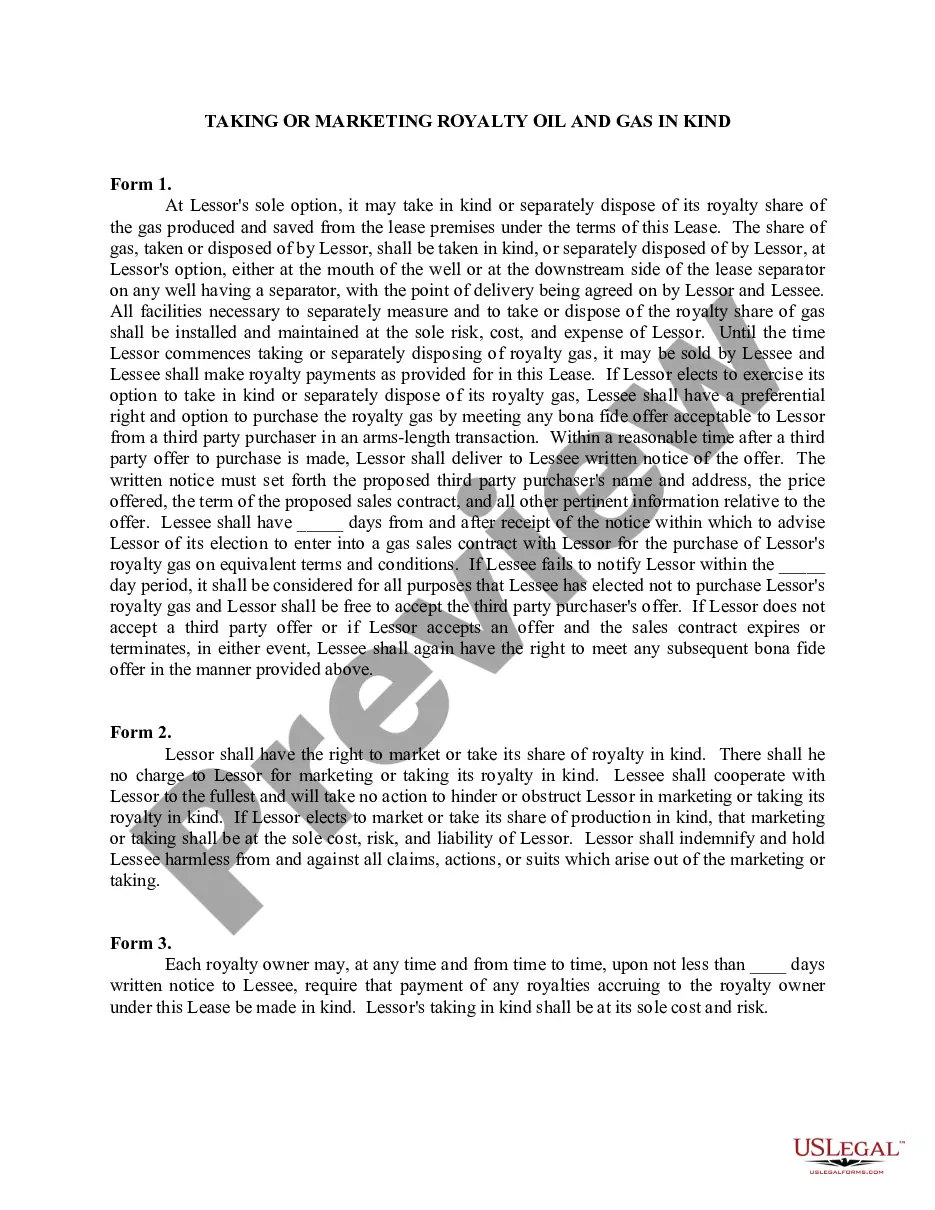

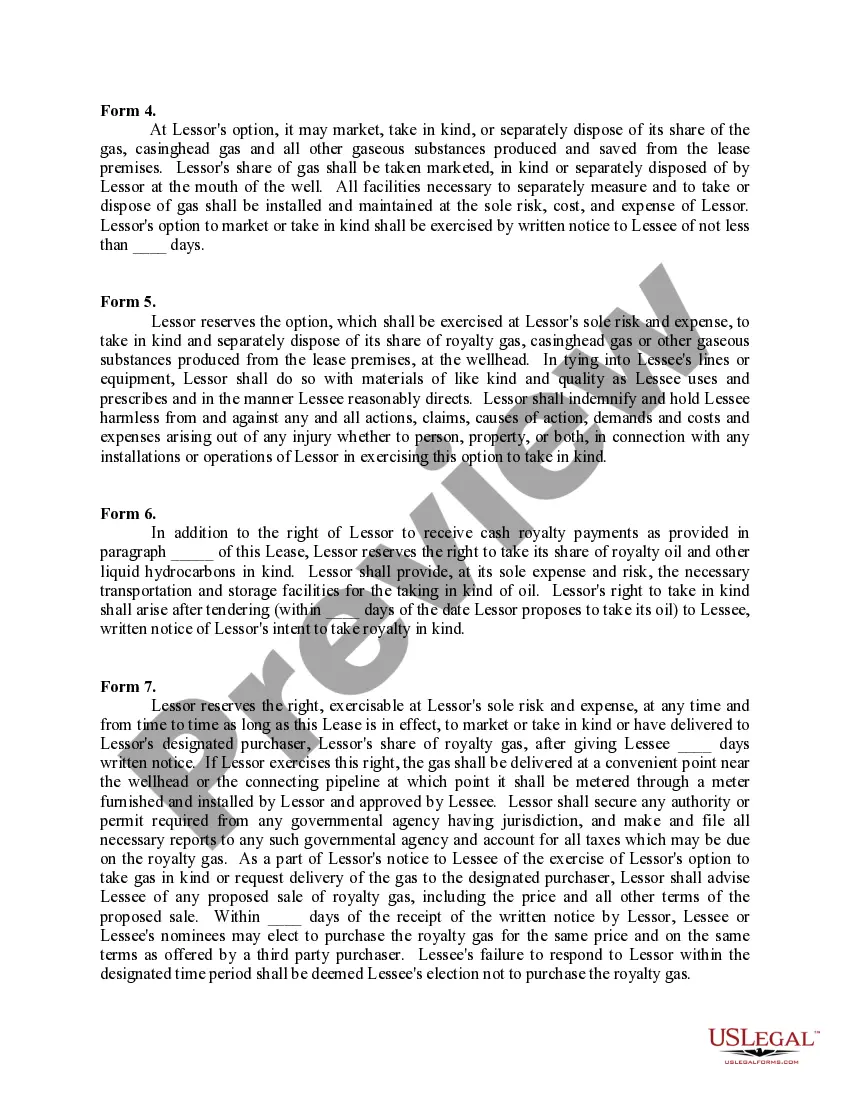

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Michigan Taking Or Marketing Royalty Oil and Gas in Kind

Description

How to fill out Taking Or Marketing Royalty Oil And Gas In Kind?

If you need to total, obtain, or print lawful file layouts, use US Legal Forms, the greatest collection of lawful varieties, that can be found on the Internet. Utilize the site`s basic and handy lookup to obtain the documents you require. Various layouts for business and individual purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to obtain the Michigan Taking Or Marketing Royalty Oil and Gas in Kind in a few clicks.

If you are currently a US Legal Forms customer, log in for your account and then click the Obtain key to obtain the Michigan Taking Or Marketing Royalty Oil and Gas in Kind. Also you can accessibility varieties you formerly delivered electronically in the My Forms tab of your respective account.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for your correct metropolis/region.

- Step 2. Utilize the Preview choice to check out the form`s content. Never forget about to see the information.

- Step 3. If you are unhappy using the develop, take advantage of the Look for discipline on top of the monitor to find other versions in the lawful develop template.

- Step 4. Upon having located the form you require, go through the Get now key. Select the prices strategy you choose and add your qualifications to register to have an account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Select the file format in the lawful develop and obtain it in your product.

- Step 7. Total, revise and print or sign the Michigan Taking Or Marketing Royalty Oil and Gas in Kind.

Each and every lawful file template you get is your own property permanently. You may have acces to every develop you delivered electronically in your acccount. Go through the My Forms area and decide on a develop to print or obtain once again.

Be competitive and obtain, and print the Michigan Taking Or Marketing Royalty Oil and Gas in Kind with US Legal Forms. There are many professional and state-specific varieties you can use for your business or individual requires.

Form popularity

FAQ

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

Percentage Depletion Allowance For oil and gas royalty owners, percentage depletion is calculated using a rate of 15% of the gross income based on your average daily production of crude oil or natural gas, up to your depletable oil or natural gas quantity.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The easiest way to invest for royalty income is by purchasing shares of a royalty trust. These are publicly traded corporations that acquire ownership of rights to leases and deposits of oil, gas and minerals. The income generated from royalties is distributed to shareholders as dividends.