Michigan Assignment of Overriding Royalty Interest (By Owner of Override)

Description

How to fill out Assignment Of Overriding Royalty Interest (By Owner Of Override)?

If you want to complete, acquire, or print legitimate file templates, use US Legal Forms, the greatest selection of legitimate types, that can be found on the web. Take advantage of the site`s basic and handy research to discover the paperwork you need. Numerous templates for enterprise and person uses are sorted by classes and claims, or keywords. Use US Legal Forms to discover the Michigan Assignment of Overriding Royalty Interest (By Owner of Override) with a handful of clicks.

Should you be currently a US Legal Forms customer, log in in your accounts and then click the Acquire switch to find the Michigan Assignment of Overriding Royalty Interest (By Owner of Override). You may also gain access to types you in the past acquired in the My Forms tab of your respective accounts.

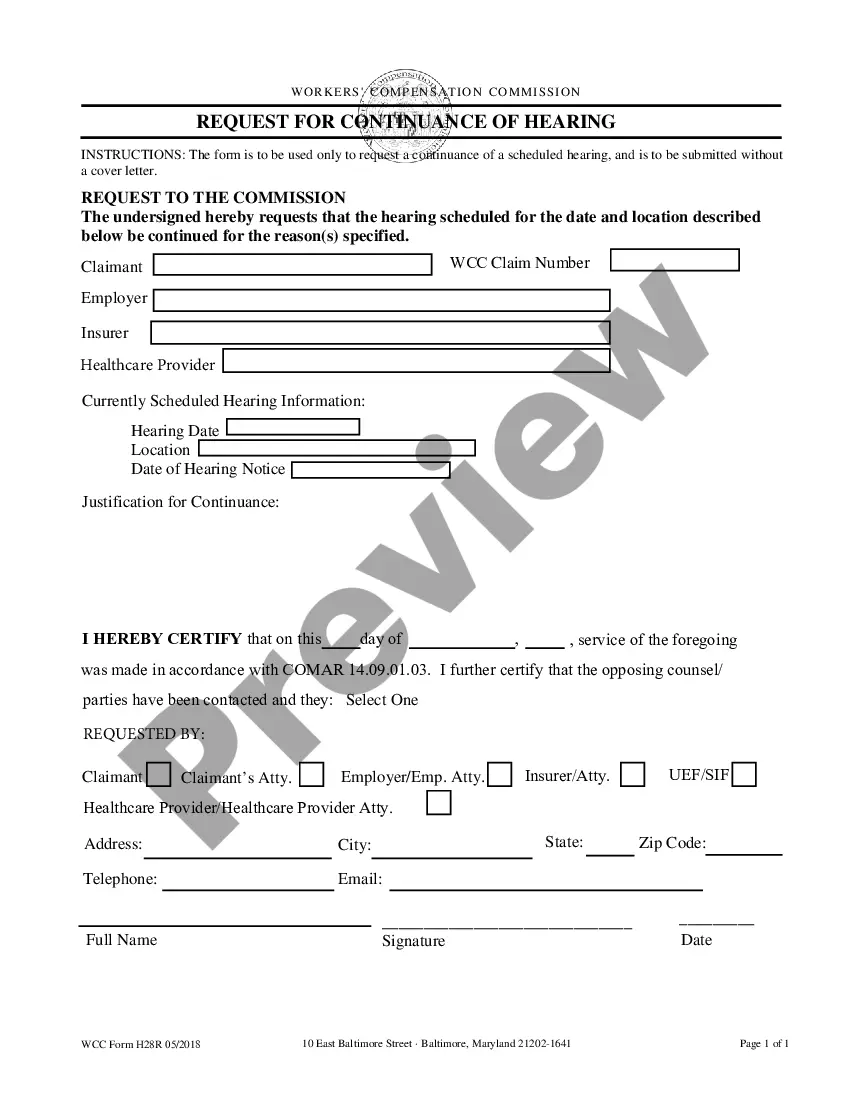

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for the correct city/nation.

- Step 2. Utilize the Preview option to look over the form`s content material. Do not forget about to read the description.

- Step 3. Should you be unhappy with all the type, make use of the Research area towards the top of the screen to find other types from the legitimate type design.

- Step 4. After you have located the shape you need, select the Buy now switch. Select the rates prepare you like and include your credentials to sign up to have an accounts.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the formatting from the legitimate type and acquire it in your product.

- Step 7. Complete, edit and print or indicator the Michigan Assignment of Overriding Royalty Interest (By Owner of Override).

Each and every legitimate file design you purchase is your own property permanently. You have acces to every type you acquired in your acccount. Select the My Forms section and pick a type to print or acquire yet again.

Be competitive and acquire, and print the Michigan Assignment of Overriding Royalty Interest (By Owner of Override) with US Legal Forms. There are thousands of professional and state-particular types you may use to your enterprise or person demands.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

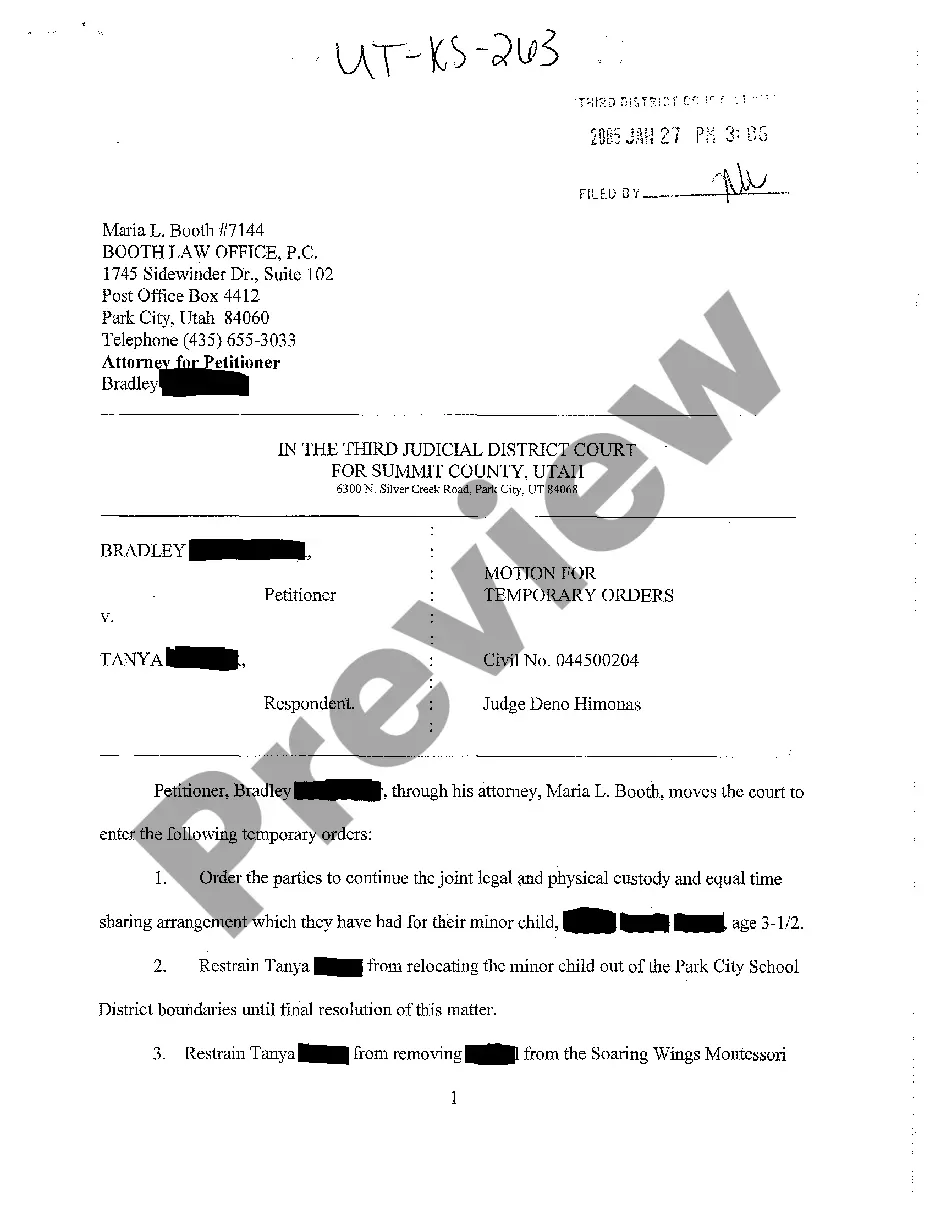

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...