Michigan Employee Agreement Incentive Compensation and Stock Bonus are forms of compensation and rewards offered to employees in Michigan based on their performance and contributions to the company. These incentives are designed to motivate employees to exceed expectations and achieve company goals. Incentive Compensation: Incentive compensation in Michigan refers to additional monetary rewards given to employees based on their performance, productivity, and achievement of specific goals. It serves as a way to incentivize employees to go above and beyond their normal duties and contribute to the overall success of the organization. Incentive compensation programs can take various forms, such as performance bonuses, commissions, profit-sharing, and stock options. Stock Bonus: A stock bonus is a specific type of incentive compensation where employees receive company stock as a reward for their performance or length of service. In Michigan, stock bonuses can be given through various means, such as stock options, restricted stock units (RSS), or Employee Stock Ownership Plans (Sops). These stock bonuses provide employees with an opportunity to share in the company's success and increase their wealth through capital appreciation. Different Types of Michigan Employee Agreement Incentive Compensation and Stock Bonus: 1. Performance-Based Incentive Compensation: This type of incentive compensation in Michigan is directly tied to an employee's performance metrics or achievements. Organizations may set specific targets or goals for employees to reach, and if these goals are met or exceeded, the employee receives a performance-based bonus or stock grant. 2. Profit-Sharing Incentive Compensation: Profit-sharing is a popular method of incentive compensation where a percentage of the company's profits is distributed among employees. This bonus is usually calculated based on a predetermined formula or a pro rata share of the organization's profitability. Profit-sharing can be paid in cash or company stock, depending on the company's policy. 3. Sales Commission Incentive Compensation: Particularly common in sales-driven industries, sales commissions are a form of incentive compensation where employees earn a percentage or fixed amount of money for each sale they generate. Typically, sales commissions are offered to sales representatives or employees who directly contribute to increasing revenue for the company. 4. Stock Options and RSS: Stock options and RSS provide employees with the opportunity to buy or receive company shares at a predetermined price or upon achieving specific performance or service milestones. These options and RSS can incentivize employees to work harder, align their interests with those of the company, and potentially benefit from the growth in the organization's stock value. It is important to note that the specific terms and conditions of Michigan Employee Agreement Incentive Compensation and Stock Bonus may vary between organizations and industries. Companies often outline the details of these incentive programs in formal agreements or contracts, ensuring clarity on eligibility criteria, payment structures, vesting periods, and any other applicable conditions.

Michigan Employee Agreement Incentive Compensation and Stock Bonus

Description

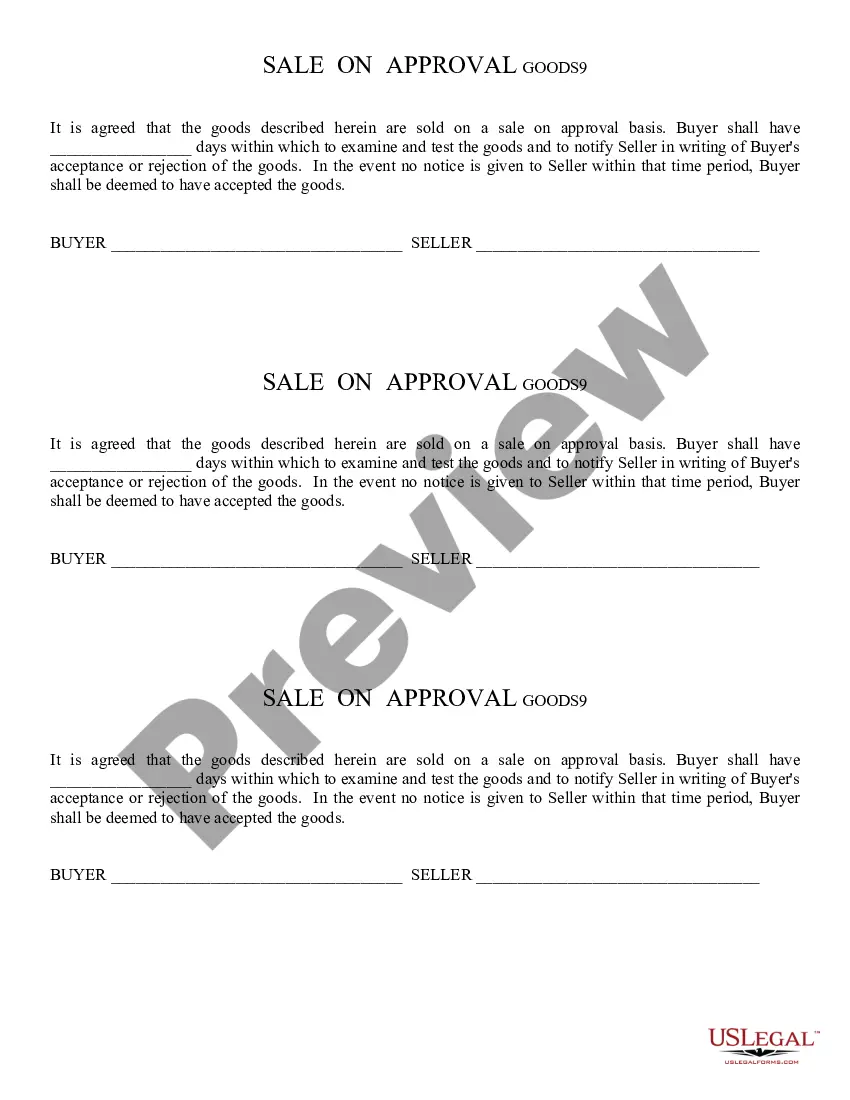

How to fill out Michigan Employee Agreement Incentive Compensation And Stock Bonus?

If you want to total, down load, or print out lawful record themes, use US Legal Forms, the biggest collection of lawful types, which can be found on-line. Use the site`s easy and convenient lookup to find the files you want. Different themes for company and person uses are sorted by types and states, or key phrases. Use US Legal Forms to find the Michigan Employee Agreement Incentive Compensation and Stock Bonus in just a few mouse clicks.

Should you be currently a US Legal Forms client, log in to your bank account and click the Obtain button to have the Michigan Employee Agreement Incentive Compensation and Stock Bonus. You may also entry types you earlier delivered electronically inside the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that appropriate area/country.

- Step 2. Use the Preview choice to look through the form`s content material. Don`t neglect to learn the information.

- Step 3. Should you be not satisfied together with the form, use the Lookup discipline towards the top of the screen to locate other models in the lawful form web template.

- Step 4. Once you have found the form you want, click on the Get now button. Opt for the pricing plan you favor and add your credentials to sign up for an bank account.

- Step 5. Process the purchase. You should use your bank card or PayPal bank account to complete the purchase.

- Step 6. Pick the structure in the lawful form and down load it on your own device.

- Step 7. Comprehensive, edit and print out or signal the Michigan Employee Agreement Incentive Compensation and Stock Bonus.

Every single lawful record web template you get is yours eternally. You may have acces to every form you delivered electronically within your acccount. Click the My Forms portion and decide on a form to print out or down load once again.

Compete and down load, and print out the Michigan Employee Agreement Incentive Compensation and Stock Bonus with US Legal Forms. There are millions of expert and state-particular types you can use for your personal company or person requirements.