The employee stock option prospectus explains the stock option plan to the employees. It addresses the employee's right to exercise the option of buying common stock in the company, along with explaining the obligations of the employee where taxes and capital gains are concerned.

Michigan Employee Stock Option Prospectus

Description

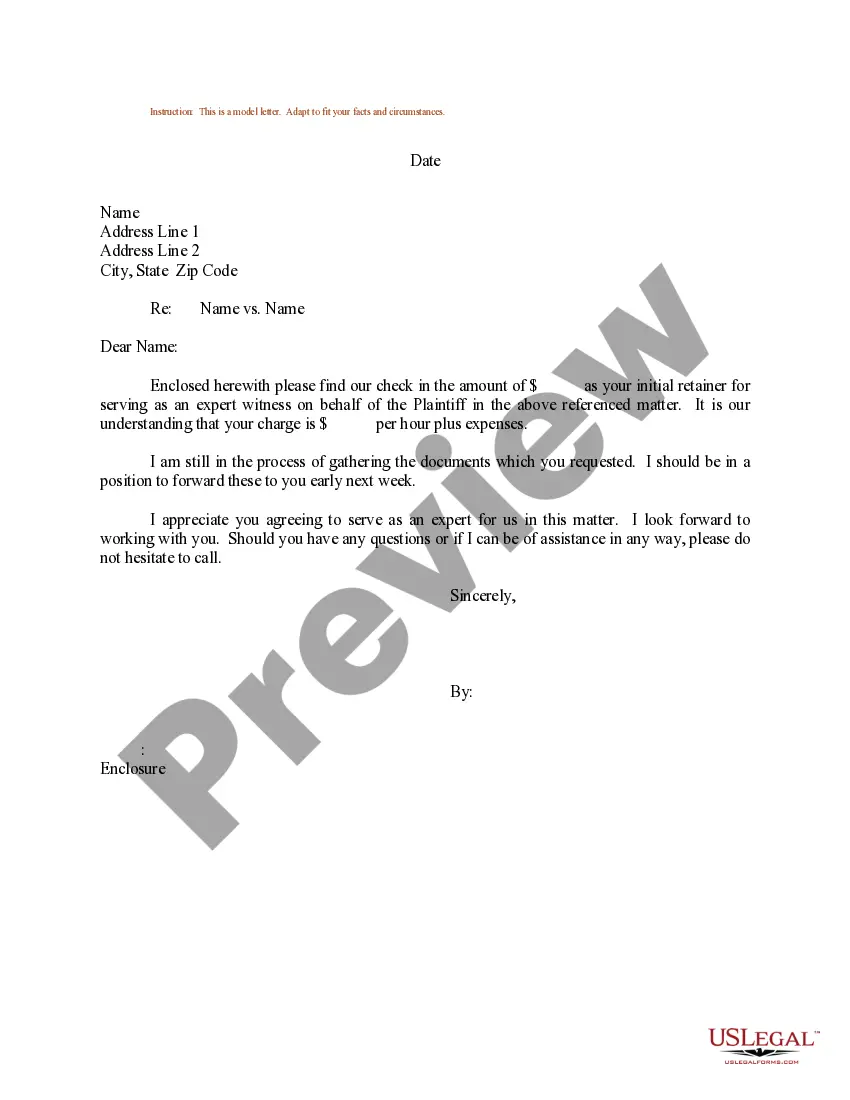

How to fill out Employee Stock Option Prospectus?

You can commit time online looking for the legal papers format which fits the state and federal needs you need. US Legal Forms gives thousands of legal kinds which are evaluated by experts. It is simple to acquire or print out the Michigan Employee Stock Option Prospectus from our support.

If you have a US Legal Forms account, it is possible to log in and click the Obtain switch. Next, it is possible to full, edit, print out, or signal the Michigan Employee Stock Option Prospectus. Every legal papers format you purchase is your own for a long time. To obtain one more version associated with a purchased kind, visit the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site the very first time, adhere to the simple guidelines below:

- Initial, be sure that you have chosen the best papers format for the county/town of your choosing. Read the kind outline to ensure you have picked out the proper kind. If available, make use of the Review switch to look from the papers format also.

- If you wish to find one more model from the kind, make use of the Research discipline to discover the format that fits your needs and needs.

- After you have discovered the format you need, just click Get now to move forward.

- Pick the rates prepare you need, enter your references, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal account to pay for the legal kind.

- Pick the formatting from the papers and acquire it in your product.

- Make modifications in your papers if required. You can full, edit and signal and print out Michigan Employee Stock Option Prospectus.

Obtain and print out thousands of papers web templates making use of the US Legal Forms web site, that provides the greatest assortment of legal kinds. Use specialist and express-specific web templates to deal with your business or person requires.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Key Takeaways. An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

Employee Share Option (ESOP) An ESOP plan gives an employee the right to purchase shares in a company (usually the employer or a parent company of the employer) at a specific pre-determined price on or after specific dates under the plan.

Employee stock options (ESOPs) are a form of compensation that gives employees the right to buy a certain amount of company shares at a predetermined price for a specific period of time. ESOPs are intended to align the interests of employees and shareholders, as well as to attract and retain talent.

There are two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they're taxed. ISOs could qualify for special tax treatment. With NSOs, you usually have to pay taxes both when you exercise and sell.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

What Is an Option Schedule? The term option schedule refers to a list of options granted by a company to its employees. Employers commonly offer employees options in the form of stocks as a type of compensation. This is especially common for high-level employees like officers and directors of public companies.