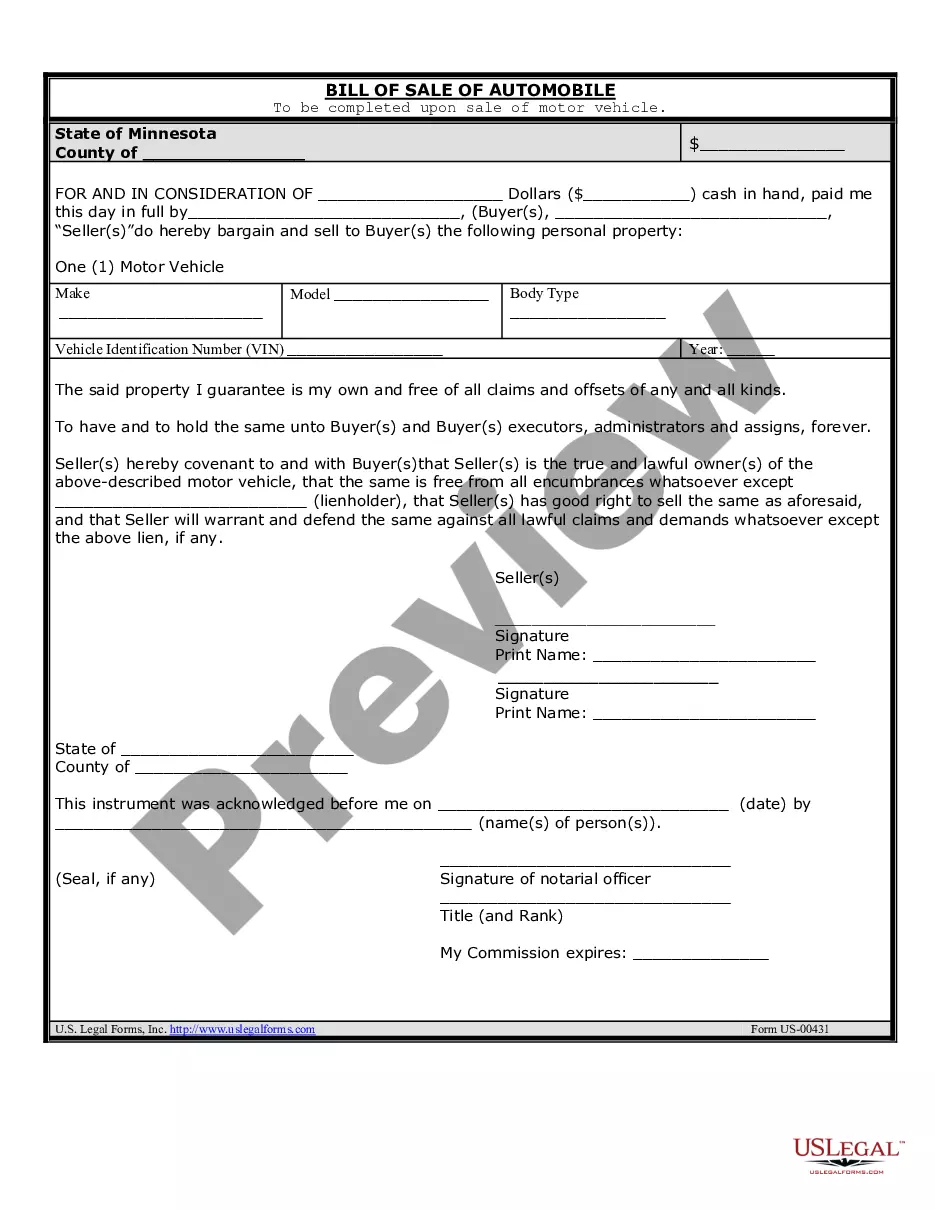

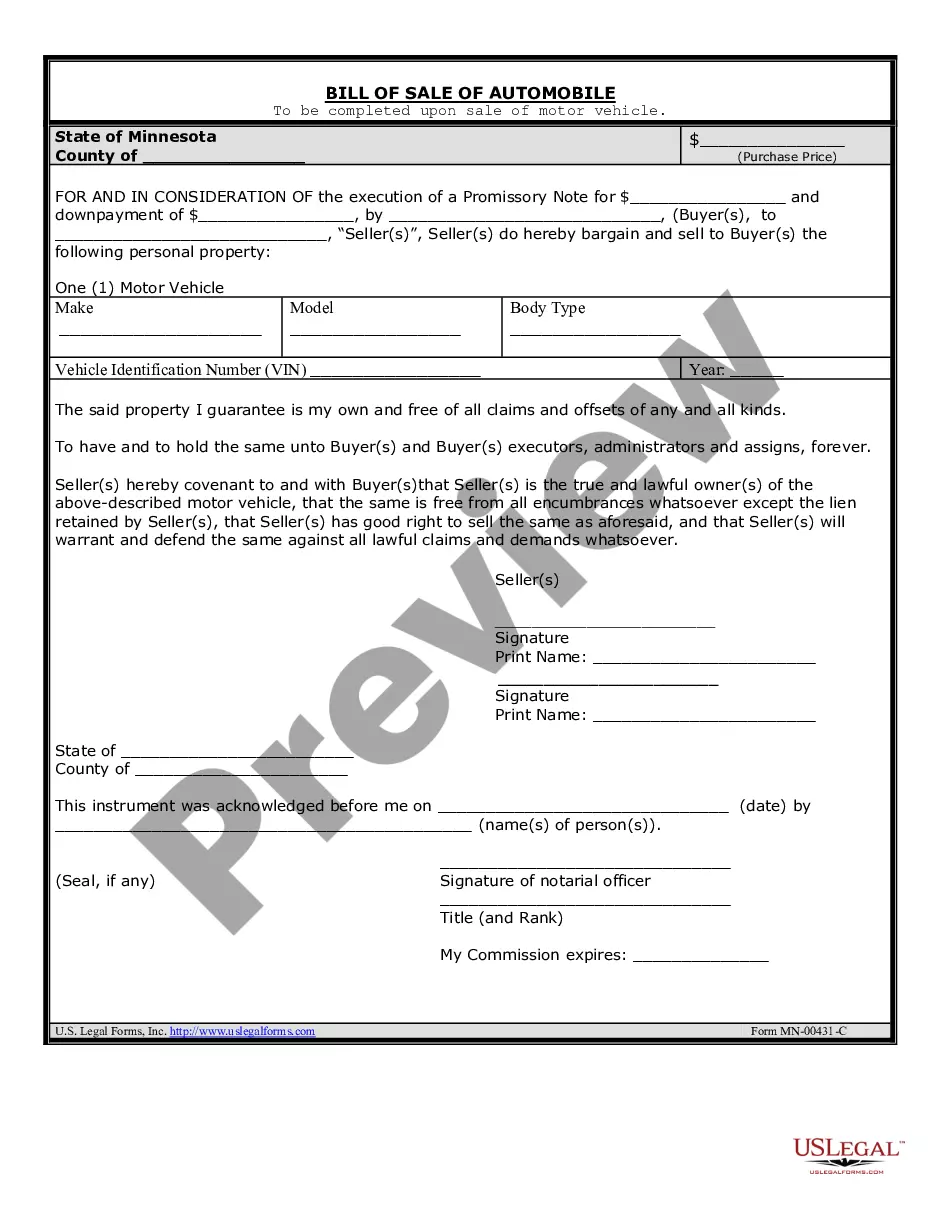

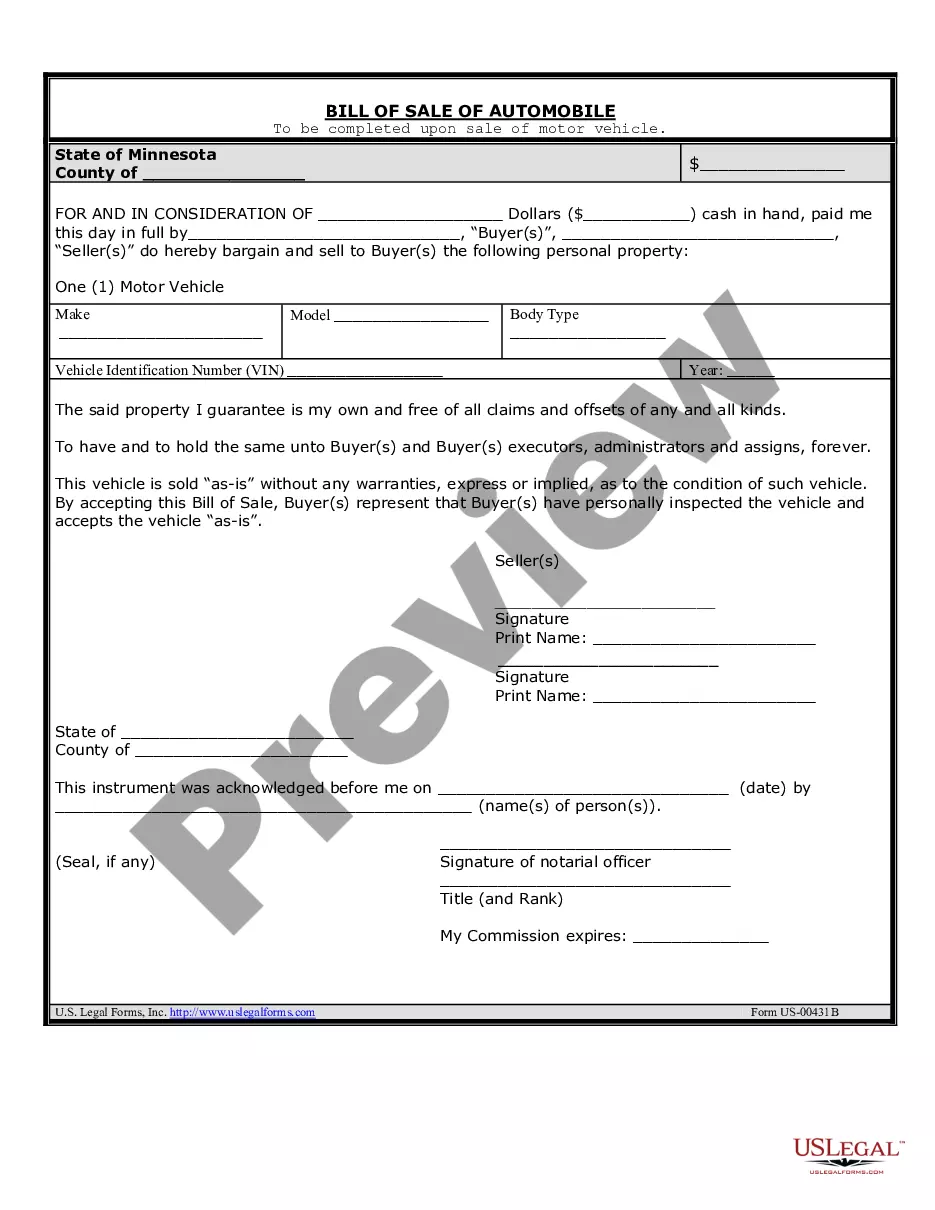

Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Minnesota Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Get any form from 85,000 legal documents such as Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile on-line with US Legal Forms. Every template is drafted and updated by state-accredited lawyers.

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile you would like to use.

- Read through description and preview the template.

- Once you’re confident the template is what you need, click on Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by bank card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the proper downloadable template. The platform will give you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile easy and fast.

Form popularity

FAQ

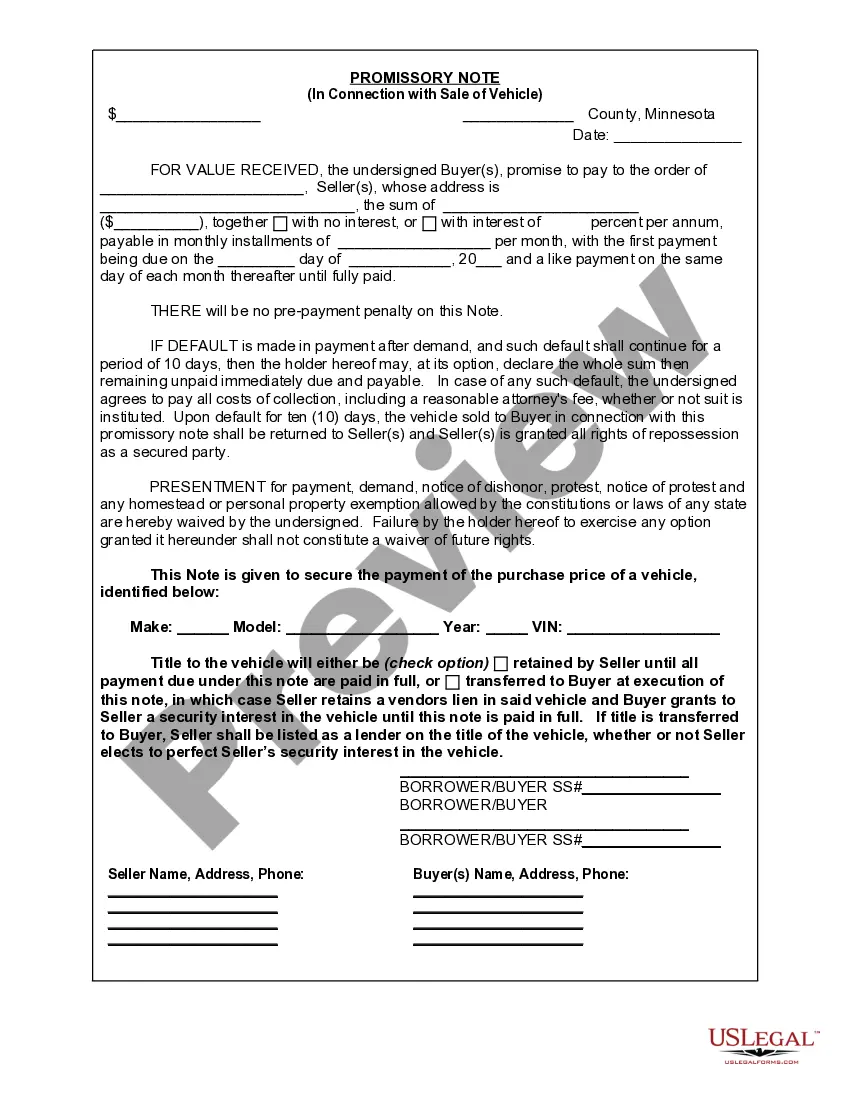

A promissory note is often included in a mortgage, student loan, car loan, business loan, or personal loan agreement. If you're loaning someone a large sum of money, you'll likely want a legal record of it. Therefore, promissory notes can be used in personal transactions as well.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

All sellers must handprint their name and sign in the assignment area of the title. The seller must list the sales price of the vehicle in the sales tax declaration area on the back of the certificate of title. The seller must enter the date of sale and complete any disclosure statements that apply.

Debt Classification A promissory note is a type of written contract a lender uses for secured debts where the lender has collateral to seize in the event of default. It is more likely your car loan is a promissory note if you have a schedule of payments and a fixed interest rate spelled out on your loan document.

Both the buyer and seller must fill out the ownership of the title transfer. In Minnesota the transfer of ownership must take place on the certificate of title within 10 days of the sale. The DMV title transfer form can be filled out and sent into DVS or brought in person to a local deputy registrar office.

200b200bThe promissory note should contain: The car's VIN number, model, make and year of manufacture. The statement that the borrower promises to pay the lender a specific amount, how much each payment will be, the annual interest rate and when the loan will be completely repaid.